Understanding Health Insurance Premiums and Deductibles-www.waukeshahealthinsurance.com

Table of Content

Understanding Health Insurance Premiums and Deductibles

Navigating the world of health insurance can feel like deciphering a complex code. Terms like "premium," "deductible," "copay," and "coinsurance" often leave individuals confused and overwhelmed. This article aims to clarify these key concepts, focusing on premiums and deductibles, to empower you to make informed decisions about your health insurance coverage. For those seeking health insurance options in the Waukesha, Wisconsin area, consider exploring resources available at www.waukeshahealthinsurance.com.

What is a Health Insurance Premium?

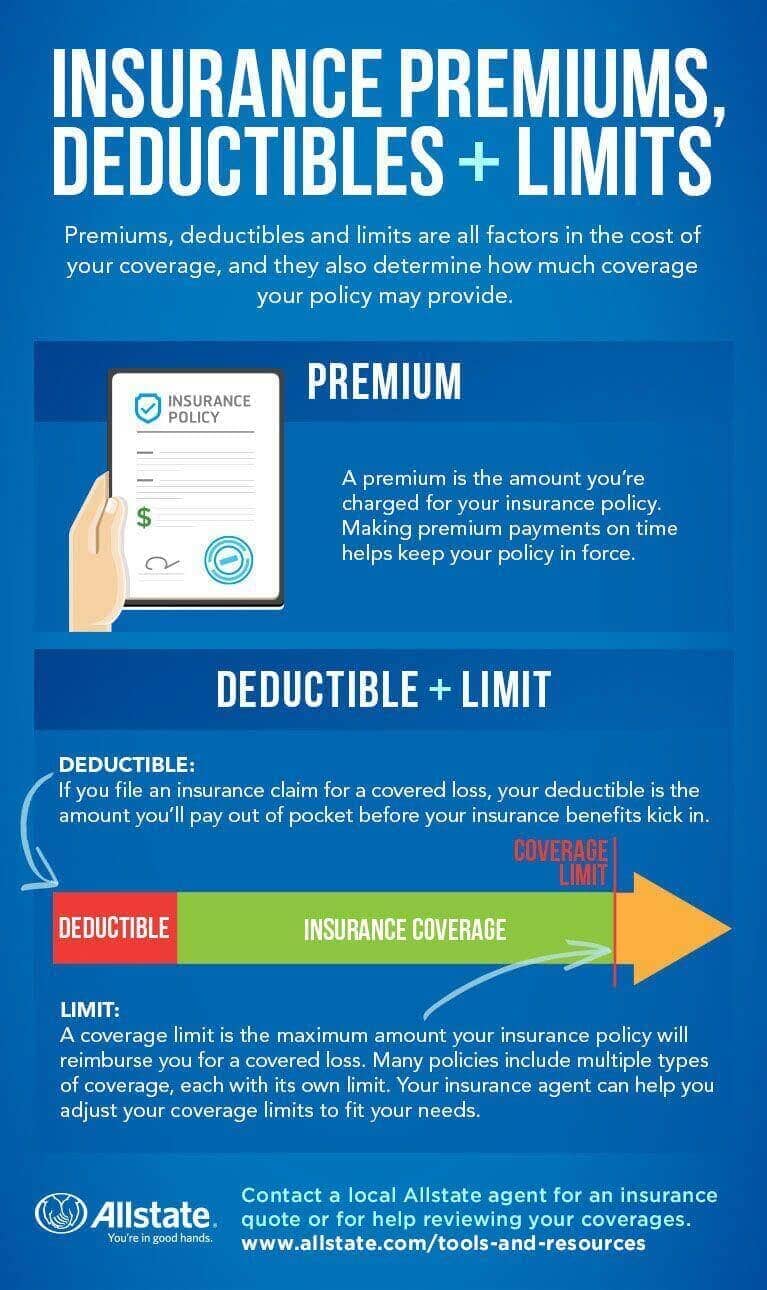

Your health insurance premium is the monthly payment you make to your insurance company in exchange for coverage. Think of it as your rent for having access to their network of doctors, hospitals, and other healthcare services. The amount you pay depends on several factors, including:

Your chosen plan: Different plans offer varying levels of coverage and, consequently, different premium costs. A plan with lower premiums might have higher out-of-pocket costs later on, while a plan with higher premiums might offer more comprehensive coverage. www.waukeshahealthinsurance.com can help you compare plans and find one that fits your budget and needs.

Your age: Generally, older individuals pay higher premiums than younger individuals due to the increased likelihood of needing healthcare services.

Your location: Premiums can vary based on geographic location, reflecting differences in healthcare costs in different areas.

Your family size: Premiums for family plans are typically higher than those for individual plans.

Your health status: While pre-existing conditions cannot be used to deny coverage under the Affordable Care Act (ACA), your health status can influence the cost of your premium in some cases.

Your employer (if applicable): If your employer offers health insurance, they may contribute a portion of your premium, reducing your out-of-pocket expense.

Understanding your premium is crucial for budgeting. It’s a recurring cost, so it’s essential to factor it into your monthly expenses. Ignoring this can lead to unexpected financial strain. If you’re unsure about how to manage your health insurance costs, seeking guidance from a qualified insurance broker or exploring resources like those at www.waukeshahealthinsurance.com can be invaluable.

What is a Health Insurance Deductible?

Your health insurance deductible is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company starts paying its share. It’s essentially the initial cost you bear before your coverage kicks in. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of your healthcare expenses yourself. After you meet your deductible, your insurance company will begin to cover the costs of your healthcare, according to the terms of your plan.

Deductibles vary significantly depending on the type of plan you choose. High-deductible health plans (HDHPs) have higher deductibles but lower premiums, while low-deductible plans have lower deductibles but higher premiums. The best option for you depends on your individual circumstances, risk tolerance, and financial situation. Comparing plans and understanding the implications of different deductible levels is crucial. www.waukeshahealthinsurance.com can assist you in this process.

How Deductibles and Premiums Interact

Premiums and deductibles are inversely related. Generally, a higher premium means a lower deductible, and vice versa. Choosing a plan involves carefully weighing these two factors. Consider your health history, anticipated healthcare needs, and your financial capacity to handle unexpected medical expenses. If you anticipate needing frequent medical care, a lower deductible plan might be preferable despite the higher premium. Conversely, if you are generally healthy and prefer lower monthly payments, a high-deductible plan might be a better fit.

Other Important Considerations

Beyond premiums and deductibles, other cost-sharing mechanisms exist within health insurance plans:

Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible. For example, 80/20 coinsurance means your insurance company pays 80% and you pay 20%.

Out-of-pocket maximum: The maximum amount you’ll pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance company covers 100% of the costs.

Finding the Right Plan

Choosing the right health insurance plan requires careful consideration of your individual needs and financial situation. Understanding premiums and deductibles is a crucial first step. Take the time to compare different plans, considering the trade-offs between premiums and deductibles. Don’t hesitate to seek assistance from insurance professionals or utilize online resources like those provided by www.waukeshahealthinsurance.com. They can provide valuable guidance and help you navigate the complexities of health insurance.

The Importance of Open Enrollment

Open enrollment is the period during which you can enroll in or change your health insurance plan. Missing this window can significantly impact your access to affordable healthcare. Staying informed about open enrollment deadlines is crucial. www.waukeshahealthinsurance.com can provide updates and information on open enrollment periods.

Conclusion

Health insurance can be complicated, but understanding the fundamentals of premiums and deductibles is essential for making informed decisions. By carefully weighing the costs and benefits of different plans, you can choose a plan that aligns with your health needs and financial capabilities. Remember to utilize available resources and seek professional guidance when needed. For residents of Waukesha, Wisconsin, www.waukeshahealthinsurance.com offers a valuable starting point for exploring your health insurance options. Taking the time to understand your coverage will empower you to make the best choices for your health and financial well-being.