The Real Cost of Not Having Health Insurance and How to Avoid It-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The lack of coverage isn’t just about the immediate expense of a doctor’s visit; it’s a cascade of financial repercussions that can cripple individuals and families for years. Understanding the true cost of being uninsured is the first step towards securing affordable and necessary health coverage.

The Unseen Costs Beyond the Doctor’s Bill:

Many believe the primary cost of being uninsured is simply paying out-of-pocket for medical services. While this is a significant burden, it’s only the tip of the iceberg. The true cost encompasses a far wider range of financial and personal hardships:

Medical Debt: This is the most obvious consequence. Without insurance, even a minor illness or injury can lead to thousands of dollars in medical bills. These bills can quickly snowball, leading to collections agencies, damaged credit scores, and even wage garnishment. The impact on your financial health can be devastating, making it difficult to secure loans, rent an apartment, or even get a job. Navigating this complex system without the support of an insurance provider can be incredibly stressful. For help understanding your options and finding affordable plans, explore your options with a trusted insurance provider like Waukesha Health Insurance. www.waukeshahealthinsurance.com

Delayed or Forgone Care: The fear of accumulating insurmountable debt often leads individuals to delay or avoid necessary medical care altogether. This can have severe consequences, allowing minor ailments to escalate into major health crises, requiring far more expensive treatment in the long run. Preventive care, such as annual checkups and screenings, also gets neglected, leading to the late detection of serious conditions like cancer.

Financial Ruin: A single unexpected illness or accident can wipe out a family’s savings, forcing them into bankruptcy. The emotional toll of this financial strain is immense, impacting family relationships and overall well-being. This is particularly true for those without a safety net of family or savings to fall back on.

Lost Productivity and Income: Illness and injury can lead to missed work, reduced productivity, and even job loss. The inability to work due to lack of access to timely medical care further exacerbates the financial burden, creating a vicious cycle of debt and hardship.

Impact on Mental Health: The constant worry about medical bills and the potential for financial ruin can take a significant toll on mental health, leading to increased stress, anxiety, and depression. This can further impact an individual’s ability to work and maintain healthy relationships.

Legal Ramifications: In some cases, failure to seek necessary medical care can lead to legal repercussions, particularly if it involves accidents or injuries to others.

Understanding Your Options: Navigating the Maze of Health Insurance

The good news is that there are options available to avoid the crushing weight of uninsured healthcare. Understanding these options is crucial to securing affordable and appropriate coverage:

Employer-Sponsored Insurance: Many employers offer health insurance as part of their employee benefits package. This is often the most affordable option, with the employer contributing a significant portion of the premium. However, not all employers offer this benefit, and the quality of coverage can vary significantly.

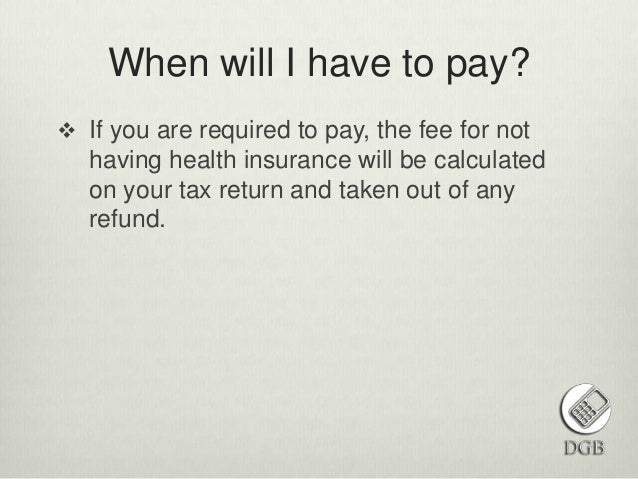

Individual Health Insurance Marketplace: The Affordable Care Act (ACA) created health insurance marketplaces where individuals can purchase plans from various insurance providers. These marketplaces offer subsidies and tax credits to help make coverage more affordable, particularly for those with lower incomes. Waukesha Health Insurance can assist you in navigating the complexities of the marketplace and finding a plan that fits your needs and budget. www.waukeshahealthinsurance.com

Medicaid and CHIP: Medicaid provides healthcare coverage for low-income individuals and families, while the Children’s Health Insurance Program (CHIP) covers children in families who earn too much to qualify for Medicaid but cannot afford private insurance. Eligibility requirements vary by state.

Medicare: Medicare is a federal health insurance program for people age 65 or older and certain younger people with disabilities.

COBRA: COBRA allows individuals who have lost their employer-sponsored health insurance to continue their coverage for a limited time, but at their own expense. This can be a costly option, but it provides a bridge until other coverage can be secured.

Choosing the Right Plan: Factors to Consider

Selecting the right health insurance plan requires careful consideration of several factors:

Premium Costs: This is the monthly payment you make for your insurance coverage.

Deductible: This is the amount you must pay out-of-pocket before your insurance begins to cover your medical expenses.

Copay: This is a fixed amount you pay for a doctor’s visit or other medical service.

Coinsurance: This is the percentage of your medical expenses that you are responsible for after you meet your deductible.

Out-of-Pocket Maximum: This is the maximum amount you will have to pay out-of-pocket for your medical expenses in a given year.

Network of Providers: This is the list of doctors, hospitals, and other healthcare providers that your insurance plan covers.

Prescription Drug Coverage: This is the coverage your plan provides for prescription medications.

The Value of Professional Guidance:

Navigating the complexities of health insurance can be overwhelming. Seeking professional guidance from an experienced insurance broker, such as those at Waukesha Health Insurance, can significantly simplify the process. They can help you understand your options, compare plans, and choose the coverage that best meets your needs and budget. They can also assist with enrollment and address any questions or concerns you may have. Visit their website at www.waukeshahealthinsurance.com to learn more.

Conclusion:

The real cost of not having health insurance extends far beyond the immediate medical bills. It’s a web of financial hardship, delayed care, and emotional distress that can have lasting consequences. However, by understanding the available options and seeking professional guidance, individuals and families can secure affordable and appropriate health coverage, protecting themselves from the devastating financial and personal impact of uninsured healthcare. Don’t wait until a crisis arises; take proactive steps today to secure your health and financial future. Contact Waukesha Health Insurance today for a personalized consultation. www.waukeshahealthinsurance.com