What to Know About Health Insurance Deductibles-www.waukeshahealthinsurance.com

Table of Content

What to Know About Health Insurance Deductibles

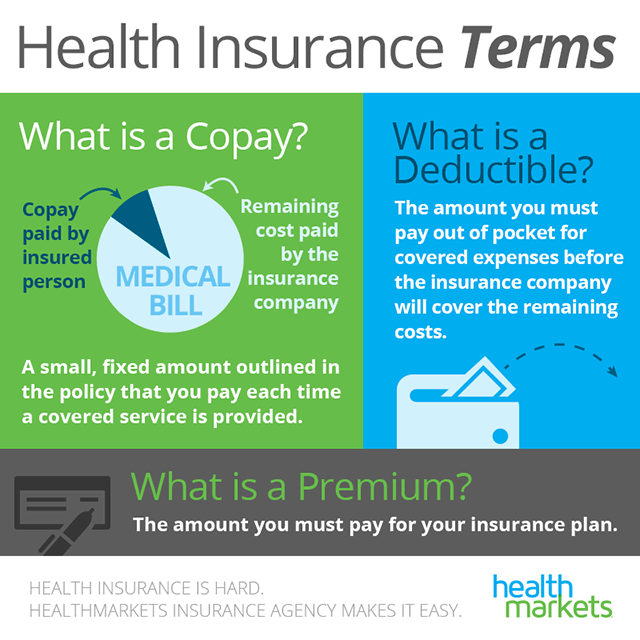

Navigating the world of health insurance can feel overwhelming, especially when confronted with terms like "deductible," "copay," and "coinsurance." Understanding these terms is crucial to making informed decisions about your healthcare coverage. This article focuses specifically on health insurance deductibles, explaining what they are, how they work, and how to choose a plan that best suits your needs and budget. For personalized guidance on finding the right health insurance plan in Waukesha County, Wisconsin, visit www.waukeshahealthinsurance.com.

What is a Health Insurance Deductible?

Your health insurance deductible is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company starts paying its share. Think of it as your initial investment in your healthcare coverage. Once you’ve met your deductible, your insurance company will typically begin covering a significant portion of your medical expenses, according to your plan’s terms. It’s important to note that deductibles usually apply to in-network services. Out-of-network services often have higher costs and may not be covered at all, or covered at a much lower rate.

How Deductibles Work:

Let’s illustrate with an example. Suppose you have a health insurance plan with a $2,000 annual deductible. This means you’ll need to pay the first $2,000 of your covered medical expenses yourself. If you receive medical care totaling $3,000, you’ll pay the $2,000 deductible, and your insurance company will then cover the remaining $1,000 (or a portion of it, depending on your coinsurance).

Types of Deductibles:

Individual Deductible: This is the amount you must pay before your insurance company begins to cover your expenses. This applies to your individual coverage.

Family Deductible: If you have a family plan, you may have a family deductible. This means the total amount your family must pay out-of-pocket before the insurance company begins to cover expenses. Some plans have a combined deductible, where the family pays the deductible as a whole, while others have separate deductibles for each family member. www.waukeshahealthinsurance.com can help you understand the specifics of family deductibles.

Annual Deductible: This is the most common type of deductible, resetting each calendar year. Once you meet your annual deductible, you start fresh the following year.

Factors Affecting Deductible Amounts:

Several factors influence the amount of your deductible:

Plan Type: Different health insurance plans, such as HMOs, PPOs, and EPOs, have varying deductible amounts. Generally, plans with lower premiums tend to have higher deductibles, and vice-versa. Understanding the differences between these plan types is essential for making an informed choice. Learn more about the different plan types available in Waukesha County by visiting www.waukeshahealthinsurance.com.

Coverage Level: Your chosen coverage level (e.g., bronze, silver, gold, platinum) significantly impacts your deductible. Bronze plans typically have the highest deductibles and lowest premiums, while platinum plans have the lowest deductibles and highest premiums.

Insurance Provider: Different insurance providers offer plans with varying deductible amounts. Comparing plans from multiple providers is crucial to finding the best value for your money.

Strategies for Managing Your Deductible:

High deductibles can be a significant financial burden. Here are some strategies to manage them effectively:

Health Savings Account (HSA): If you have a high-deductible health plan (HDHP), you can contribute pre-tax dollars to an HSA to pay for eligible medical expenses. The money grows tax-free, and you can use it to pay your deductible and other out-of-pocket costs. www.waukeshahealthinsurance.com can provide information on HSA eligibility and benefits.

Flexible Spending Account (FSA): Similar to an HSA, an FSA allows you to set aside pre-tax dollars to pay for medical expenses. However, FSAs typically have a "use-it-or-lose-it" provision, meaning any unused funds at the end of the year are forfeited.

Emergency Fund: Building an emergency fund can help you cover unexpected medical expenses, especially those that might exceed your deductible.

Negotiating Medical Bills: Don’t hesitate to negotiate with healthcare providers to reduce your medical bills. Many providers are willing to work with patients to create payment plans or offer discounts.

Preventive Care: Many plans cover preventive care services, such as annual checkups and vaccinations, at no cost to you, even before you meet your deductible. Taking advantage of these services can help prevent more expensive health issues down the line.

Choosing the Right Deductible:

Choosing the right deductible involves balancing affordability with risk. A lower deductible means lower out-of-pocket costs if you need medical care, but it usually comes with higher premiums. A higher deductible means lower premiums but higher out-of-pocket costs if you need significant medical care. Consider your health history, anticipated healthcare needs, and financial situation when making your decision.

Understanding Your Policy:

Carefully review your health insurance policy to fully understand your deductible and other cost-sharing responsibilities. Pay attention to details like whether your deductible applies to all covered services or only certain ones. If you have any questions or need clarification, contact your insurance provider or a licensed insurance agent.

The Role of a Health Insurance Broker:

Navigating the complexities of health insurance can be challenging. A health insurance broker, like those at www.waukeshahealthinsurance.com, can provide valuable assistance. They can help you compare plans, understand your options, and choose a plan that best meets your individual needs and budget. They can also answer your questions about deductibles and other aspects of your health insurance coverage.

Conclusion:

Understanding your health insurance deductible is crucial for managing your healthcare costs effectively. By understanding how deductibles work, choosing the right plan, and employing effective cost-management strategies, you can navigate the healthcare system with greater confidence and financial security. For personalized assistance in finding the perfect health insurance plan in Waukesha County, Wisconsin, don’t hesitate to contact the experts at www.waukeshahealthinsurance.com. They can help you find a plan that fits your budget and healthcare needs, ensuring you’re well-prepared for any unexpected medical expenses. Remember to always read your policy carefully and ask questions if anything is unclear. Your health and financial well-being depend on it.