Health Insurance for Young Adults: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Leaving the safety net of your parents’ plan can be a daunting task, filled with unfamiliar terms and complex choices. However, understanding your options and securing appropriate coverage is crucial for protecting your financial well-being and ensuring access to quality healthcare. This article will guide you through the essential aspects of health insurance for young adults, helping you make informed decisions about your health and future.

Why Health Insurance Matters for Young Adults:

While youth often equates to good health, accidents, illnesses, and unexpected medical emergencies can happen at any age. The costs associated with even minor medical issues can quickly spiral out of control without health insurance. A single emergency room visit or a short hospital stay can leave you with thousands of dollars in debt, significantly impacting your financial stability. Health insurance provides a crucial safety net, protecting you from these potentially devastating financial burdens. Beyond emergency care, insurance also covers preventative care, such as annual checkups and vaccinations, which are essential for maintaining good health and preventing future problems.

Understanding Your Options:

Several avenues exist for young adults to obtain health insurance coverage. The most common options include:

Staying on a Parent’s Plan: The Affordable Care Act (ACA) allows young adults to remain on their parents’ health insurance plans until the age of 26, regardless of their student status or marital status. This is often the most affordable and convenient option, particularly if your parents have a comprehensive plan. However, it’s important to understand the specific terms and conditions of your parents’ policy.

Employer-Sponsored Insurance: If you’re employed, your employer may offer health insurance as a benefit. This is often a good option, as employers often contribute a significant portion of the premium costs. However, you should carefully review the plan’s coverage details, including deductibles, co-pays, and out-of-pocket maximums, to ensure it meets your needs. Check with your Human Resources department for more information about your employer’s offerings.

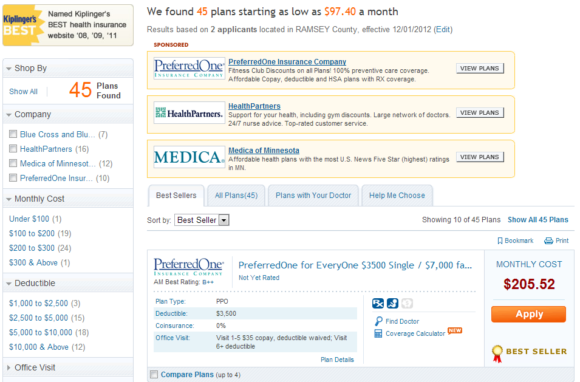

Purchasing a Plan Through the Marketplace: The Health Insurance Marketplace (also known as Healthcare.gov) is a government-run website where you can compare and purchase health insurance plans from various private insurers. The ACA provides subsidies to individuals and families who meet certain income requirements, making coverage more affordable. Navigating the Marketplace can be complex, so it’s helpful to utilize the available resources and tools to find a plan that fits your budget and health needs. Learn more about finding the right plan for you by visiting our website: www.waukeshahealthinsurance.com

Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or free health coverage to eligible individuals and families. Eligibility requirements vary by state, so it’s important to check your state’s specific guidelines. These programs are particularly beneficial for young adults who are low-income or uninsured.

Key Terms to Understand:

Understanding the terminology associated with health insurance is crucial for making informed decisions. Here are some key terms to familiarize yourself with:

Premium: The monthly payment you make to maintain your health insurance coverage.

Deductible: The amount you must pay out-of-pocket for covered healthcare services before your insurance begins to pay.

Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount.

Out-of-Pocket Maximum: The most you will have to pay out-of-pocket during a policy year for covered healthcare services. Once you reach your out-of-pocket maximum, your insurance will cover 100% of your covered healthcare costs for the remainder of the year.

Network: A group of doctors, hospitals, and other healthcare providers who have contracted with your insurance company to provide services at negotiated rates. Using in-network providers typically results in lower out-of-pocket costs.

Choosing the Right Plan:

Selecting the right health insurance plan depends on several factors, including your budget, health needs, and lifestyle. Consider the following:

Your Budget: Determine how much you can afford to pay monthly for premiums. Consider the potential costs of deductibles, copays, and coinsurance as well.

Your Health Needs: If you have pre-existing conditions or anticipate needing significant healthcare services, you’ll want a plan with comprehensive coverage and a lower out-of-pocket maximum.

Your Lifestyle: If you are generally healthy and only require occasional medical care, a plan with a higher deductible and lower premiums might be suitable.

Network of Providers: Ensure that your chosen plan includes doctors and hospitals within your geographic area that you are comfortable using.

The Importance of Preventative Care:

Many health insurance plans cover preventative care services, such as annual checkups, vaccinations, and screenings, at no cost to you. Taking advantage of these services is crucial for maintaining good health and preventing more serious health problems down the line. Regular checkups can help detect potential issues early on, when treatment is often less expensive and more effective.

Finding Help and Resources:

Navigating the world of health insurance can be challenging. Don’t hesitate to seek help from the following resources:

Your Employer’s Human Resources Department: If your employer offers health insurance, your HR department can provide valuable information and assistance.

The Health Insurance Marketplace (Healthcare.gov): This website offers a wealth of information and tools to help you compare and purchase health insurance plans.

Independent Insurance Brokers: Independent brokers, like those at Waukesha Health Insurance, can provide personalized guidance and assistance in finding the right plan for your individual needs. Contact us today for a free consultation: www.waukeshahealthinsurance.com

State Insurance Departments: Your state’s insurance department can provide information about consumer rights and protections.

Conclusion:

Securing appropriate health insurance is a critical step in safeguarding your financial well-being and ensuring access to quality healthcare. By understanding your options, familiarizing yourself with key terms, and utilizing available resources, you can make informed decisions that protect your health and future. Don’t delay – take the time to explore your options and choose a plan that meets your individual needs. Remember, proactive planning now can save you significant stress and expense in the future. For personalized assistance in finding the right health insurance plan in Waukesha, Wisconsin, contact us at www.waukeshahealthinsurance.com. We are dedicated to helping you navigate the complexities of health insurance and find the best coverage for your unique circumstances.