How to Budget for Health Insurance Premiums-www.waukeshahealthinsurance.com

Table of Content

How to Budget for Health Insurance Premiums

Healthcare costs in the United States are notoriously high, making health insurance a necessity rather than a luxury. However, the monthly premiums associated with health insurance can be a significant financial burden. Understanding how to effectively budget for these premiums is crucial for maintaining financial stability and ensuring access to necessary medical care. This article will guide you through the process of budgeting for health insurance premiums, offering practical tips and strategies to manage this essential expense.

Understanding Your Health Insurance Premiums

Before diving into budgeting strategies, it’s essential to understand what constitutes your health insurance premiums. Your premium is the monthly payment you make to your insurance company in exchange for coverage. Several factors influence the cost of your premium, including:

Plan Type: Different plans offer varying levels of coverage. Health Maintenance Organizations (HMOs) typically have lower premiums but restrict your choice of doctors and specialists. Preferred Provider Organizations (PPOs) offer more flexibility in choosing providers but usually come with higher premiums. High Deductible Health Plans (HDHPs) have lower premiums but require you to pay a significant amount out-of-pocket before your insurance coverage kicks in. Understanding the nuances of each plan type is crucial in selecting one that aligns with your budget and healthcare needs. You can explore your options and compare plans at www.waukeshahealthinsurance.com.

Age: Premiums generally increase with age, reflecting the higher likelihood of needing medical care as you get older.

Location: The cost of living and healthcare services in your geographic area significantly impacts your premiums. Rural areas may have lower premiums than densely populated urban centers.

Health Status: Pre-existing conditions can influence your premium cost. Insurance companies assess your health risk when determining your premium.

Family Size: Adding dependents to your plan will naturally increase your premium.

Employer Contribution (if applicable): If your employer offers health insurance, they may contribute a portion of your premium, reducing your out-of-pocket expenses.

Strategies for Budgeting Health Insurance Premiums

Effectively budgeting for health insurance premiums requires a multi-faceted approach. Here are some key strategies:

1. Assess Your Current Financial Situation:

Begin by evaluating your overall financial health. Track your income and expenses for a few months to understand your spending habits and identify areas where you can cut back. Use budgeting apps or spreadsheets to gain a clear picture of your financial situation. This will help you determine how much you can realistically allocate towards health insurance premiums without compromising other essential expenses.

2. Explore Different Health Insurance Plans:

Don’t settle for the first plan you encounter. Compare different plans offered by various insurance providers. Use online comparison tools or consult with an insurance broker to find a plan that offers the right balance of coverage and affordability. www.waukeshahealthinsurance.com can be a valuable resource for comparing plans in your area.

3. Consider a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA):

HDHPs offer lower premiums but require you to pay a substantial deductible before your insurance coverage begins. However, if you pair an HDHP with an HSA, you can contribute pre-tax dollars to the account to pay for eligible medical expenses. The money in your HSA grows tax-free, and you can use it to cover your deductible and other out-of-pocket costs. This strategy can be particularly beneficial for healthy individuals who don’t anticipate frequent medical expenses.

4. Negotiate with Your Employer (if applicable):

If your employer offers health insurance, inquire about the possibility of negotiating a higher employer contribution. Some employers are willing to increase their contribution to help employees manage the rising cost of health insurance.

5. Automate Your Payments:

Set up automatic payments for your health insurance premiums to avoid late fees and ensure consistent payments. This will also help you track your spending and maintain a consistent budget.

6. Build an Emergency Fund:

Unexpected medical expenses can significantly impact your finances. Building an emergency fund can provide a financial cushion to cover unexpected healthcare costs or gaps in your insurance coverage. Aim to save enough to cover at least three to six months of living expenses.

7. Explore Subsidies and Tax Credits:

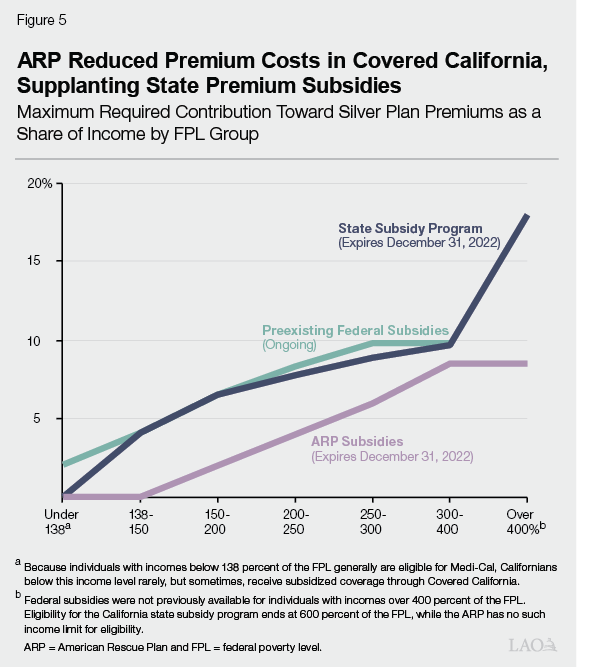

The Affordable Care Act (ACA) offers subsidies and tax credits to individuals and families who meet certain income requirements. These subsidies can significantly reduce the cost of health insurance premiums. Check your eligibility for these programs through the HealthCare.gov website or consult with a healthcare navigator.

8. Maintain a Healthy Lifestyle:

Preventing illness through healthy habits can help reduce your healthcare costs in the long run. Regular exercise, a balanced diet, and preventative check-ups can help you avoid costly medical treatments.

9. Shop Around for Prescription Drugs:

Prescription drugs can be a significant expense. Compare prices at different pharmacies and utilize discount programs or generic medications to save money.

10. Understand Your Out-of-Pocket Maximum:

Familiarize yourself with your plan’s out-of-pocket maximum. This is the maximum amount you will have to pay for covered healthcare services in a given year. Once you reach your out-of-pocket maximum, your insurance company will cover 100% of your eligible expenses for the remainder of the year.

11. Utilize Telemedicine:

Telemedicine offers a convenient and often more affordable alternative to in-person doctor visits for certain medical conditions. Check if your insurance plan covers telemedicine services.

12. Review Your Plan Annually:

Your healthcare needs and financial situation may change over time. Review your health insurance plan annually to ensure it still meets your needs and budget. Consider switching plans if a more affordable or better-suited option becomes available. www.waukeshahealthinsurance.com can help you compare plans and make informed decisions.

Conclusion:

Budgeting for health insurance premiums requires careful planning and proactive strategies. By understanding the factors that influence your premium costs, exploring different plan options, and implementing the strategies outlined above, you can effectively manage this essential expense and ensure access to the healthcare you need without jeopardizing your financial stability. Remember to utilize resources like www.waukeshahealthinsurance.com to find the best plan for your individual circumstances. Proactive planning and informed decision-making are key to navigating the complexities of health insurance and maintaining financial well-being.