How to Save on Health Insurance Without Sacrificing Coverage-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

waukeshahealthinsurance.com

4. Take Advantage of Employer-Sponsored Plans:

If your employer offers health insurance, it’s usually more affordable than purchasing a plan on the individual market. Carefully review the options offered by your employer and choose the plan that best suits your needs and budget. Often, employers contribute towards the premium, further reducing your cost.

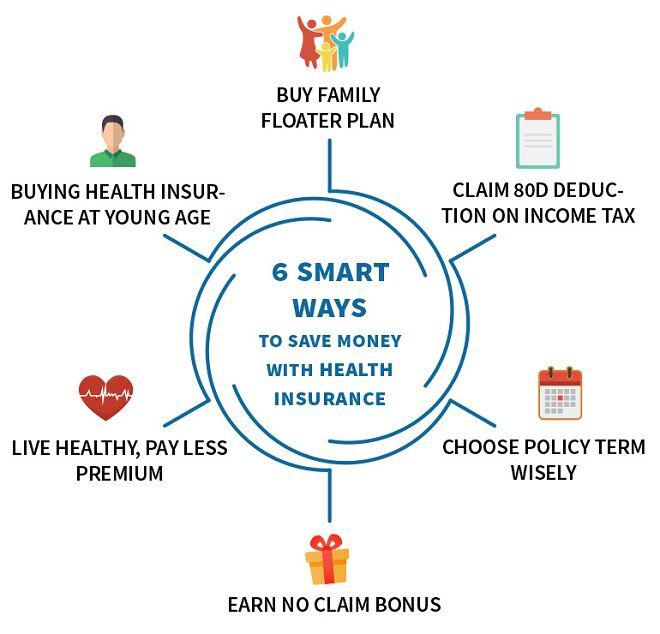

5. Maintain a Healthy Lifestyle:

While this might seem obvious, maintaining a healthy lifestyle can significantly reduce your healthcare costs in the long run. Regular exercise, a balanced diet, and preventive care can help prevent chronic illnesses, reducing the need for expensive treatments.

6. Shop Around and Compare Plans:

Don’t settle for the first plan you see. Take the time to compare plans from different insurers. Consider factors like premiums, deductibles, co-pays, and out-of-pocket maximums. Use our comparison tools at www.waukeshahealthinsurance.com to easily compare different plans side-by-side.

7. Negotiate with Providers:

Before receiving medical services, inquire about the cost. Many providers are willing to negotiate prices, especially for cash payments. Consider using in-network providers whenever possible, as they usually offer discounted rates.

8. Utilize Preventive Care:

Preventive care, such as annual checkups and screenings, can help detect and treat health problems early, preventing them from becoming more expensive to manage later. Many plans cover preventive care at no cost to you.

9. Understand Your Plan’s Coverage:

Familiarize yourself with your plan’s details, including what’s covered, what’s not, and your out-of-pocket responsibilities. This will help you make informed decisions about your healthcare and avoid unexpected costs.

10. Consider Telemedicine:

Telemedicine offers convenient and often more affordable access to healthcare services. Many plans cover telemedicine visits, providing a cost-effective alternative to in-person appointments.

11. Ask About Prescription Drug Discounts:

Many pharmacies offer discount programs that can lower the cost of your medications. Check with your pharmacist or your insurance provider to see if you’re eligible for any discounts.

12. Appeal Denied Claims:

If your insurance company denies a claim, don’t give up. Review the denial reason and appeal the decision if you believe it’s unjustified. Our website, www.waukeshahealthinsurance.com, offers resources to help you understand your rights and navigate the appeals process.

Conclusion:

Saving money on health insurance without sacrificing coverage is achievable with careful planning and a proactive approach. By understanding your options, utilizing available resources, and adopting a healthy lifestyle, you can significantly reduce your healthcare costs while ensuring you have the coverage you need. Remember to leverage the tools and resources available to you, including online comparison tools and expert advice. Contact us at www.waukeshahealthinsurance.com to speak with a knowledgeable agent who can help you find the best plan for your individual needs. Taking control of your health insurance decisions is a crucial step towards securing your financial well-being and access to quality healthcare.