How to Evaluate Your Health Insurance Plan-www.waukeshahealthinsurance.com

Table of Content

How to Evaluate Your Health Insurance Plan

Choosing the right health insurance plan can feel overwhelming. With a myriad of options, varying coverage levels, and complex terminology, navigating the healthcare marketplace requires careful consideration. This comprehensive guide will walk you through the essential steps to evaluate your health insurance plan and ensure it meets your individual needs and budget. Understanding your plan is crucial for accessing quality healthcare without facing unexpected financial burdens. Whether you’re selecting a new plan during open enrollment or reviewing your current coverage, this guide provides a framework for making informed decisions.

1. Understanding Your Needs:

Before diving into plan details, honestly assess your healthcare requirements. Consider the following:

Your Health History: Do you have pre-existing conditions? Are you currently managing any chronic illnesses like diabetes or heart disease? Pre-existing conditions significantly impact plan selection, as some plans may have limitations or exclusions. Understanding your health history helps you identify plans that adequately cover your specific needs.

Your Healthcare Utilization: How often do you typically visit the doctor? Do you anticipate needing specialized care, such as surgery or extensive testing, in the near future? Your healthcare utilization patterns directly influence the type of plan that best suits you. Frequent healthcare users may benefit from a plan with lower out-of-pocket costs, even if the premiums are higher.

Your Family’s Needs: If you’re covering dependents, their healthcare needs must also be factored into your decision. Children require regular checkups and vaccinations, while elderly family members may have more complex healthcare requirements. Ensure your plan adequately covers the entire family.

Your Prescription Medications: If you regularly take prescription medications, carefully review the plan’s formulary (the list of covered drugs). Some plans may require you to use specific pharmacies or may not cover certain medications. Understanding your medication needs and the plan’s formulary is critical to avoid unexpected costs.

2. Deciphering Key Plan Features:

Health insurance plans often use confusing jargon. Understanding the following key features is essential for effective evaluation:

Premium: This is your monthly payment to maintain your health insurance coverage. Lower premiums don’t always equate to better value; consider the overall cost of the plan.

Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance company begins to pay. High-deductible plans have lower premiums but require significant upfront payments.

Copay: This is a fixed amount you pay for covered services, such as doctor visits. Copays are typically lower than the cost of the service itself.

Coinsurance: This is the percentage of costs you share with your insurance company after you’ve met your deductible. For example, 80/20 coinsurance means you pay 20% of the cost, and your insurance pays 80%.

Out-of-Pocket Maximum: This is the most you’ll pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance company covers 100% of the costs.

Network: This is the group of doctors, hospitals, and other healthcare providers contracted with your insurance company. Using in-network providers generally results in lower costs. Check the provider directory on your chosen plan’s website or through your insurer’s resources to ensure your preferred doctors are included. For assistance finding a plan with your preferred providers, consider using online tools or consulting with a local insurance broker. For Waukesha residents, resources like www.waukeshahealthinsurance.com can be invaluable.

3. Comparing Plans:

Once you understand your needs and the key plan features, it’s time to compare different plans. Use online comparison tools or contact your insurance broker to obtain quotes from various insurers. Consider the following factors when comparing:

Cost: Compare premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Consider the total cost of the plan over a year, not just the monthly premium.

Coverage: Evaluate the plan’s coverage for essential services, such as doctor visits, hospital stays, prescription drugs, and mental health services.

Network: Ensure your preferred doctors and hospitals are included in the plan’s network. A limited network can significantly increase your out-of-pocket costs.

Customer Service: Research the insurer’s reputation for customer service. Read online reviews and ask for referrals from friends or family. A responsive and helpful insurer can make a significant difference in your healthcare experience.

4. Utilizing Online Resources:

Several online resources can simplify the plan selection process. Government websites, such as the HealthCare.gov marketplace, provide tools to compare plans and determine eligibility for subsidies. Many insurance companies also offer online plan comparison tools on their websites, such as www.waukeshahealthinsurance.com, which may provide additional resources specific to your location.

5. Seeking Professional Advice:

If you’re still feeling overwhelmed, consider seeking professional advice. An independent insurance broker can provide unbiased guidance and help you choose the plan that best meets your needs and budget. They can explain complex plan features and help you navigate the selection process.

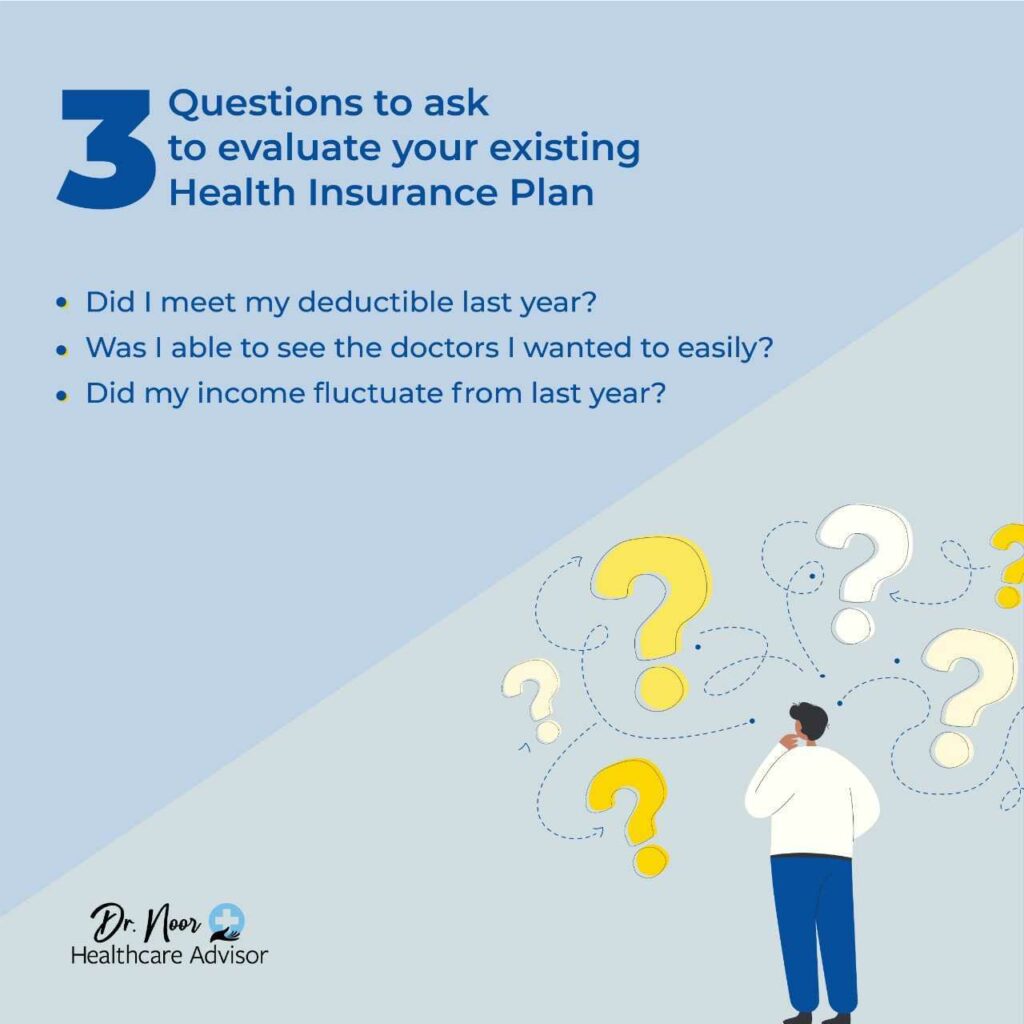

6. Regularly Review Your Plan:

Your healthcare needs and circumstances may change over time. Regularly review your health insurance plan to ensure it continues to meet your needs. Take advantage of open enrollment periods to switch plans if necessary.

7. Understanding the Implications of Choosing the Wrong Plan:

Choosing an unsuitable health insurance plan can lead to several negative consequences:

High Out-of-Pocket Costs: An inadequate plan can result in unexpectedly high out-of-pocket expenses, potentially leading to financial strain.

Limited Access to Care: A plan with a narrow network may restrict your access to preferred doctors and specialists.

Delayed or Foregone Care: High costs and limited access can lead to delayed or foregone necessary medical care, potentially impacting your health.

Choosing the right health insurance plan is a crucial decision that impacts your financial well-being and access to quality healthcare. By carefully considering your needs, understanding key plan features, comparing plans, and utilizing available resources, you can make an informed decision that ensures you receive the healthcare coverage you deserve. Remember to utilize online resources and consider seeking professional advice if needed. For those in the Waukesha area, www.waukeshahealthinsurance.com offers a valuable starting point for your research. Take the time to understand your options, and you’ll be well-equipped to navigate the complexities of health insurance and secure the best possible coverage for yourself and your family.