Understanding Health Insurance for Families-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The costs of healthcare are constantly rising, making comprehensive health insurance a necessity rather than a luxury. Understanding the different types of plans, coverage options, and the intricacies of the enrollment process is crucial for protecting your family’s financial well-being and ensuring access to quality healthcare. This guide aims to demystify family health insurance, providing you with the knowledge you need to make informed decisions.

Types of Health Insurance Plans:

Several types of health insurance plans are available, each with its own structure and cost-sharing mechanisms. Choosing the right plan depends on your family’s specific needs and budget. Let’s explore some common options:

HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within the plan’s network. Referrals from your PCP are usually needed to see specialists. HMOs generally offer lower premiums but may have stricter limitations on out-of-network care.

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see specialists without a referral and visit out-of-network providers, although you’ll generally pay more out-of-pocket. PPOs typically have higher premiums than HMOs.

EPO (Exclusive Provider Organization): EPO plans are similar to HMOs, requiring you to stay within the network. However, unlike HMOs, EPOs usually don’t require a referral to see a specialist. Out-of-network coverage is typically not provided.

POS (Point of Service): POS plans combine elements of HMOs and PPOs. You choose a PCP within the network, but you have the option to see out-of-network providers, although at a higher cost.

HDHP (High Deductible Health Plan): HDHPs have high deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) but lower premiums. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money to pay for medical expenses. Learn more about finding the right plan for your family by contacting a health insurance specialist at www.waukeshahealthinsurance.com.

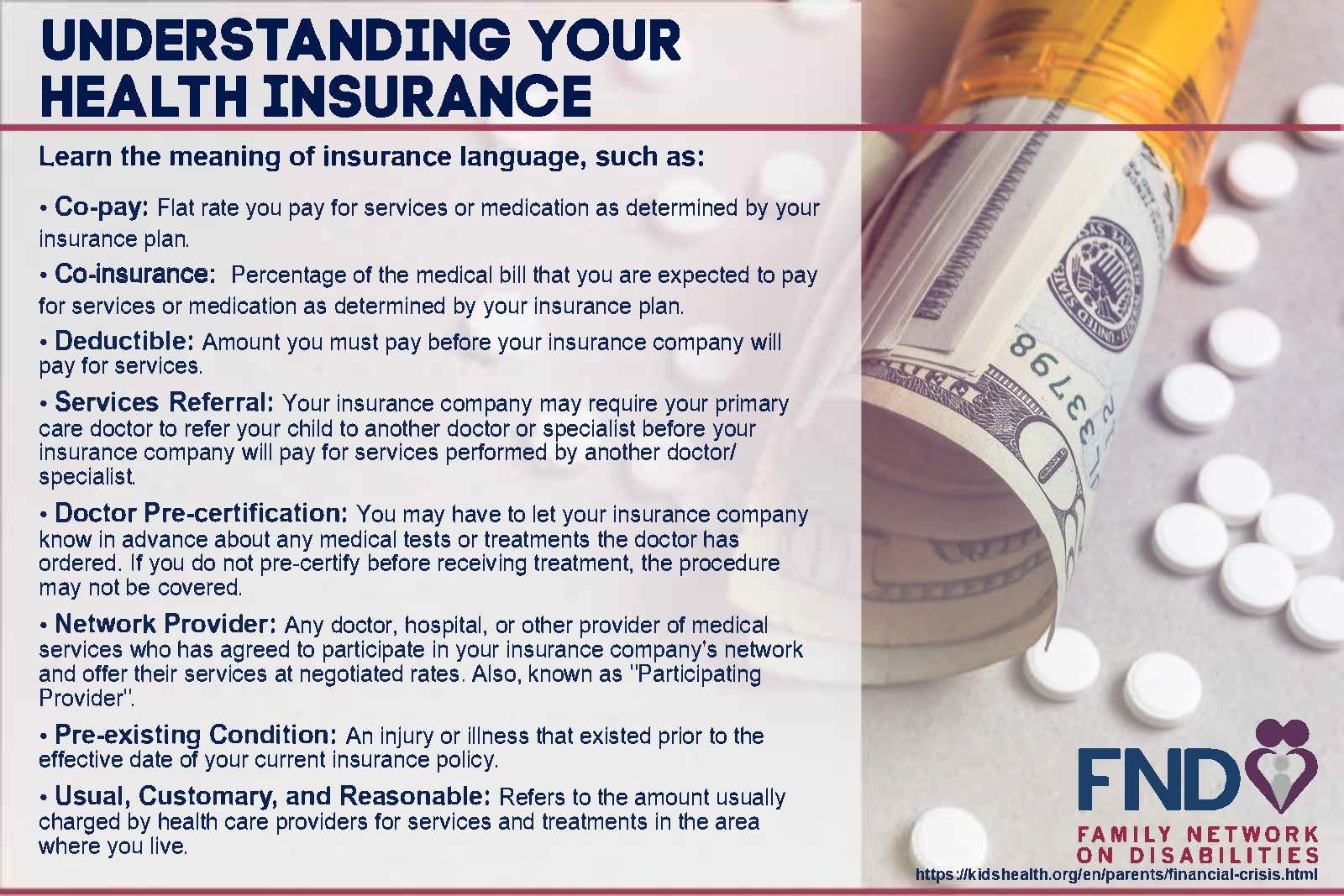

Key Terms to Understand:

Understanding the following terms is essential for navigating your health insurance policy:

Premium: The monthly payment you make to maintain your health insurance coverage.

Deductible: The amount you pay out-of-pocket for healthcare services before your insurance coverage begins.

Copay: A fixed amount you pay for a doctor’s visit or other services.

Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount.

Out-of-Pocket Maximum: The most you will pay out-of-pocket in a year for covered services. Once you reach this limit, your insurance will cover 100% of the costs.

Network: The group of doctors, hospitals, and other healthcare providers that your insurance plan contracts with.

Choosing the Right Plan for Your Family:

Selecting the best health insurance plan for your family requires careful consideration of several factors:

Budget: Compare premiums, deductibles, copays, and coinsurance for different plans to find one that fits your budget.

Healthcare Needs: Consider your family’s current and anticipated healthcare needs. If you have chronic conditions or anticipate significant healthcare expenses, a plan with lower out-of-pocket costs might be preferable.

Network Providers: Check if your preferred doctors and hospitals are in the plan’s network.

Prescription Drug Coverage: Review the formulary (list of covered medications) to ensure your family’s prescription needs are covered.

Children’s Coverage: Ensure the plan covers your children’s healthcare needs, including well-child visits and immunizations.

Open Enrollment and Special Enrollment Periods:

Most people can enroll in a health insurance plan during the annual Open Enrollment Period. However, there are also Special Enrollment Periods for qualifying life events, such as marriage, birth, or job loss. Missing the Open Enrollment period can result in a gap in coverage, so staying informed is crucial. Consult www.waukeshahealthinsurance.com for guidance on enrollment deadlines and eligibility.

The Role of a Health Insurance Broker:

Navigating the complexities of health insurance can be overwhelming. A health insurance broker can provide invaluable assistance. They can help you compare plans, understand your options, and choose the best plan for your family’s needs. Find a qualified broker in your area by visiting www.waukeshahealthinsurance.com and utilizing their resources. They can also assist with the enrollment process and answer any questions you may have.

Understanding Your Policy:

Once you have chosen a plan, it’s crucial to thoroughly understand your policy. Read the Summary of Benefits and Coverage (SBC) carefully to understand what is covered and what your cost-sharing responsibilities are. Keep your policy documents in a safe place and refer to them when needed.

Maintaining Your Coverage:

To maintain your health insurance coverage, ensure you make your monthly premium payments on time. Notify your insurance company of any changes in your family’s circumstances, such as a change of address or the addition of a new family member. For assistance with maintaining your coverage and understanding your policy details, reach out to the experts at www.waukeshahealthinsurance.com.

Conclusion:

Choosing the right health insurance plan for your family is a significant decision that requires careful planning and research. By understanding the different types of plans, key terms, and the enrollment process, you can make an informed choice that protects your family’s health and financial well-being. Don’t hesitate to seek assistance from a qualified health insurance broker or utilize online resources to guide you through this process. Remember, proactive planning and understanding are key to securing comprehensive and affordable healthcare for your loved ones. Start your journey to finding the perfect family health insurance plan today by visiting www.waukeshahealthinsurance.com. They offer personalized consultations and can answer all your questions.