How Health Insurance Can Make Your Life Easier-www.waukeshahealthinsurance.com

Table of Content

How Health Insurance Can Make Your Life Easier

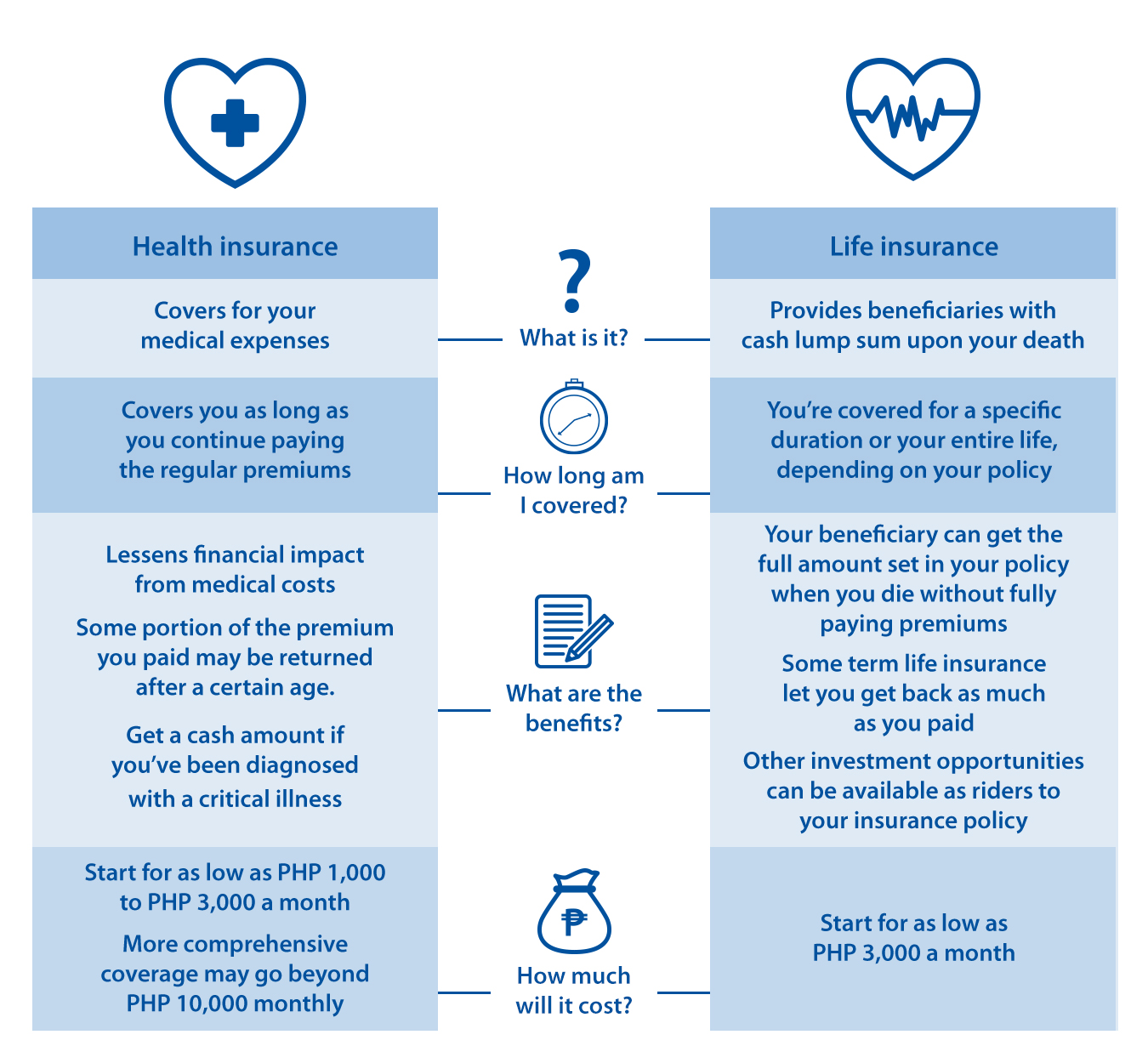

Life is unpredictable. One minute you’re enjoying a sunny afternoon, the next you’re facing an unexpected medical emergency. The costs associated with healthcare can be staggering, leaving even the most financially secure individuals vulnerable. This is where health insurance steps in, acting as a crucial safety net and a significant contributor to peace of mind. Understanding how health insurance can simplify your life and protect your financial well-being is essential. This article explores the various ways health insurance makes life easier, highlighting its benefits and addressing common concerns.

Financial Protection Against Unexpected Medical Expenses:

The most significant benefit of health insurance is its ability to mitigate the financial burden of unexpected medical costs. A single hospital stay, a serious illness, or a chronic condition can quickly accumulate tens of thousands of dollars in bills. Without health insurance, these costs can lead to crippling debt, impacting your credit score and overall financial stability. Health insurance significantly reduces these out-of-pocket expenses by covering a portion or all of your medical bills, depending on your plan. This financial protection allows you to focus on your recovery rather than worrying about mounting medical debt. Finding the right plan for your needs is crucial, and exploring options like those offered by www.waukeshahealthinsurance.com can be a great starting point.

Access to Quality Healthcare:

Health insurance provides access to a wider network of healthcare providers, including doctors, specialists, and hospitals. This ensures you can receive timely and quality care from qualified professionals. Without insurance, you might be limited to clinics or hospitals that accept cash payments, potentially compromising the quality of care you receive. Many insurance plans offer access to a vast network of in-network providers, offering discounts and streamlined billing processes. This simplifies the process of finding and accessing care, ensuring you receive the best possible treatment without unnecessary administrative hurdles. www.waukeshahealthinsurance.com can help you find plans that offer access to a wide range of reputable healthcare providers in your area.

Preventive Care and Early Detection:

Many health insurance plans cover preventive care services, such as annual checkups, vaccinations, and screenings. These services are crucial for early detection and prevention of serious health conditions. Regular checkups can identify potential health issues early on, allowing for timely intervention and potentially preventing more serious and costly treatments down the line. The cost savings associated with preventive care far outweigh the premiums paid for insurance, making it a worthwhile investment in your long-term health and well-being. Check out the preventive care coverage offered by different plans available through www.waukeshahealthinsurance.com to find the best fit for your needs.

Mental Health and Wellness Coverage:

Mental health is an integral part of overall well-being, and many modern health insurance plans recognize this by including coverage for mental health services. This includes therapy sessions, medication management, and inpatient treatment for mental health conditions. Access to mental health services can be life-changing, allowing individuals to address mental health challenges and improve their quality of life. The stigma surrounding mental health is gradually decreasing, and increased insurance coverage plays a vital role in making mental healthcare more accessible and affordable. Explore the mental health benefits offered by various plans listed on www.waukeshahealthinsurance.com to find a plan that supports your holistic well-being.

Prescription Drug Coverage:

Prescription medications can be expensive, especially for individuals with chronic conditions requiring ongoing medication. Health insurance plans typically include prescription drug coverage, reducing the cost of essential medications. This coverage can significantly reduce the financial burden associated with managing chronic illnesses and ensures individuals can access the medications they need to maintain their health. Comparing prescription drug formularies across different plans is essential to ensure your medications are covered at an affordable cost. www.waukeshahealthinsurance.com can help you compare plans and find one that covers your specific prescription needs.

Simplified Billing and Payment Processes:

Health insurance companies handle the complex billing and payment processes with healthcare providers, simplifying the experience for policyholders. Instead of dealing directly with multiple medical bills, you receive a single bill from your insurance company, making it easier to manage your healthcare expenses. Many insurance plans offer online portals for managing your account, viewing claims, and accessing your explanation of benefits (EOB). This streamlined process saves you time and reduces the administrative burden associated with healthcare.

Peace of Mind and Reduced Stress:

Perhaps the most valuable benefit of health insurance is the peace of mind it provides. Knowing you have a safety net in place to protect you from unexpected medical expenses reduces stress and anxiety. This allows you to focus on your health and well-being without the constant worry of financial ruin due to medical bills. This peace of mind is invaluable, contributing to a healthier and happier life.

Choosing the Right Health Insurance Plan:

Choosing the right health insurance plan can be overwhelming, given the variety of options available. Factors to consider include your budget, health needs, and preferred healthcare providers. It’s essential to carefully review the terms and conditions of each plan, understanding the coverage details, deductibles, co-pays, and out-of-pocket maximums. Comparing plans from different insurers is crucial to find the best value for your money. Resources like www.waukeshahealthinsurance.com can simplify this process by providing a comprehensive comparison of available plans in your area.

Understanding Your Policy:

Once you have chosen a health insurance plan, it’s crucial to understand your policy thoroughly. Familiarize yourself with the terms and conditions, coverage details, and procedures for filing claims. Keep your insurance card readily available and contact your insurance provider if you have any questions or concerns.

Conclusion:

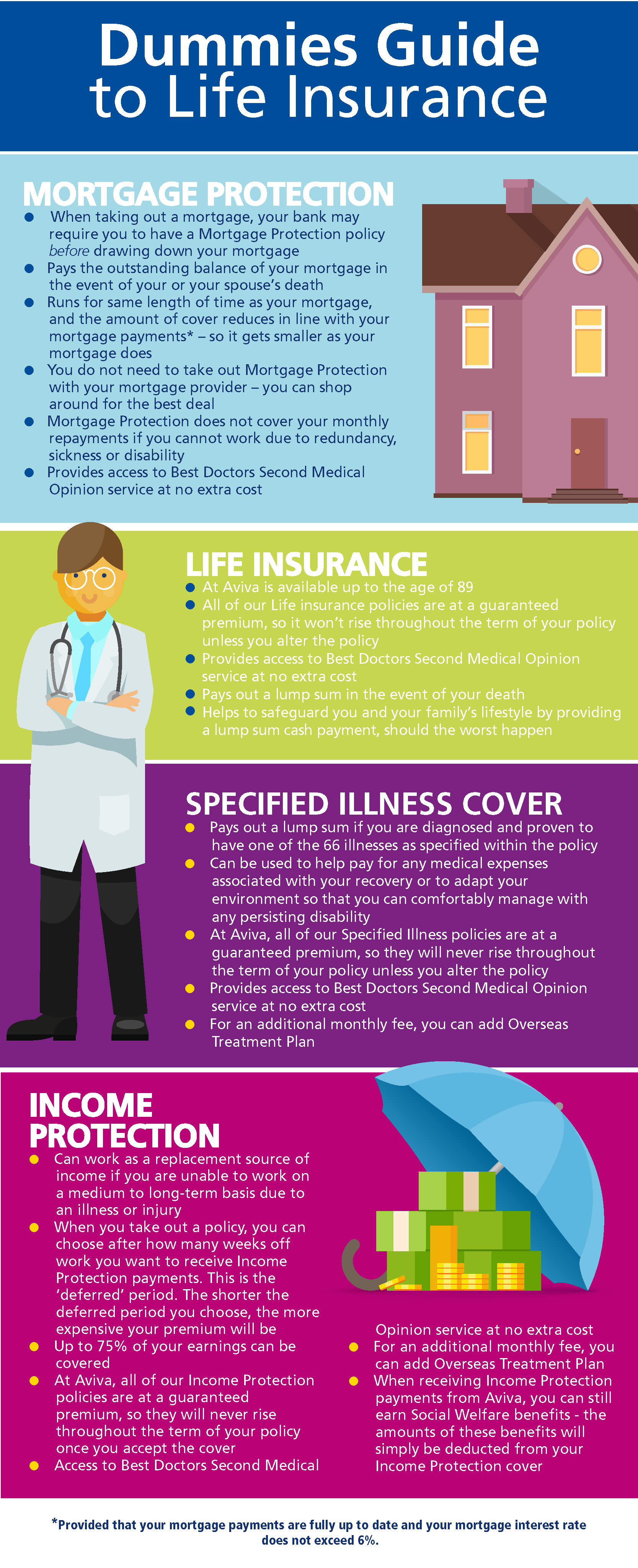

.jpg/b73a92d7-6144-d3aa-2f7a-ff7bc79da374)

Health insurance is more than just a financial safety net; it’s an investment in your health, well-being, and peace of mind. It provides access to quality healthcare, simplifies billing processes, and protects you from the potentially devastating financial consequences of unexpected medical expenses. By understanding the benefits of health insurance and choosing the right plan for your needs, you can significantly improve your overall quality of life and navigate the complexities of healthcare with greater ease and confidence. Start your search for the perfect plan today by visiting www.waukeshahealthinsurance.com and taking control of your healthcare future.