5 Ways Health Insurance Can Lower Your Long-Term Healthcare Costs-www.waukeshahealthinsurance.com

5 Ways Health Insurance Can Lower Your Long-Term Healthcare Costs

Healthcare costs in the United States are notoriously high, leaving many individuals and families facing significant financial burdens. The unpredictable nature of illness and injury only exacerbates this problem, making long-term financial planning a daunting task. However, health insurance plays a crucial role in mitigating these risks and significantly lowering your overall healthcare expenses over time. While the upfront cost of premiums might seem substantial, the long-term benefits far outweigh the initial investment. This article explores five key ways health insurance can protect your financial well-being and reduce your long-term healthcare costs.

1. Prevention and Early Detection through Preventative Care:

One of the most significant advantages of health insurance is access to preventative care services. Many plans cover routine checkups, screenings, and vaccinations at little to no cost to the insured. These preventative measures are crucial for early detection of potential health problems. Early detection often leads to less invasive and less expensive treatments. For example, regular mammograms covered by your insurance can detect breast cancer in its early stages, significantly increasing the chances of successful treatment and reducing the need for extensive and costly procedures later on. Similarly, regular colonoscopies can detect colon cancer early, potentially saving lives and reducing the overall cost of treatment.

Think about the potential cost of ignoring preventative care. A delayed diagnosis of a serious illness can lead to more extensive and expensive treatments, prolonged hospital stays, and potentially long-term disability. By utilizing the preventative services covered by your health insurance, you’re actively investing in your long-term health and financial security. Find a plan that best suits your preventative care needs by browsing our comprehensive selection at www.waukeshahealthinsurance.com. We offer plans with varying levels of preventative care coverage to help you make an informed decision.

2. Reduced Out-of-Pocket Expenses for Necessary Care:

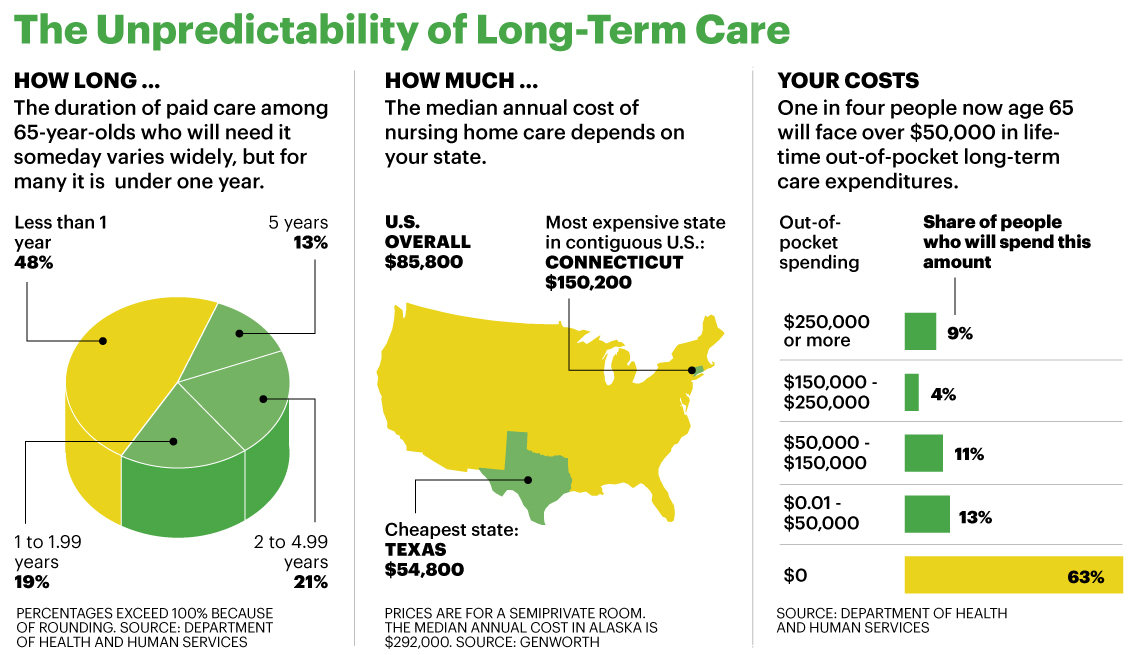

Unexpected illnesses and injuries can strike at any time, leading to substantial medical bills. Without health insurance, these costs can quickly spiral out of control, potentially leading to bankruptcy. Health insurance acts as a financial buffer, significantly reducing your out-of-pocket expenses for necessary medical care. Depending on your plan, your insurance will cover a portion or even the entirety of your hospital stays, doctor visits, surgeries, medications, and other medical services.

Consider the cost of a single emergency room visit without insurance. The bill can easily reach tens of thousands of dollars. With health insurance, even with a high deductible, your out-of-pocket expenses will be significantly lower. The insurance company will negotiate lower rates with healthcare providers and cover a substantial portion of the costs. Explore our various plans at www.waukeshahealthinsurance.com and compare deductibles, co-pays, and out-of-pocket maximums to find the best fit for your budget and healthcare needs. Understanding these key terms is crucial in selecting a plan that effectively manages your potential out-of-pocket expenses.

3. Access to Specialized Care and Treatments:

Many serious illnesses require specialized care and treatments, which can be incredibly expensive. Without health insurance, accessing these vital services can be financially prohibitive. Health insurance provides access to a network of healthcare providers, including specialists, ensuring you can receive the necessary care without facing insurmountable financial obstacles. This access extends to advanced treatments, such as chemotherapy, radiation therapy, and organ transplants, which are often exceptionally costly.

Imagine the financial burden of needing specialized cancer treatment without insurance. The cost of chemotherapy alone can easily exceed hundreds of thousands of dollars. With health insurance, a significant portion of these costs will be covered, allowing you to focus on your health and recovery rather than worrying about crippling debt. Our website, www.waukeshahealthinsurance.com, provides detailed information on the specialist networks covered by our various plans. This allows you to choose a plan that provides access to the specialists you may need in the future.

4. Negotiating Lower Healthcare Costs:

Health insurance companies have significant leverage in negotiating lower prices with healthcare providers. Their large networks of insured individuals allow them to negotiate bulk discounts and favorable payment terms, which ultimately translate into lower costs for you. This negotiating power is something you wouldn’t have as an individual consumer. The insurance company acts as a powerful advocate, ensuring you receive quality care at a more affordable price.

Without insurance, you’re negotiating healthcare costs on your own, leaving you vulnerable to inflated prices. Insurance companies leverage their size and influence to secure better rates, reducing the overall cost of your care. To understand the specific provider networks and negotiated rates associated with our plans, visit www.waukeshahealthinsurance.com. This transparency allows you to make informed decisions about your healthcare coverage.

5. Long-Term Financial Security and Peace of Mind:

The ultimate benefit of health insurance is the long-term financial security and peace of mind it provides. Knowing you have a safety net in place reduces the stress and anxiety associated with unexpected medical expenses. This peace of mind allows you to focus on your health and well-being, rather than worrying about the financial implications of illness or injury. This is particularly important for families with children or elderly dependents, who may be more susceptible to health issues.

The financial burden of unexpected healthcare costs can have far-reaching consequences, impacting your ability to pay for housing, food, and other essential needs. Health insurance protects you from these potential financial catastrophes, allowing you to maintain a stable financial footing even in the face of adversity. Invest in your future by exploring our comprehensive range of health insurance plans at www.waukeshahealthinsurance.com. We offer plans designed to provide you with the financial security and peace of mind you deserve.

In conclusion, while the monthly premiums for health insurance represent a cost, the long-term benefits significantly outweigh this expense. By providing access to preventative care, reducing out-of-pocket expenses, facilitating access to specialized care, negotiating lower healthcare costs, and offering long-term financial security, health insurance is a crucial investment in your overall well-being and financial future. Don’t hesitate to contact us at www.waukeshahealthinsurance.com to learn more about our plans and find the perfect coverage for your needs. Your health and financial future are worth protecting.