Health Insurance for Young Adults: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Leaving the nest often means leaving behind the safety net of your parents’ health insurance plan. Understanding your options and making informed decisions is crucial to protecting your financial well-being and your health. This comprehensive guide will walk you through the essentials of health insurance for young adults, covering everything from eligibility to choosing the right plan.

Why Health Insurance is Crucial for Young Adults

While youth often equates to good health, unexpected illnesses and injuries can strike anyone, regardless of age. A simple broken bone, a sudden illness, or a chronic condition can quickly lead to exorbitant medical bills. Without health insurance, these costs can be financially devastating, potentially leading to crippling debt. Health insurance provides a financial safety net, protecting you from unexpected medical expenses and allowing you to focus on your recovery rather than worrying about how to pay for it. Furthermore, preventative care, such as annual check-ups and vaccinations, is often covered by insurance, helping you maintain your health and potentially avoid more serious problems down the line.

Understanding Your Options:

Several options are available to young adults seeking health insurance:

Staying on your parents’ plan: The Affordable Care Act (ACA) allows young adults to remain on their parents’ health insurance plan until age 26, regardless of their student status or marital status. This is often the most affordable option, especially if your parents have a comprehensive plan. However, it’s crucial to understand the specifics of your parents’ plan, including coverage limitations and potential out-of-pocket costs.

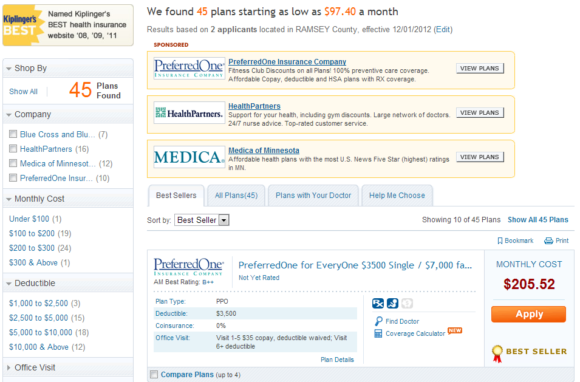

Marketplace plans (through the ACA): The Affordable Care Act established health insurance marketplaces, where individuals can compare and purchase plans from various insurance providers. These marketplaces offer subsidies and tax credits to individuals and families who meet certain income requirements, making coverage more affordable. Navigating the marketplace can be complex, but resources are available to assist you. Learn more about navigating the ACA marketplace and finding the right plan for you by visiting our website: www.waukeshahealthinsurance.com

Employer-sponsored plans: If you’re employed, your employer may offer a health insurance plan as part of your benefits package. These plans can vary significantly in terms of coverage and cost, so it’s important to carefully review the details before enrolling. Often, employer-sponsored plans offer a more comprehensive range of benefits compared to individual plans.

Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or free health coverage to eligible individuals and families. Eligibility requirements vary by state, but generally, these programs are available to low-income individuals and families, pregnant women, and children. Check your state’s eligibility requirements and apply for coverage if you qualify. We can help you understand the process: www.waukeshahealthinsurance.com

Key Factors to Consider When Choosing a Plan:

Selecting the right health insurance plan requires careful consideration of several factors:

Premium costs: This is the monthly payment you make for your insurance coverage. Lower premiums often come with higher deductibles and out-of-pocket costs.

Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance coverage kicks in. High deductibles mean you’ll pay more upfront before your insurance starts to cover expenses.

Copay: This is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

Coinsurance: This is the percentage of the cost of covered healthcare services you pay after you’ve met your deductible.

Out-of-pocket maximum: This is the maximum amount you’ll pay out-of-pocket for covered healthcare services in a given year. Once you reach this limit, your insurance will cover 100% of the costs.

Network of providers: This is the list of doctors, hospitals, and other healthcare providers that your insurance plan covers. Choosing a plan with a wide network ensures you have access to a broader range of healthcare professionals.

Prescription drug coverage: If you take prescription medications, it’s crucial to check the plan’s formulary (list of covered medications) and the associated costs.

Understanding Your Health Insurance Documents:

Once you’ve chosen a plan, it’s essential to understand the documents you receive. Your insurance card provides essential information, including your member ID number and the plan’s contact information. Your Summary of Benefits and Coverage (SBC) outlines the plan’s key features, including coverage details, cost-sharing amounts, and the network of providers. Carefully reviewing these documents will help you understand your coverage and avoid unexpected costs.

Tips for Young Adults:

Start early: Don’t wait until you need healthcare to obtain insurance. Enroll in a plan as soon as possible to ensure continuous coverage.

Compare plans: Don’t settle for the first plan you see. Take the time to compare different plans and find the one that best suits your needs and budget. Use online comparison tools and consult with an insurance professional for assistance: www.waukeshahealthinsurance.com

Understand your coverage: Familiarize yourself with your plan’s details, including the deductible, copay, coinsurance, and out-of-pocket maximum.

Ask questions: Don’t hesitate to ask questions if you’re unsure about anything related to your health insurance. Your insurance provider’s customer service department is there to help.

Maintain good health habits: Practicing healthy habits, such as regular exercise, a balanced diet, and preventative care, can help you stay healthy and reduce your healthcare costs in the long run.

The Importance of Professional Guidance:

Navigating the complexities of health insurance can be challenging. Seeking professional guidance can significantly simplify the process and ensure you choose the right plan for your individual needs. Our team at Waukesha Health Insurance is dedicated to providing personalized assistance and helping you find the best coverage for your situation. Contact us today for a free consultation: www.waukeshahealthinsurance.com We can help you understand your options, compare plans, and enroll in the coverage that best protects your health and financial well-being. Don’t face this crucial decision alone; let us guide you towards a healthier and more secure future. Remember, choosing the right health insurance is an investment in your future health and financial stability.