Here’s a 1500-word article about health insurance for people with autoimmune diseases, incorporating the requested link and underlined keywords:-www.waukeshahealthinsurance.com

Here’s a 1500-word article about health insurance for people with autoimmune diseases, incorporating the requested link and underlined keywords:

Navigating the Complexities of Health Insurance with an Autoimmune Disease

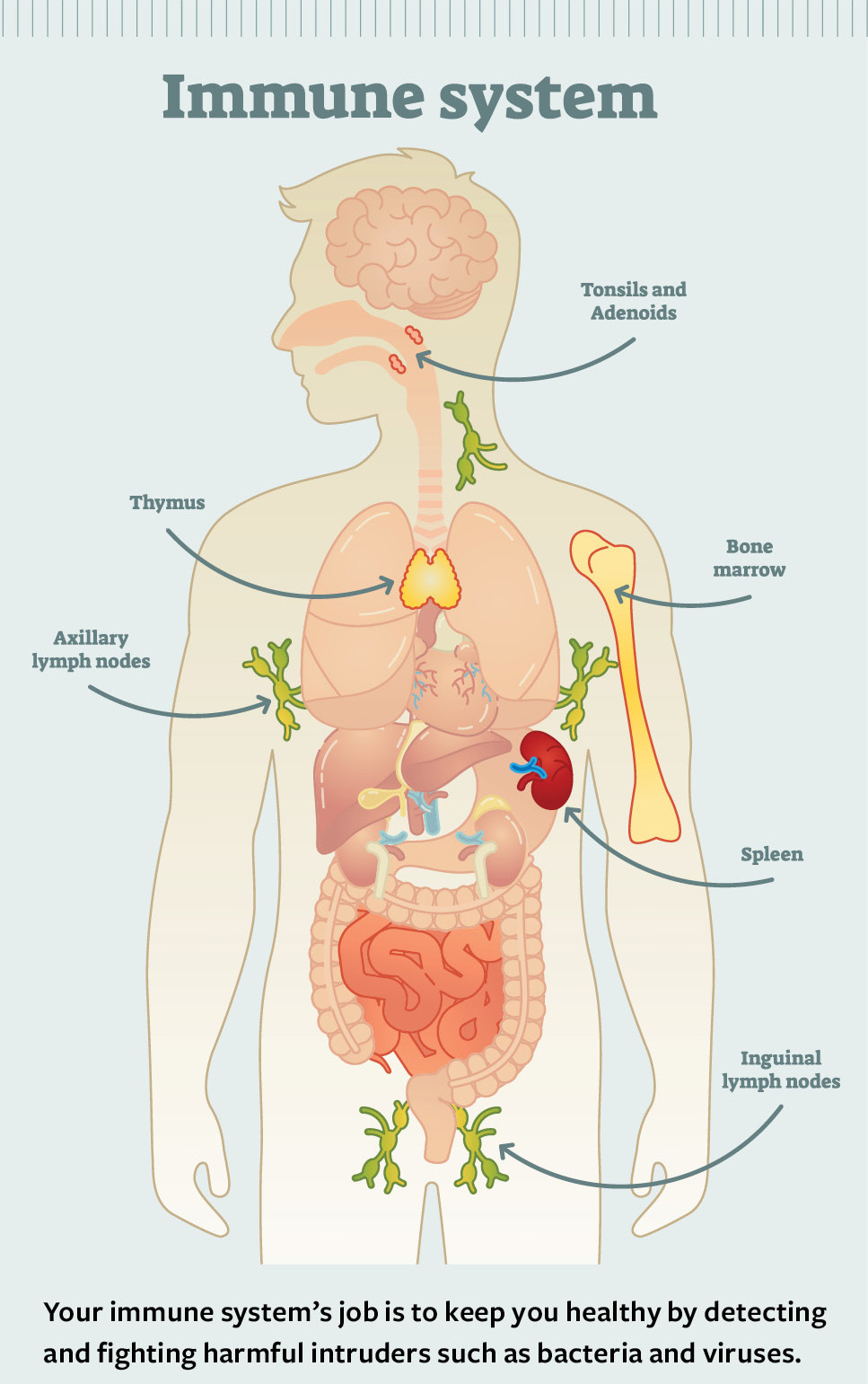

Living with an autoimmune disease presents a unique set of challenges, and securing adequate health insurance is paramount. Autoimmune diseases, characterized by the immune system mistakenly attacking healthy tissues and organs, often require extensive and ongoing medical care, including specialist visits, medications, and potentially hospitalizations. The financial burden of managing these conditions can be overwhelming without comprehensive health insurance coverage. This article explores the intricacies of obtaining and utilizing health insurance when living with an autoimmune disease, offering guidance and resources to help you navigate this complex landscape.

Understanding Autoimmune Diseases and Their Impact on Healthcare Costs:

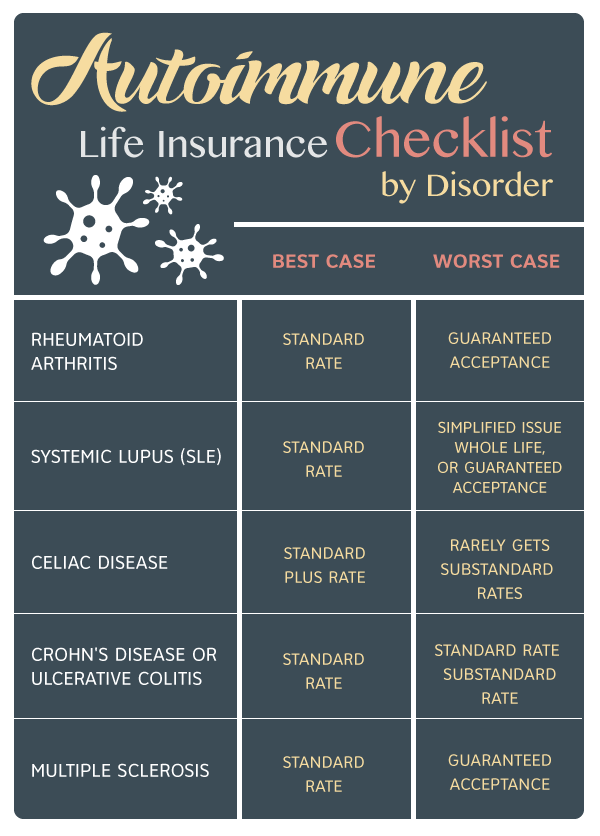

Autoimmune diseases encompass a wide range of conditions, each with its own set of symptoms and treatment protocols. Some common examples include rheumatoid arthritis, lupus, multiple sclerosis (MS), type 1 diabetes, Crohn’s disease, and psoriasis. These diseases can affect various parts of the body, leading to chronic pain, inflammation, fatigue, and organ damage.

The cost of managing an autoimmune disease can be substantial. Regular doctor visits, specialized testing (like blood work and imaging), prescription medications (often expensive biologics), physical therapy, and potential hospitalizations can quickly accumulate significant medical expenses. The unpredictable nature of many autoimmune diseases further complicates financial planning, as flare-ups and exacerbations can necessitate additional and unexpected medical interventions.

Choosing the Right Health Insurance Plan:

Finding the right health insurance plan is crucial for individuals with autoimmune diseases. The ideal plan should offer comprehensive coverage, including:

Low Deductible: A low deductible means you’ll pay less out-of-pocket before your insurance begins to cover expenses. This is particularly important for those with chronic conditions requiring frequent medical attention. Explore your options for low-deductible plans at www.waukeshahealthinsurance.com.

Low Copay: Low copays for doctor visits and specialist appointments reduce the cost of routine care. Many autoimmune diseases necessitate regular visits to specialists, making low copays a significant factor in affordability.

Comprehensive Drug Coverage: Autoimmune diseases often require ongoing medication, including expensive biologics. Ensure your plan includes a robust formulary with coverage for the specific medications you need. Check the drug formularies of different plans available through www.waukeshahealthinsurance.com.

Network of Specialists: Verify that your chosen plan includes a network of doctors and specialists who are experienced in treating your specific autoimmune condition. Accessing specialists within your network will significantly reduce your out-of-pocket costs. Find doctors in your network at www.waukeshahealthinsurance.com.

Mental Health Coverage: Living with a chronic illness can significantly impact mental health. Ensure your plan includes comprehensive mental health coverage, including therapy and medication management.

Navigating the Healthcare System with an Autoimmune Disease:

Beyond choosing the right plan, effectively navigating the healthcare system is essential for managing your autoimmune disease and minimizing costs. Consider these strategies:

Pre-authorization: Many expensive treatments and procedures require pre-authorization from your insurance company. Ensure you understand the pre-authorization process and submit all necessary paperwork in a timely manner to avoid delays and denials.

Appeal Denials: If your insurance company denies a claim, understand your rights and the appeals process. Don’t hesitate to appeal denials if you believe the decision is incorrect.

Advocacy Groups: Connect with advocacy groups and patient organizations dedicated to your specific autoimmune disease. These organizations can provide valuable resources, support, and guidance on navigating the healthcare system.

Financial Assistance Programs: Explore financial assistance programs offered by pharmaceutical companies, hospitals, and charitable organizations. Many programs offer assistance with medication costs and other medical expenses.

HSA or FSA: Consider using a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help manage healthcare costs. These accounts allow you to set aside pre-tax dollars to pay for eligible medical expenses.

The Importance of Open Communication with Your Doctor and Insurance Provider:

Open communication is key to effectively managing your autoimmune disease and your insurance coverage. Discuss your treatment plan and anticipated costs with your doctor and insurance provider. Ask questions, clarify any uncertainties, and proactively address potential issues before they arise.

Understanding Your Policy:

Thoroughly review your health insurance policy to understand your coverage details, including deductibles, copays, coinsurance, and out-of-pocket maximums. Familiarize yourself with the claims process and understand how to submit claims for reimbursement. Download helpful guides and resources on understanding your policy from www.waukeshahealthinsurance.com.

The Role of Technology in Managing Autoimmune Diseases and Insurance:

Technology plays an increasingly important role in managing autoimmune diseases and interacting with insurance providers. Many insurance companies offer online portals where you can access your policy information, submit claims, and communicate with customer service representatives. Mobile apps can help you track your medications, appointments, and symptoms.

Looking Ahead:

Living with an autoimmune disease requires proactive management of both your health and your finances. Securing comprehensive health insurance is a critical step in this process. By understanding your options, actively engaging with your healthcare team and insurance provider, and utilizing available resources, you can navigate the complexities of healthcare and focus on managing your condition effectively. Remember to explore your options and seek professional advice when making decisions about your health insurance. Start your search for the right plan today at www.waukeshahealthinsurance.com. This resource can provide valuable information and support as you navigate this important aspect of your healthcare journey. Remember, proactive planning and informed decision-making are essential to ensuring you have the coverage you need to live your best life, despite the challenges of living with an autoimmune disease.