Finding the Right Health Insurance Plan for You-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

With a bewildering array of plans, terms, and providers, it’s easy to feel overwhelmed. However, understanding the basics and employing a strategic approach can empower you to find the perfect health insurance plan that fits your individual needs and budget. This guide will walk you through the process, helping you make informed decisions and secure the coverage you deserve.

Understanding the Basics of Health Insurance

Before diving into the specifics of plan selection, it’s crucial to grasp the fundamental concepts. Health insurance is a contract between you and an insurance company (or your employer). In exchange for regular premium payments, the insurer agrees to cover a portion or all of your medical expenses. These expenses can range from doctor visits and prescription drugs to hospital stays and surgeries.

Several key terms define the landscape of health insurance:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you must pay out-of-pocket for covered healthcare services before your insurance company begins to pay.

- Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount.

- Out-of-pocket maximum: The most you will pay out-of-pocket during a policy year. Once this limit is reached, your insurance company covers 100% of covered services.

- Network: The group of doctors, hospitals, and other healthcare providers contracted with your insurance company. Using in-network providers generally results in lower costs.

Types of Health Insurance Plans

Several types of health insurance plans exist, each with its own advantages and disadvantages:

Health Maintenance Organization (HMO): HMOs typically require you to choose a primary care physician (PCP) who acts as your gatekeeper. Referrals are usually needed to see specialists. HMOs generally offer lower premiums but have stricter network restrictions.

Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs. You don’t need a PCP referral to see specialists, and you can see out-of-network providers, although it will cost more. PPOs usually have higher premiums than HMOs.

Point of Service (POS): POS plans combine elements of HMOs and PPOs. They typically require a PCP, but you can see out-of-network providers for a higher cost.

Exclusive Provider Organization (EPO): EPOs are similar to HMOs, requiring you to use in-network providers. However, unlike HMOs, they usually don’t require a PCP referral to see specialists.

High Deductible Health Plan (HDHP): HDHPs have high deductibles but lower premiums. They are often paired with a Health Savings Account (HSA), allowing you to save pre-tax dollars to pay for medical expenses.

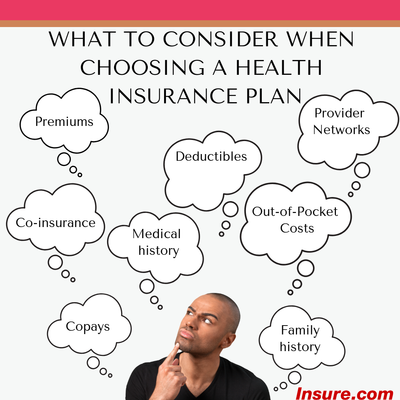

Factors to Consider When Choosing a Plan

Selecting the right health insurance plan requires careful consideration of several factors:

Your Budget: Premiums, deductibles, copays, and coinsurance all impact your out-of-pocket costs. Carefully evaluate your financial situation to determine what you can comfortably afford.

Your Health Needs: Consider your current health status and anticipated healthcare needs. If you have pre-existing conditions or anticipate significant healthcare expenses, a plan with lower out-of-pocket costs might be preferable.

Your Doctor’s Network: If you have a preferred doctor or specialist, ensure they are included in the plan’s network. Using out-of-network providers can significantly increase your costs.

Prescription Drug Coverage: If you take prescription medications regularly, carefully review the plan’s formulary (list of covered drugs) and associated costs.

Geographic Location: The availability of plans and providers varies by location. Consider the plans available in your area.

Finding the Right Plan for You in Waukesha County

If you reside in Waukesha County, Wisconsin, finding the right health insurance plan is crucial. Visit our website at www.waukeshahealthinsurance.com to explore a range of options tailored to your specific needs. We offer comprehensive resources and expert guidance to help you navigate the complexities of health insurance. Our team can assist you in understanding the different plan types, comparing coverage options, and selecting the most suitable plan for your circumstances.

www.waukeshahealthinsurance.com provides access to a comprehensive database of health insurance plans available in Waukesha County. You can use our online tools to compare plans based on various factors, including premium costs, deductibles, and network providers. We also offer personalized consultations to help you make informed decisions.

The Importance of Regular Review

Your health insurance needs can change over time. It’s essential to review your plan annually or whenever significant life events occur, such as marriage, childbirth, or a change in employment. Regular review ensures your plan continues to meet your evolving needs and budget.

Utilizing Online Resources and Tools

Several online resources can assist you in finding the right health insurance plan. Healthcare.gov is a valuable resource for understanding the Affordable Care Act (ACA) and finding plans available in your area. Many insurance companies also offer online tools and resources to compare plans and estimate costs.

Remember to thoroughly read the plan documents before enrolling to fully understand the terms and conditions. Don’t hesitate to contact the insurance company directly if you have any questions or require clarification.

Conclusion

Finding the right health insurance plan is a crucial decision that significantly impacts your financial well-being and access to healthcare. By understanding the basics of health insurance, considering your individual needs, and utilizing available resources, you can make an informed choice and secure the coverage you deserve. For residents of Waukesha County, Wisconsin, www.waukeshahealthinsurance.com is your trusted partner in finding the perfect health insurance plan. Contact us today to begin your journey towards comprehensive and affordable healthcare coverage. We are dedicated to helping you navigate the complexities of health insurance and find a plan that meets your unique requirements. Don’t delay – secure your health and financial future by choosing the right health insurance plan today. Contact us at www.waukeshahealthinsurance.com to learn more.