Health Insurance vs. Medical Debt: Why You Should Care-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Navigating this system effectively is crucial for maintaining financial stability and overall well-being. Two key concepts stand at the forefront of this challenge: health insurance and medical debt. Understanding the critical relationship between these two, and the vital role of proactive planning, is paramount to protecting your financial future and your health.

The High Cost of Healthcare in America:

The United States boasts some of the most advanced medical technology and skilled healthcare professionals globally. However, this comes at a steep price. The cost of medical care, including doctor visits, hospital stays, prescription drugs, and diagnostic tests, has been steadily rising for decades, outpacing inflation significantly. This escalating cost creates a significant financial burden for many Americans, leading to widespread medical debt.

What is Health Insurance?

Health insurance is a contract between you and an insurance company (or a government program like Medicare or Medicaid). In exchange for regular payments (premiums), the insurance company agrees to cover a portion of your healthcare expenses. This coverage can vary significantly depending on the type of plan you choose. Different plans offer different levels of coverage, deductibles (the amount you pay out-of-pocket before insurance coverage begins), co-pays (fixed fees you pay for services), and out-of-pocket maximums (the most you’ll pay in a year).

Choosing the right health insurance plan is a crucial decision. Factors to consider include your budget, your health needs, the network of doctors and hospitals covered by the plan, and the specific benefits offered. Learn more about finding the right plan for your needs by visiting our website: www.waukeshahealthinsurance.com. We offer a range of plans to suit diverse needs and budgets.

Types of Health Insurance Plans:

Several types of health insurance plans exist, each with its own set of features and limitations:

HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within the plan’s network. Referrals from your PCP are usually needed to see specialists. HMO plans generally offer lower premiums but more restricted access to care.

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see specialists without a referral, and you can see out-of-network providers, although you’ll typically pay more. PPO plans usually have higher premiums than HMO plans.

EPO (Exclusive Provider Organization): EPO plans are similar to HMOs, but they generally offer slightly more flexibility. You usually need a referral to see specialists, but you may have access to a wider network of providers.

POS (Point of Service): POS plans combine elements of HMOs and PPOs. They typically require a PCP, but you can see out-of-network providers at a higher cost.

Medicare and Medicaid: These are government-sponsored health insurance programs. Medicare is for individuals aged 65 and older or those with certain disabilities, while Medicaid is for low-income individuals and families. For information on Medicare and Medicaid options in Waukesha County, please visit www.waukeshahealthinsurance.com.

The Crushing Weight of Medical Debt:

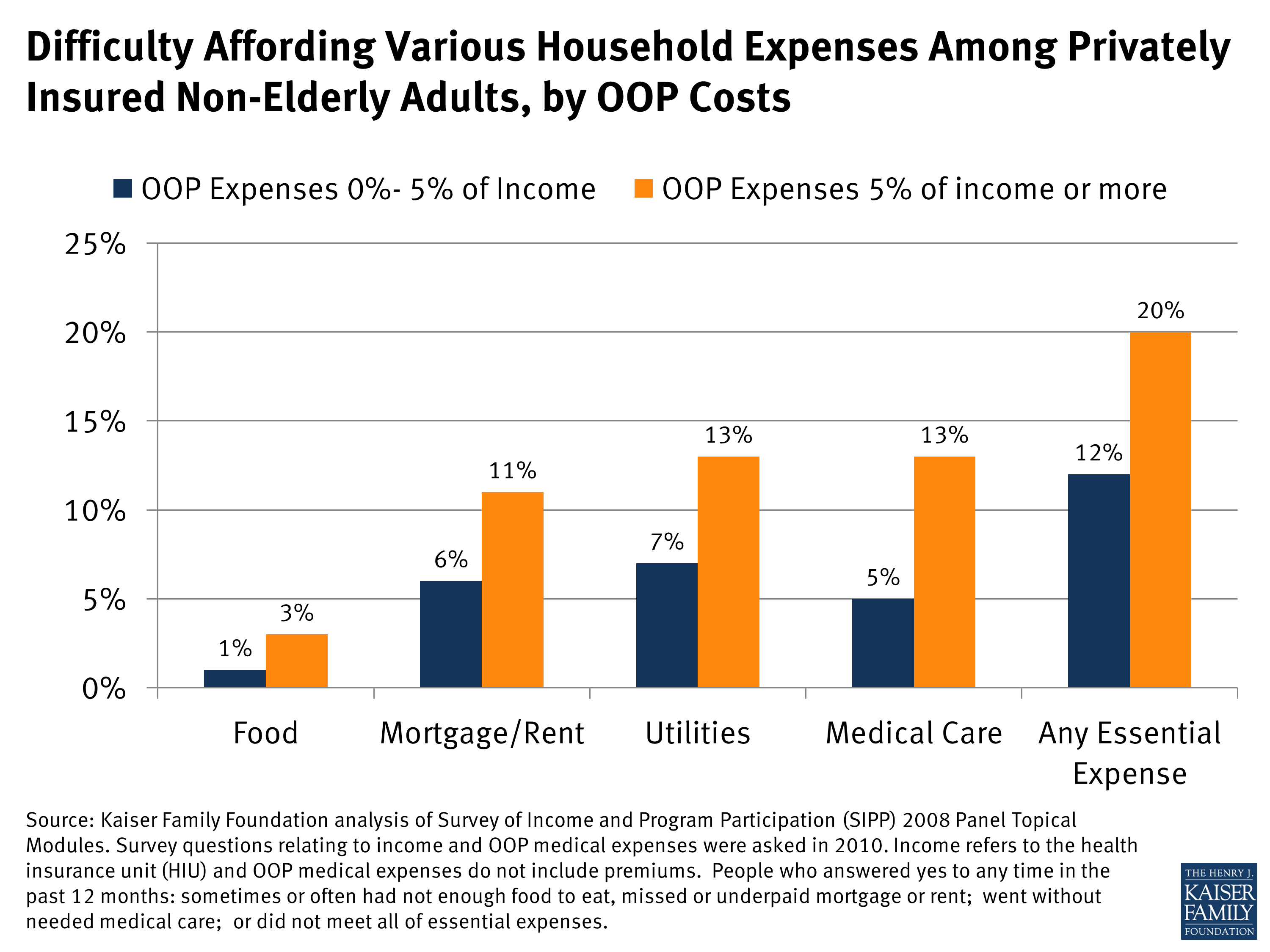

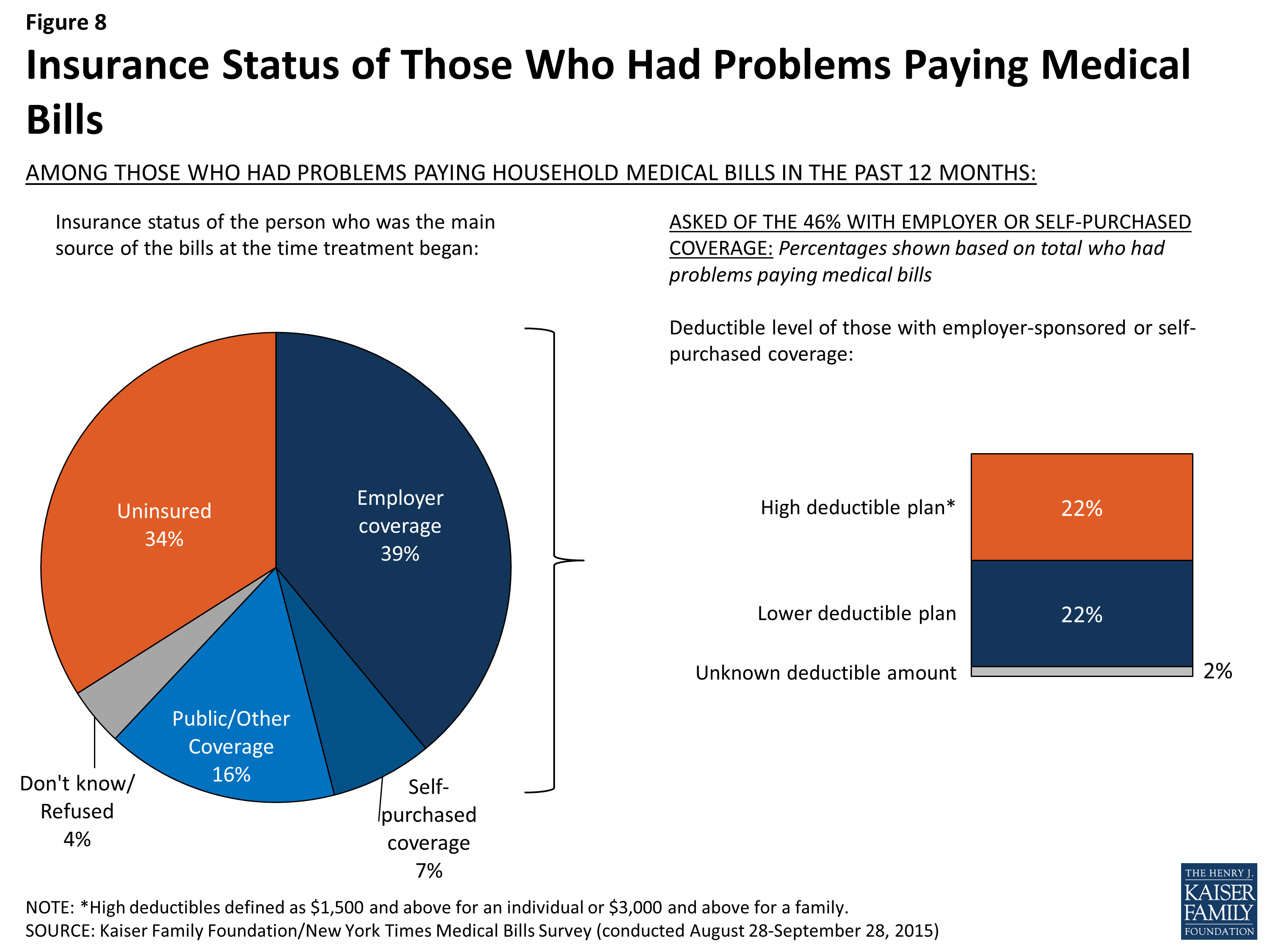

Medical debt is a significant and growing problem in the United States. Unexpected illnesses or injuries can lead to massive medical bills, even with health insurance. High deductibles, co-pays, and out-of-pocket maximums can leave individuals struggling to pay their medical bills. This debt can have devastating consequences, leading to:

Financial hardship: Medical debt can lead to difficulty paying other bills, such as rent, utilities, and groceries.

Credit score damage: Unpaid medical bills can significantly damage your credit score, making it harder to obtain loans, rent an apartment, or even get a job.

Stress and anxiety: The financial burden of medical debt can cause significant stress and anxiety, impacting mental and physical health.

Collection agencies: Unpaid medical bills often end up with collection agencies, which can aggressively pursue payment, further compounding the stress and financial burden.

The Protective Shield of Health Insurance:

Health insurance acts as a crucial buffer against the financial devastation of medical debt. While it doesn’t eliminate all costs, it significantly reduces the financial burden of unexpected medical expenses. A comprehensive health insurance plan can cover a substantial portion of your medical bills, protecting you from crippling debt.

Strategies to Minimize Medical Debt:

Even with health insurance, medical expenses can still be substantial. Here are some strategies to minimize your risk of accumulating medical debt:

Choose a plan carefully: Consider your budget, health needs, and the network of providers when selecting a health insurance plan. Use our online tools at www.waukeshahealthinsurance.com to compare plans and find the best fit for you.

Negotiate medical bills: Don’t hesitate to negotiate with healthcare providers and hospitals to reduce your bills. Many are willing to work with patients who are experiencing financial hardship.

Explore payment plans: Ask healthcare providers about payment plans to spread out the cost of your medical bills over time.

Consider a medical savings account (HSA): HSAs allow you to save pre-tax money to pay for eligible medical expenses. This can help you manage out-of-pocket costs.

Seek financial assistance: Many hospitals and healthcare providers offer financial assistance programs to patients who are struggling to pay their bills.

Understand your insurance policy: Familiarize yourself with your health insurance policy to understand your coverage, deductibles, co-pays, and out-of-pocket maximums. This will help you avoid unexpected costs.

Conclusion:

The relationship between health insurance and medical debt is inextricably linked. Health insurance serves as a vital shield against the potentially catastrophic financial consequences of unexpected medical expenses. While the cost of healthcare remains a significant challenge, proactive planning, careful selection of a health insurance plan, and responsible financial management can significantly mitigate the risk of accumulating crippling medical debt. Contact us today at www.waukeshahealthinsurance.com to discuss your health insurance needs and secure your financial future. Protecting your health and your financial well-being is an investment worth making.