How to Handle Rising Health Insurance Premiums-www.waukeshahealthinsurance.com

Table of Content

How to Handle Rising Health Insurance Premiums

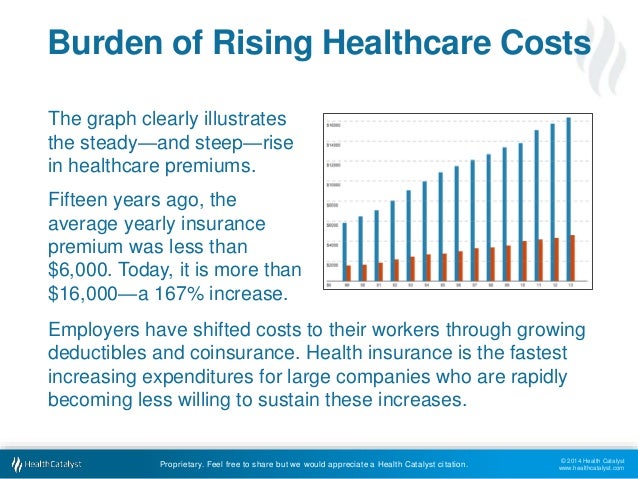

Health insurance is a crucial component of financial security, offering a safety net against unexpected medical expenses. However, the rising cost of health insurance premiums is a significant concern for many individuals and families. Understanding the factors driving these increases and exploring strategies to manage them is essential for maintaining financial stability and access to quality healthcare. This article will delve into the reasons behind escalating premiums and provide practical solutions to help you navigate this challenging landscape.

Understanding the Factors Driving Premium Increases

Several interconnected factors contribute to the persistent upward trend in health insurance premiums. These include:

Rising Healthcare Costs: The fundamental driver of premium increases is the escalating cost of healthcare services. This includes everything from hospital stays and physician visits to prescription drugs and advanced medical technologies. The complexity of modern medicine and the development of expensive new treatments contribute significantly to this upward pressure.

Inflation: General inflation impacts the cost of providing healthcare services, impacting everything from staffing costs to the price of medical supplies. As the cost of goods and services rises across the board, so too does the cost of healthcare, necessitating higher premiums.

Administrative Costs: A significant portion of health insurance premiums goes towards administrative expenses, including billing, claims processing, and marketing. The complexity of the healthcare system and the administrative burden associated with insurance plans contribute to these costs.

Prescription Drug Prices: The cost of prescription drugs has been escalating at an alarming rate. The high price of brand-name medications and the increasing use of expensive specialty drugs significantly impact insurance premiums.

Increased Utilization of Healthcare Services: As the population ages and chronic diseases become more prevalent, the demand for healthcare services increases. This higher utilization rate translates into higher costs for insurance companies, leading to higher premiums.

Lack of Transparency and Competition: The lack of transparency in healthcare pricing and limited competition in certain markets can contribute to higher costs. Consumers often lack the information needed to compare prices and choose the most cost-effective options.

Strategies for Managing Rising Premiums

While you can’t control the overall cost of healthcare, you can take proactive steps to manage your health insurance premiums and mitigate their impact on your budget. Here are some effective strategies:

Shop Around and Compare Plans: Don’t settle for the first plan you find. Take the time to compare different health insurance plans offered by various insurers. Use online comparison tools or consult with an independent insurance broker to find the most suitable and affordable plan for your needs. Consider using resources like those available at www.waukeshahealthinsurance.com to explore your options in the Waukesha area.

Choose a High-Deductible Plan with a Health Savings Account (HSA): High-deductible health plans (HDHPs) typically have lower premiums than traditional plans. Coupled with an HSA, this can be a cost-effective strategy. HSAs allow you to save pre-tax dollars to pay for eligible medical expenses. The money you contribute to your HSA grows tax-free, providing a valuable tool for managing healthcare costs.

Negotiate with Your Employer: If your employer provides health insurance, explore the possibility of negotiating a better plan or contributing more towards your premiums. Many employers are willing to work with employees to find solutions that benefit both parties.

Maintain a Healthy Lifestyle: Preventive care and a healthy lifestyle can significantly reduce your healthcare costs in the long run. Regular checkups, vaccinations, and healthy habits can help prevent costly illnesses and hospitalizations.

Utilize Telemedicine: Telemedicine offers a convenient and often more affordable alternative to in-person doctor visits for certain conditions. This can help reduce your out-of-pocket expenses and potentially lower your overall healthcare costs.

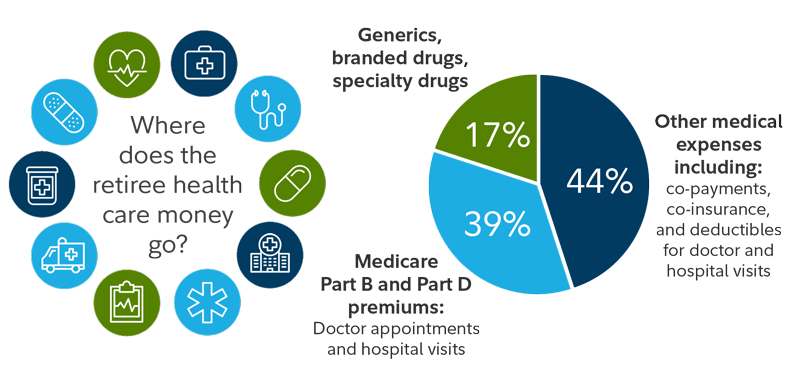

Review Your Prescription Drug Costs: Prescription drugs can significantly impact your healthcare expenses. Explore options like generic medications, negotiating prices with your pharmacy, or using prescription discount cards to reduce the cost of your medications.

Understand Your Plan’s Coverage: Familiarize yourself with your health insurance plan’s coverage details, including deductibles, co-pays, and out-of-pocket maximums. Understanding your plan’s limitations can help you make informed decisions about your healthcare choices and avoid unexpected costs.

Consider a Flexible Spending Account (FSA): FSAs allow you to set aside pre-tax dollars to pay for eligible medical expenses. While funds typically expire at the end of the year, they can provide a valuable tool for managing healthcare costs.

Appeal Denied Claims: If your health insurance company denies a claim, don’t hesitate to appeal the decision. Many denied claims are overturned upon appeal, saving you significant out-of-pocket expenses.

Seek Financial Assistance: If you’re struggling to afford your health insurance premiums, explore options for financial assistance. Many government programs and charitable organizations offer assistance to individuals and families who need help paying for healthcare. Check with your state’s health insurance marketplace for potential assistance programs.

Finding the Right Insurance in Waukesha County

For residents of Waukesha County, Wisconsin, navigating the complexities of health insurance can be simplified by utilizing local resources. www.waukeshahealthinsurance.com can provide valuable information and assistance in finding the right plan to fit your needs and budget. This resource can help you compare plans, understand coverage options, and make informed decisions about your health insurance. Remember to carefully consider your individual needs and circumstances when choosing a plan.

Conclusion

Rising health insurance premiums are a significant challenge for many, but by understanding the factors contributing to these increases and employing the strategies outlined above, you can take control of your healthcare costs and maintain financial stability. Remember that proactive planning, informed decision-making, and utilizing available resources are key to effectively managing your health insurance and ensuring access to quality healthcare. Don’t hesitate to reach out to insurance professionals or utilize online resources like www.waukeshahealthinsurance.com to find the best options for your specific situation. Your health and financial well-being depend on it.