What to Know About Health Insurance and Financial Assistance Programs-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Understanding health insurance and available financial assistance programs is crucial for navigating this complex landscape and ensuring access to quality healthcare. This article will delve into the intricacies of health insurance, explore various financial assistance options, and guide you towards making informed decisions about your healthcare coverage.

Understanding Health Insurance Basics

Health insurance is a contract between you and an insurance company (or a government program). In exchange for regular payments (premiums), the insurance company agrees to pay a portion of your medical expenses. Different plans offer varying levels of coverage, impacting your out-of-pocket costs. Key terms to understand include:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you must pay out-of-pocket for covered healthcare services before your insurance company starts paying.

- Copay: A fixed amount you pay for a covered healthcare service at the time of service.

- Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

- Out-of-pocket maximum: The most you will pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance company covers 100% of the costs.

- Network: The group of doctors, hospitals, and other healthcare providers your insurance plan contracts with. Using in-network providers typically results in lower costs.

Types of Health Insurance Plans

Several types of health insurance plans exist, each with its own features and cost structure:

HMO (Health Maintenance Organization): Typically requires you to choose a primary care physician (PCP) who coordinates your care. Seeing specialists usually requires a referral from your PCP. Generally, HMOs offer lower premiums but restrict your choice of providers.

PPO (Preferred Provider Organization): Offers more flexibility in choosing doctors and specialists. You don’t need a referral to see a specialist, but using out-of-network providers will result in higher costs. PPOs generally have higher premiums than HMOs.

EPO (Exclusive Provider Organization): Similar to an HMO, but typically offers slightly more flexibility in choosing specialists. Seeing out-of-network providers is generally not covered.

POS (Point of Service): Combines elements of HMOs and PPOs. You choose a PCP, but you have more flexibility to see out-of-network providers, although at a higher cost.

Medicare: A federal health insurance program for individuals aged 65 and older and certain younger people with disabilities. Medicare has different parts (A, B, C, and D) that cover various services.

Medicaid: A joint federal and state program that provides healthcare coverage to low-income individuals and families. Eligibility requirements vary by state.

Finding the Right Health Insurance Plan

Choosing the right health insurance plan depends on your individual needs and financial situation. Consider the following factors:

- Your health status: If you have pre-existing conditions, you’ll want a plan that offers comprehensive coverage.

- Your budget: Compare premiums, deductibles, copays, and coinsurance to find a plan that fits your budget.

- Your healthcare needs: Consider the types of medical services you anticipate needing and choose a plan that covers those services.

- Your preferred doctors and hospitals: Check if your preferred providers are in the plan’s network.

Financial Assistance Programs

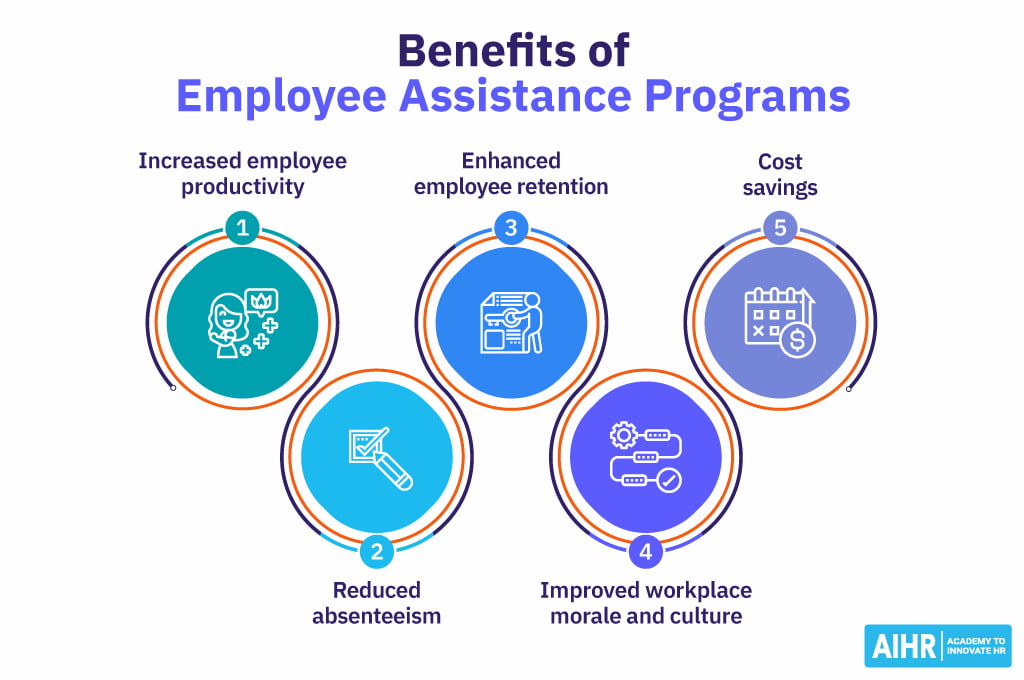

Many financial assistance programs can help individuals and families afford health insurance and healthcare costs. These include:

The Affordable Care Act (ACA) Marketplaces: These marketplaces offer subsidized health insurance plans to individuals and families who meet certain income requirements. You can learn more about ACA Marketplace plans and subsidies by visiting our website: www.waukeshahealthinsurance.com. The subsidies can significantly reduce the cost of premiums and out-of-pocket expenses.

Medicaid: As mentioned earlier, Medicaid provides healthcare coverage to low-income individuals and families. Eligibility requirements vary by state, so check your state’s Medicaid website for details. We can help you navigate the process; contact us at www.waukeshahealthinsurance.com.

CHIP (Children’s Health Insurance Program): CHIP provides low-cost health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

Hospital Financial Assistance Programs: Many hospitals offer financial assistance programs to patients who cannot afford their medical bills. Check with the hospital’s billing department for details. Our team at www.waukeshahealthinsurance.com can also help you understand these options.

Manufacturer Patient Assistance Programs: Pharmaceutical companies often offer patient assistance programs to help individuals afford their prescription medications. These programs can significantly reduce or eliminate the cost of medications. Learn more about available programs by contacting us at www.waukeshahealthinsurance.com.

Charitable Organizations: Several charitable organizations provide financial assistance for healthcare costs. Research local and national organizations to see if they can help you. We can provide resources at www.waukeshahealthinsurance.com.

Navigating the Application Process

Applying for health insurance or financial assistance programs can be complex. Here are some tips to make the process smoother:

- Gather necessary documents: You’ll need documentation such as proof of income, social security numbers, and birth certificates.

- Complete the application accurately: Inaccurate information can delay or prevent your application from being approved.

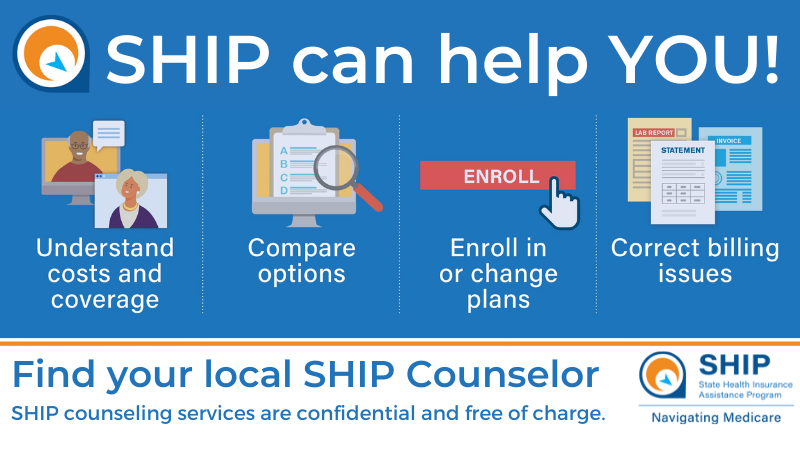

- Seek assistance if needed: Don’t hesitate to seek help from a healthcare navigator or insurance broker. Our team at www.waukeshahealthinsurance.com is here to assist you through every step of the process.

The Importance of Prevention

While insurance and financial assistance programs are crucial, preventive care plays a vital role in managing healthcare costs. Regular checkups, vaccinations, and healthy lifestyle choices can help prevent serious illnesses and reduce the need for expensive treatments.

Conclusion

Understanding health insurance and available financial assistance programs is essential for accessing quality healthcare. By carefully considering your needs, exploring different plan options, and utilizing available resources, you can make informed decisions that protect your health and financial well-being. Remember to utilize the resources available to you, including online tools and expert assistance. Don’t hesitate to contact us at www.waukeshahealthinsurance.com for personalized guidance and support in navigating the complexities of health insurance and financial assistance programs. We are dedicated to helping you find the best coverage for your individual circumstances.