How Health Insurance Can Help You Save Money on Medical Bills-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Even routine check-ups, prescription medications, and dental care can accumulate substantial expenses over time. Major medical events, such as hospital stays, surgeries, and long-term care, can easily lead to debt that takes years, if not decades, to repay. Without health insurance, individuals are left entirely responsible for these costs, potentially facing bankruptcy or significant financial hardship.

How Health Insurance Works: A Shield Against Financial Ruin

Health insurance acts as a buffer between you and the potentially devastating financial impact of medical expenses. It works by pooling resources from many individuals to create a fund that covers the costs of healthcare services for its members. In exchange for regular premium payments, policyholders gain access to a range of benefits, including:

Coverage for Doctor Visits: Health insurance typically covers the cost of routine check-ups, specialist visits, and other medical consultations. This can significantly reduce out-of-pocket expenses for preventative care and the diagnosis and treatment of illnesses.

Hospitalization Coverage: Hospital stays are often associated with extremely high costs. Health insurance helps to cover these expenses, including room and board, surgery, medications, and other related services. The extent of coverage varies depending on the plan, but even partial coverage can make a substantial difference.

Prescription Drug Coverage: Many health insurance plans include prescription drug coverage, helping to manage the cost of necessary medications. This is particularly important for individuals with chronic conditions requiring ongoing medication.

Mental Health and Substance Abuse Coverage: Access to mental health and substance abuse treatment is increasingly important, and many health insurance plans now offer comprehensive coverage for these services. This helps to address critical health needs that might otherwise go untreated due to cost concerns.

Preventive Care: Many plans cover preventative services, such as vaccinations, screenings, and wellness visits, at little to no cost to the member. This proactive approach to healthcare can help to prevent more serious and costly health problems down the line.

Choosing the Right Health Insurance Plan: A Personalized Approach

Finding the right health insurance plan is crucial to maximizing its cost-saving benefits. There are several types of plans available, each with its own features and cost structure:

Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists.

Preferred Provider Organizations (PPOs): PPOs generally offer more flexibility, allowing you to see specialists without referrals and offering broader network choices. However, premiums tend to be higher than HMOs.

Point of Service (POS) Plans: POS plans combine features of both HMOs and PPOs, offering a balance between cost and flexibility.

High Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles (the amount you pay out-of-pocket before insurance coverage kicks in). They are often paired with a Health Savings Account (HSA), which allows for tax-advantaged savings for medical expenses.

The best plan for you will depend on your individual needs, health status, and budget. It’s essential to carefully compare plans and consider factors like premiums, deductibles, co-pays, and out-of-pocket maximums. You can use online comparison tools or consult with an insurance broker to find the most suitable option. For residents of Waukesha County, Wisconsin, exploring options from local providers like those listed on www.waukeshahealthinsurance.com can be a great starting point.

Beyond Cost Savings: The Value of Peace of Mind

The financial benefits of health insurance are undeniable, but the value extends beyond mere cost savings. Having health insurance provides peace of mind, knowing that you are protected from unexpected medical expenses. This allows you to focus on your health and recovery without the added stress of worrying about how you will pay for treatment. This peace of mind is invaluable and contributes significantly to overall well-being.

Managing Your Healthcare Costs Effectively

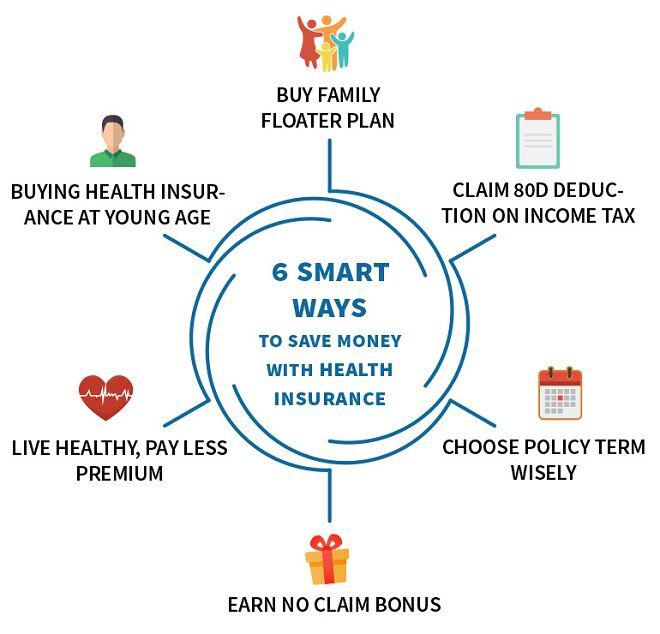

Even with health insurance, managing healthcare costs requires a proactive approach. Here are some tips to help you minimize your out-of-pocket expenses:

Choose a plan that fits your needs and budget. Carefully compare plans and consider your healthcare utilization before making a decision.

Utilize preventative care. Regular check-ups and screenings can help to prevent more serious and costly health problems down the line.

Understand your plan’s benefits and coverage. Familiarize yourself with your policy’s details to avoid unexpected bills.

Negotiate medical bills. Hospitals and healthcare providers are often willing to negotiate payment plans or discounts.

Consider a Health Savings Account (HSA). If you have a high-deductible health plan, an HSA can help you save for medical expenses tax-free.

Shop around for prescription drugs. Compare prices at different pharmacies and consider using generic medications when possible.

Take advantage of telehealth services. Telehealth can offer a more affordable and convenient alternative to in-person visits for certain medical needs.

Conclusion: A Necessary Investment in Your Future

Health insurance is not just a financial tool; it’s an investment in your health and well-being. While the premiums may seem like an expense, the potential savings and peace of mind it offers far outweigh the cost. By understanding how health insurance works and choosing a plan that fits your needs, you can protect yourself from the potentially devastating financial consequences of unexpected medical expenses and secure a healthier, more financially secure future. For those seeking health insurance options in the Waukesha, Wisconsin area, remember to explore the resources available at www.waukeshahealthinsurance.com to find a plan that meets your specific requirements. Taking the time to research and choose the right plan is a crucial step in safeguarding your financial health and ensuring access to quality healthcare. Don’t delay – protect your future today. Contact a local insurance professional or visit www.waukeshahealthinsurance.com to learn more about your options.