What Health Insurance Coverage is Right for You?-www.waukeshahealthinsurance.com

Table of Content

What Health Insurance Coverage is Right for You?

Choosing the right health insurance plan can feel overwhelming. The sheer number of options, varying coverage levels, and complex terminology can leave even the most diligent individual feeling lost. However, understanding your needs and the different types of plans available is the first step towards making an informed decision. This article will guide you through the process, helping you determine what health insurance coverage is right for you. Remember, your specific needs will dictate the best plan, and consulting with an expert can be invaluable. For personalized guidance, consider contacting a health insurance specialist in your area, such as those at www.waukeshahealthinsurance.com.

Understanding Your Needs:

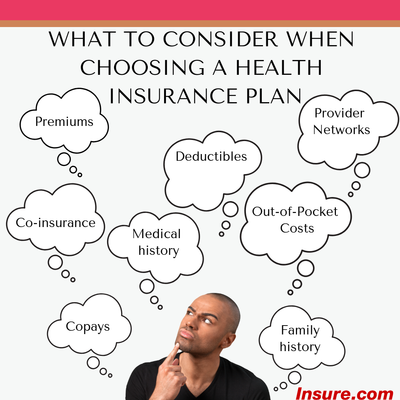

Before diving into the specifics of different plans, honestly assess your current and anticipated healthcare needs. Consider the following:

- Your Health Status: Are you generally healthy, or do you have pre-existing conditions requiring regular medical attention? Those with chronic illnesses or frequent doctor visits will require more comprehensive coverage.

- Your Age: Age significantly impacts healthcare needs. Older individuals generally require more extensive coverage due to increased susceptibility to health issues.

- Your Lifestyle: Do you engage in high-risk activities? Do you anticipate needing significant dental or vision care? Your lifestyle choices can influence your healthcare needs.

- Your Family: Do you have a family to consider? Family plans offer broader coverage, but the cost is typically higher. Consider the needs of each family member when making your decision.

- Your Budget: Health insurance premiums, deductibles, and co-pays can vary significantly. Determine how much you can comfortably afford to spend on premiums monthly. www.waukeshahealthinsurance.com can help you find plans that fit your budget.

- Your Employer: Does your employer offer health insurance? If so, understand the benefits and limitations of their plan before exploring other options. Many employers offer a range of plans to suit different needs and budgets.

Types of Health Insurance Plans:

Once you’ve assessed your needs, you can begin exploring the different types of health insurance plans available:

- Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. While cost-effective, limited choices can be a drawback.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. You can see any doctor, in-network or out-of-network, but out-of-network visits will typically result in higher costs. Premiums are generally higher than HMOs.

- Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs. They typically require a PCP, but allow you to see out-of-network providers at a higher cost.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but generally offer slightly more flexibility. While you still need a PCP and referrals, you might have more choices within the network.

- High Deductible Health Plans (HDHPs): HDHPs have high deductibles but lower premiums. They are often paired with a Health Savings Account (HSA), allowing pre-tax contributions to cover medical expenses. These plans are best suited for healthy individuals who can afford to pay a significant amount out-of-pocket before insurance coverage kicks in.

- Catastrophic Plans: Catastrophic plans are designed for young adults who meet specific income requirements. They have very high deductibles but offer protection against catastrophic medical expenses.

Key Terms to Understand:

Understanding the following terms is crucial for making an informed decision:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance coverage begins.

- Copay: A fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

- Out-of-Pocket Maximum: The maximum amount you’ll pay out-of-pocket for covered healthcare services in a year. Once this limit is reached, your insurance company covers 100% of the costs.

- Network: The group of doctors, hospitals, and other healthcare providers your insurance plan covers.

Finding the Right Plan:

Choosing the right health insurance plan is a personal decision. Factors like your health status, budget, and lifestyle all play a significant role. Several resources can help you navigate this process:

- Healthcare.gov: If you’re eligible for subsidized coverage through the Affordable Care Act (ACA), Healthcare.gov is a valuable resource.

- Your Employer: If your employer offers health insurance, review the available plans carefully and compare them to other options.

- Independent Insurance Brokers: Independent brokers can help you compare plans from different insurers and find the best fit for your needs. www.waukeshahealthinsurance.com is an example of a resource that can provide this assistance.

- Health Insurance Companies Directly: You can also contact health insurance companies directly to learn about their plans and coverage options.

The Importance of Professional Guidance:

Navigating the complexities of health insurance can be daunting. Seeking professional guidance from an experienced insurance broker can significantly simplify the process. They can help you understand your options, compare plans, and choose the coverage that best meets your individual needs and budget. For residents of Waukesha, Wisconsin, www.waukeshahealthinsurance.com provides expert advice and assistance in finding the right health insurance plan.

Conclusion:

Choosing the right health insurance plan is a crucial decision that impacts your financial well-being and access to healthcare. By carefully considering your needs, understanding the different plan types, and seeking professional guidance when necessary, you can make an informed choice that provides you with the peace of mind and protection you deserve. Remember to utilize the resources available to you, including online marketplaces and local insurance brokers like those found at www.waukeshahealthinsurance.com, to find the best health insurance coverage for your unique circumstances. Don’t hesitate to ask questions and seek clarification until you feel confident in your decision. Your health and financial security depend on it.