Here’s a 1500-word article about how health insurance can save you money in the long run, incorporating the requested link and underlined keywords:-www.waukeshahealthinsurance.com

Table of Content

Here’s a 1500-word article about how health insurance can save you money in the long run, incorporating the requested link and underlined keywords:

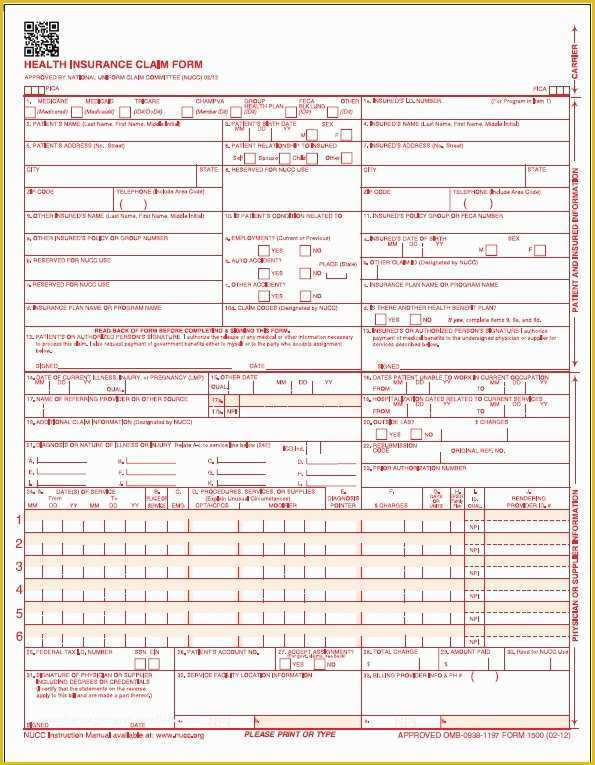

:max_bytes(150000):strip_icc()/CMS-1500-claim-form-57a2d3a85f9b589aa99caf8b.jpg)

How Health Insurance Can Save You Money in the Long Run

Unexpected illnesses and injuries can strike at any time, leaving individuals and families facing potentially crippling medical bills. The cost of healthcare in the United States is notoriously high, and even a seemingly minor ailment can quickly escalate into a financial catastrophe. This is where health insurance steps in, acting as a crucial financial safety net and, counterintuitively, a significant money-saver in the long run. While the monthly premiums might seem like an added expense, the potential savings far outweigh the cost for most people.

This article will explore the numerous ways health insurance can protect your finances and ultimately save you money over time. We’ll delve into the various types of coverage, the hidden costs of going without insurance, and the long-term financial benefits of having a comprehensive plan. For those in the Waukesha, Wisconsin area, we encourage you to explore your options with a local provider like www.waukeshahealthinsurance.com.

The High Cost of Uninsured Healthcare:

The most immediate and obvious way health insurance saves money is by mitigating the cost of medical care. Without insurance, you are entirely responsible for paying for all medical services out-of-pocket. This includes doctor visits, hospital stays, surgeries, prescription medications, diagnostic tests, and more. Even a single emergency room visit for a relatively minor injury can easily cost thousands of dollars. Major illnesses or accidents can lead to bills in the tens or even hundreds of thousands of dollars, potentially leading to bankruptcy.

Imagine a scenario where you suffer a broken leg. Without insurance, you’ll face charges for the ambulance ride, emergency room visit, X-rays, surgery (if needed), physical therapy, and follow-up appointments. These costs can quickly accumulate, placing an immense financial burden on you and your family. With health insurance, a significant portion of these costs would be covered, leaving you with a much smaller out-of-pocket expense.

Furthermore, the lack of preventative care is a significant hidden cost of being uninsured. Regular check-ups, screenings, and vaccinations are crucial for maintaining good health and preventing more serious, and more expensive, health problems down the line. Without insurance, many individuals delay or forgo these essential preventative measures, leading to more expensive treatments later on. This is a classic example of how seemingly small savings upfront can lead to significantly larger expenses later.

How Health Insurance Protects Your Finances:

Health insurance works by spreading the risk of healthcare costs across a large pool of individuals. By paying monthly premiums, you contribute to this pool, which is then used to cover the medical expenses of those who need it. This system protects you from catastrophic financial losses due to unexpected medical events.

The specific ways health insurance protects your finances include:

Reduced Out-of-Pocket Costs: Insurance plans cover a significant portion of your medical expenses, leaving you with a much smaller out-of-pocket payment. This includes deductibles, co-pays, and coinsurance. The exact amount you pay depends on your specific plan and the type of care you receive.

Negotiated Rates: Insurance companies negotiate lower rates with healthcare providers, meaning you receive services at a discounted price compared to paying out-of-pocket. This negotiation power is a significant advantage that individual consumers don’t possess.

Preventative Care Coverage: Many plans cover preventative services like annual check-ups, vaccinations, and screenings at little to no cost. This proactive approach to healthcare can prevent more serious and expensive health problems in the future.

Protection Against Catastrophic Illness: Health insurance provides crucial protection against the devastating financial consequences of serious illnesses or accidents. Without insurance, a single major illness could wipe out your savings and leave you with insurmountable debt.

Mental Health Coverage: Many plans now include comprehensive mental health coverage, addressing a critical area of healthcare that often comes with significant costs. This is particularly important given the rising rates of mental health issues.

Choosing the Right Health Insurance Plan:

Choosing the right health insurance plan is crucial to maximizing its financial benefits. Several factors should be considered, including:

Premium Costs: The monthly cost of your insurance plan.

Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

Co-pay: The fixed amount you pay for each doctor visit or service.

Coinsurance: The percentage of costs you pay after meeting your deductible.

Out-of-Pocket Maximum: The maximum amount you’ll pay out-of-pocket in a year.

Network of Providers: The doctors and hospitals included in your plan’s network. Using in-network providers generally results in lower costs.

It’s essential to carefully compare different plans and choose one that best fits your needs and budget. www.waukeshahealthinsurance.com can help you navigate this process and find a plan that suits your individual circumstances.

Long-Term Financial Security:

The long-term financial benefits of health insurance are undeniable. By protecting you from catastrophic medical expenses, it allows you to maintain financial stability, plan for the future, and avoid the crippling debt that can result from unexpected illnesses or injuries. This financial security translates into peace of mind, allowing you to focus on your health and well-being without the constant worry of overwhelming medical bills.

Health insurance is not just about covering immediate medical expenses; it’s about securing your long-term financial health. It’s an investment in your future, protecting you and your family from unforeseen financial hardship. For residents of Waukesha, Wisconsin, exploring your options with a local provider like www.waukeshahealthinsurance.com is a crucial step in securing your financial future and ensuring access to quality healthcare. Don’t wait until a health crisis strikes; protect yourself and your family today. Contact www.waukeshahealthinsurance.com to learn more about your options and find a plan that fits your needs and budget. Your financial well-being depends on it. Take control of your healthcare costs and secure your future with comprehensive health insurance. Visit www.waukeshahealthinsurance.com for a free consultation and personalized guidance. Don’t delay, protect your future today! Contact www.waukeshahealthinsurance.com.