How to Choose Between PPO and HMO Health Insurance Plans-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

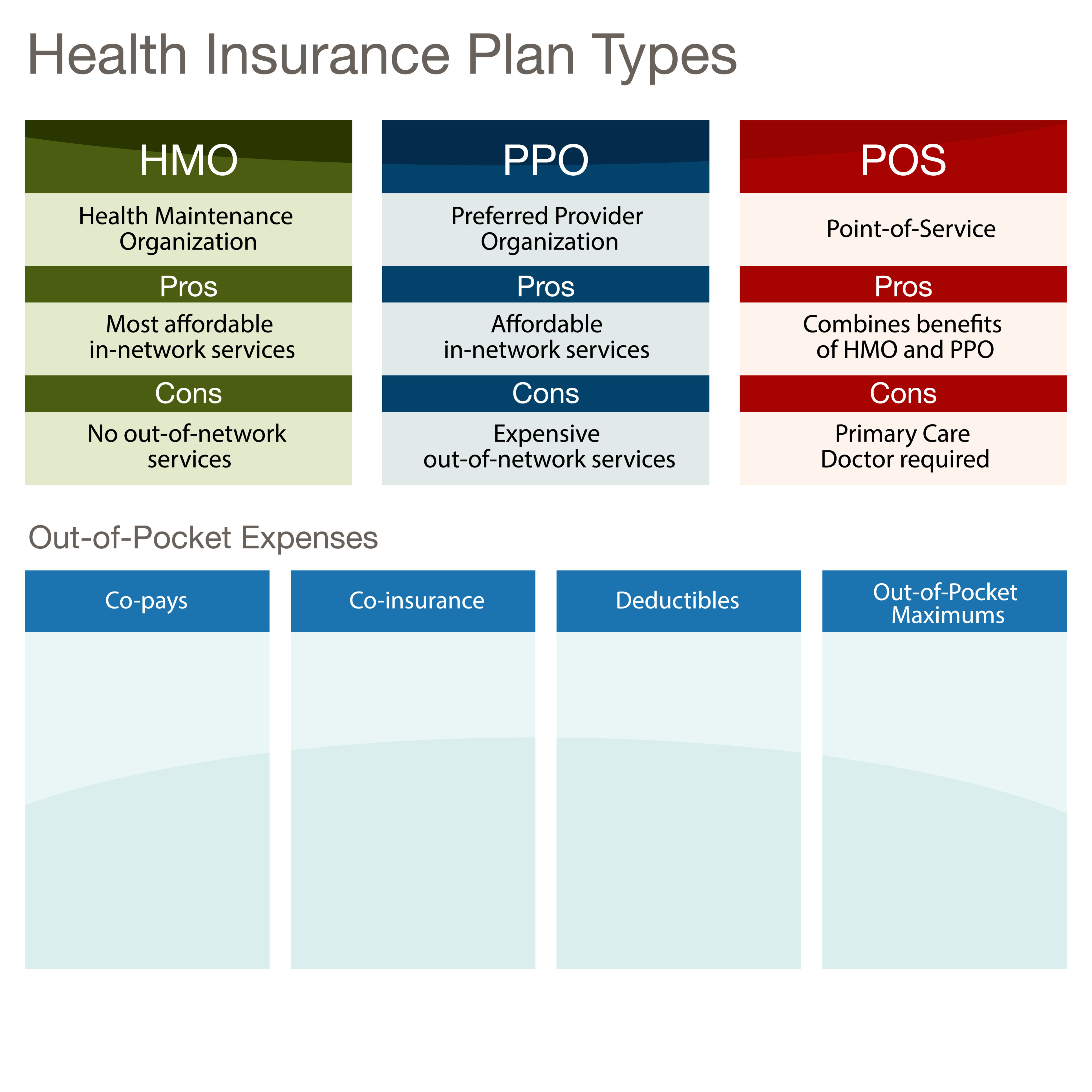

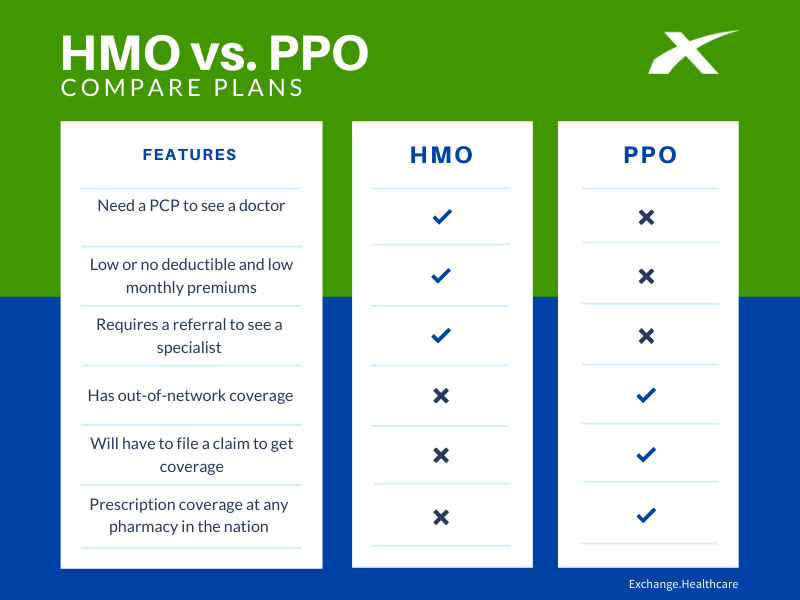

Seeing out-of-network providers is usually not covered.

Factors to Consider When Choosing a Plan:

- Your Budget: Consider your monthly budget and how much you can afford to pay in premiums and out-of-pocket expenses.

- Your Health Needs: If you have chronic conditions or anticipate needing specialized care, consider a plan that provides adequate coverage.

- Your Doctor Preferences: Check if your current doctors are in the plan’s network.

- Your Lifestyle: Consider your travel habits and whether you need access to out-of-network providers.

- Your Family’s Needs: If you have a family, consider the coverage options for dependents.

Making the Right Choice:

Choosing between a PPO and an HMO requires careful consideration of your individual needs and preferences. There’s no one-size-fits-all answer. By understanding the key differences between these plans and considering the factors outlined above, you can make an informed decision that best protects your health and your finances. For further assistance and personalized guidance in selecting the right health insurance plan for you and your family in the Waukesha area, please contact us or visit our website at www.waukeshahealthinsurance.com. We are dedicated to helping you navigate the complexities of health insurance and find a plan that meets your specific requirements. Don’t hesitate to reach out – we’re here to help you every step of the way. We also offer resources on understanding your benefits and maximizing your healthcare coverage, all available on our website www.waukeshahealthinsurance.com.