The True Cost of Health Insurance: Breaking Down the Numbers-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

However, understanding the true cost of health insurance goes far beyond the monthly premium. It’s a complex equation involving numerous variables, and navigating this landscape can be daunting. This article aims to dissect the various components of health insurance costs, helping you make informed decisions about your coverage.

Understanding the Premium: More Than Just a Monthly Payment

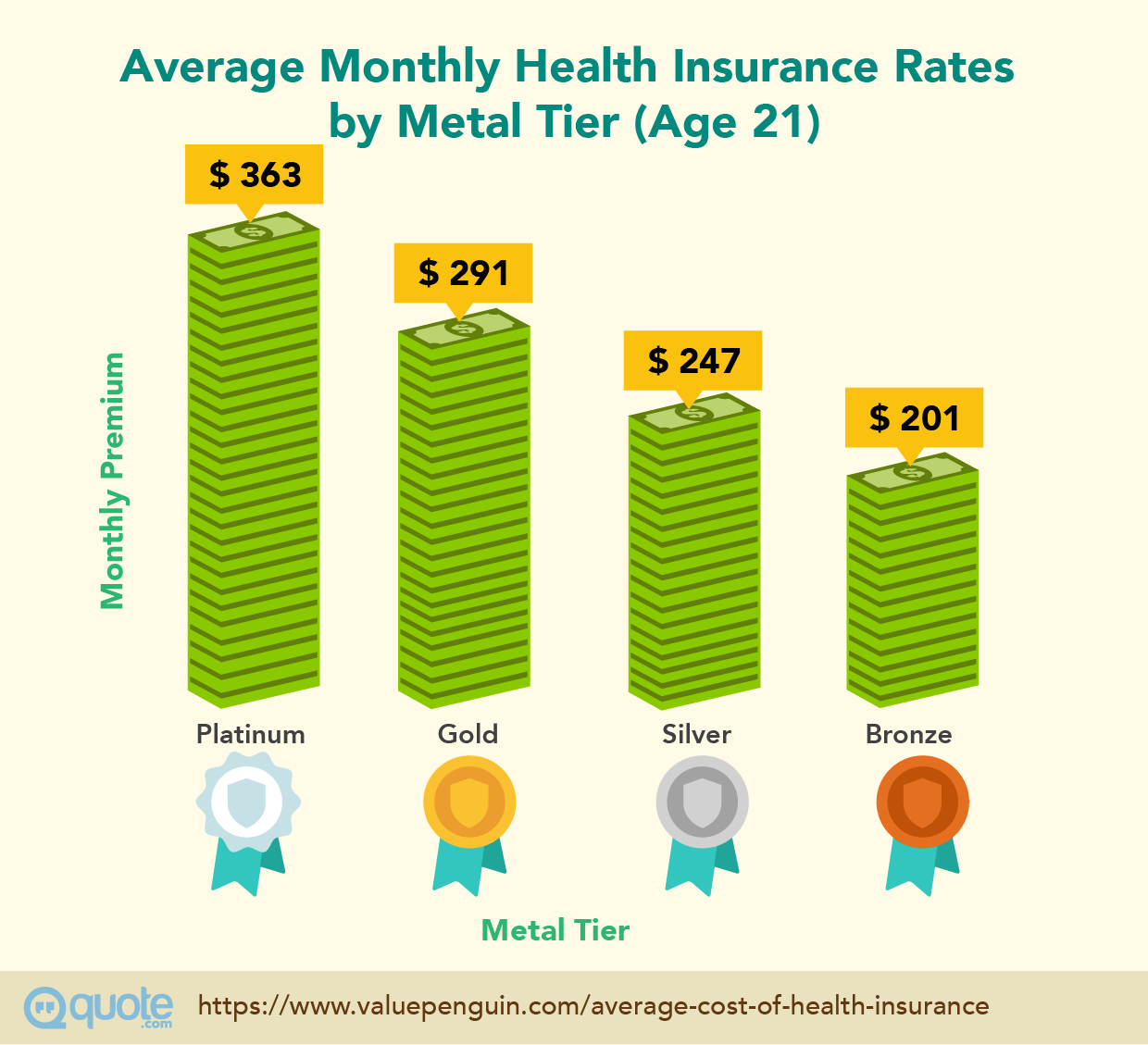

Your monthly premium is the most visible part of your health insurance cost. It’s the regular payment you make to your insurance provider in exchange for coverage. However, the premium itself is influenced by a variety of factors:

- Age: Older individuals generally pay higher premiums due to increased healthcare utilization.

- Location: Premiums vary geographically based on healthcare costs in different regions. A premium in a high-cost area like New York City will likely be significantly higher than one in a rural area.

- Health Status: Pre-existing conditions can influence premium costs. While the Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions, they can still factor them into premium calculations.

- Tobacco Use: Smokers typically pay higher premiums than non-smokers due to increased health risks.

- Plan Type: Different types of plans (HMO, PPO, EPO, etc.) offer varying levels of coverage and cost accordingly. Learn more about different plan types and how they affect your cost by visiting our website. [www.waukeshahealthinsurance.com]

- Family Size: Adding dependents to your plan will increase your premium.

Beyond the Premium: Unveiling the Hidden Costs

While the premium is a significant expense, it’s crucial to consider the other costs associated with health insurance:

- Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance begins to pay. High-deductible plans offer lower premiums but require a larger upfront payment before coverage kicks in.

- Copay: A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit. Copays are typically less than the full cost of the service.

- Coinsurance: This is the percentage of the cost of covered healthcare services you pay after you’ve met your deductible. For example, 20% coinsurance means you pay 20% of the bill, and your insurance pays the remaining 80%.

- Out-of-Pocket Maximum: This is the most you’ll pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance company covers 100% of the costs for covered services. Understanding your out-of-pocket maximum is crucial for budgeting your healthcare expenses.

- Prescription Drug Costs: Prescription drug costs can significantly impact your overall healthcare spending. Your plan’s formulary (list of covered medications) and tier system (categorizing drugs based on cost) will determine your out-of-pocket expenses for medications. Explore prescription drug coverage options and find a plan that fits your needs. [www.waukeshahealthinsurance.com]

- Network Restrictions: Many plans operate within a specific network of doctors, hospitals, and other healthcare providers. Seeing providers outside your network will typically result in higher out-of-pocket costs. Check the provider directory of your chosen plan to ensure your preferred doctors are in-network. [www.waukeshahealthinsurance.com]

Factors Influencing Your Healthcare Costs:

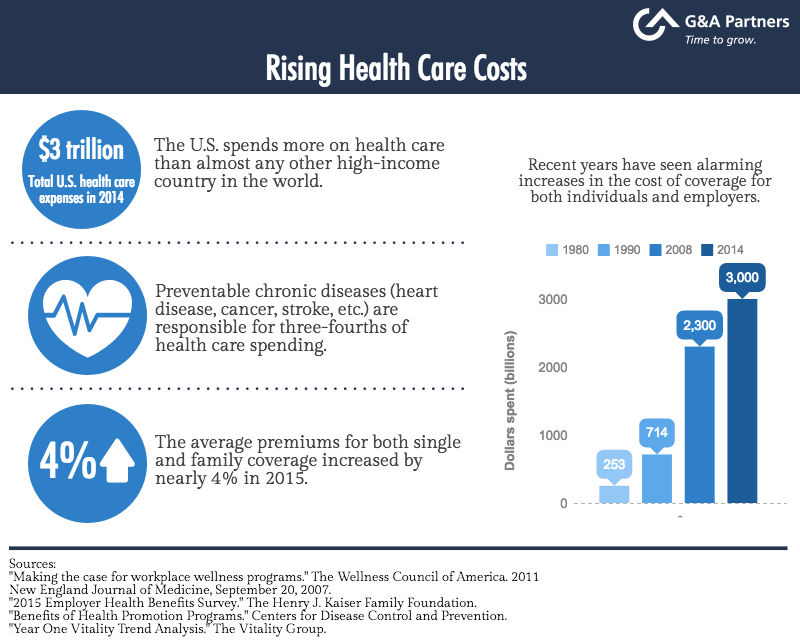

Several factors beyond your insurance plan can influence your overall healthcare expenses:

- Frequency of Healthcare Visits: The more often you need healthcare services, the higher your out-of-pocket costs will be, even with insurance.

- Type of Healthcare Services: Specialized care, such as surgery or hospitalization, is significantly more expensive than routine checkups.

- Unexpected Illnesses or Injuries: Unforeseen medical emergencies can lead to substantial healthcare bills, even with comprehensive insurance.

Choosing the Right Plan: A Balancing Act

Selecting the right health insurance plan requires careful consideration of your individual needs and financial situation. There’s no one-size-fits-all solution. Factors to consider include:

- Your Health Status: If you have pre-existing conditions or anticipate needing frequent healthcare services, a plan with lower out-of-pocket costs might be preferable, even if the premium is higher.

- Your Budget: Balance the monthly premium with your deductible, copay, and coinsurance costs to determine a plan that fits your budget.

- Your Healthcare Needs: Consider your anticipated healthcare utilization and choose a plan that adequately covers your needs.

Navigating the Complexity: Seeking Professional Guidance

The intricacies of health insurance can be overwhelming. Seeking professional guidance from an insurance broker or advisor can significantly simplify the process. They can help you understand your options, compare plans, and choose the most suitable coverage for your individual circumstances. Connect with our experienced insurance brokers today for personalized assistance. [www.waukeshahealthinsurance.com]

Conclusion: Informed Decisions for Financial Well-being

Understanding the true cost of health insurance involves analyzing not only the monthly premium but also the deductible, copay, coinsurance, out-of-pocket maximum, and other associated costs. By carefully considering your individual needs, budget, and health status, and by seeking professional guidance when necessary, you can make informed decisions that protect your financial well-being and ensure access to quality healthcare. Don’t hesitate to explore your options and find a plan that provides the right balance of coverage and affordability. Start your health insurance search today! [www.waukeshahealthinsurance.com] Remember, proactive planning and informed choices are key to managing the true cost of health insurance effectively.