Health Insurance for People with Pre-existing Conditions-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

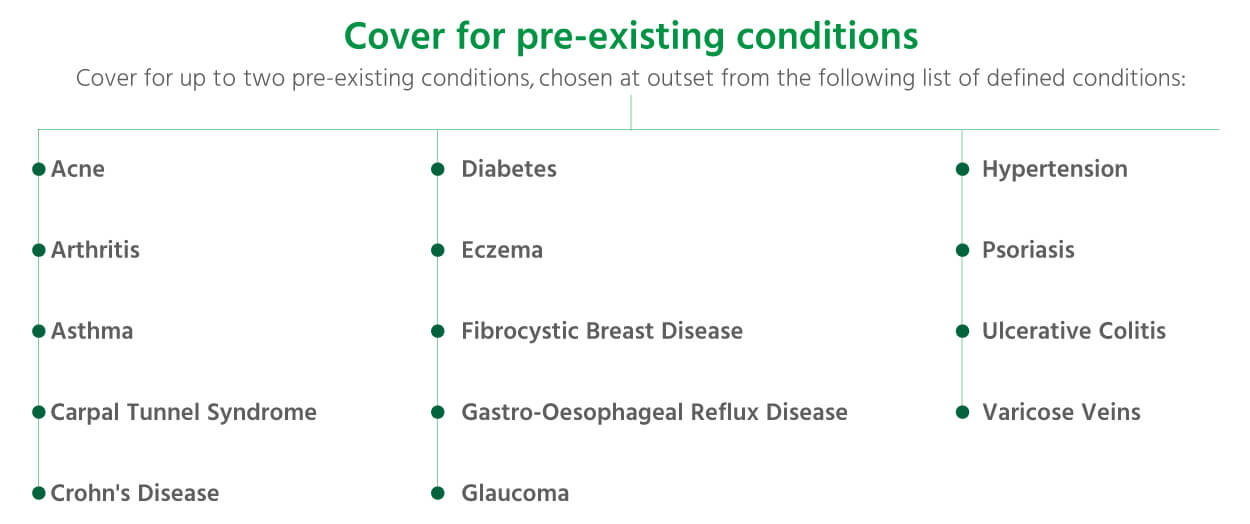

A pre-existing condition is any health issue you had before you applied for health insurance, such as asthma, diabetes, heart disease, or cancer. Before the Affordable Care Act (ACA), individuals with pre-existing conditions often faced denial of coverage or exorbitant premiums, leaving them vulnerable and financially exposed. The landscape has shifted significantly, but navigating the complexities of health insurance with a pre-existing condition still requires careful consideration.

The Affordable Care Act (ACA), also known as Obamacare, revolutionized healthcare access in the United States. One of its most impactful provisions prohibits insurance companies from denying coverage or charging higher premiums based solely on a pre-existing condition. This landmark change ensures that millions of Americans with chronic illnesses or other health concerns can finally access affordable and comprehensive healthcare. However, understanding the nuances of the ACA and how it applies to your specific situation remains crucial.

Understanding the ACA’s Protections:

The ACA’s core principle is to guarantee access to health insurance regardless of health status. This means that insurance companies cannot:

- Deny coverage: You cannot be denied coverage simply because you have a pre-existing condition.

- Charge higher premiums: Insurance companies cannot charge you more for coverage based solely on your pre-existing condition. While your overall premium might be influenced by factors like age and location, your pre-existing condition cannot be the sole determinant.

- Exclude pre-existing conditions from coverage: Your pre-existing condition must be covered under your health insurance plan, just like any other health issue. This includes both preventative care and treatment for your condition.

Finding the Right Health Insurance Plan:

While the ACA provides essential protections, choosing the right health insurance plan can still be challenging. Several factors need consideration:

- Your health needs: Consider the specific treatments and medications required for your pre-existing condition. Choose a plan with adequate coverage for these needs. Some plans offer better coverage for specific conditions than others.

- Your budget: Health insurance premiums vary significantly depending on the plan’s coverage level and your location. Consider your financial capacity and choose a plan that fits your budget without compromising essential coverage. Explore options like subsidies and tax credits available through the ACA marketplace to reduce your out-of-pocket costs.

- Your network of doctors and hospitals: Check if your preferred doctors and hospitals are included in the plan’s network. Out-of-network care can be significantly more expensive.

- Your deductible and out-of-pocket maximum: Understand your plan’s deductible (the amount you pay before insurance coverage begins) and out-of-pocket maximum (the most you’ll pay for covered services in a year). A lower deductible and out-of-pocket maximum generally translate to lower out-of-pocket costs but higher premiums.

Navigating the Marketplace:

The Health Insurance Marketplace (healthcare.gov) is a valuable resource for finding and comparing health insurance plans. The website allows you to filter plans based on your needs, budget, and location. You can also access information about available subsidies and tax credits to help you afford coverage. Utilizing the marketplace is crucial for finding the best plan for your specific circumstances.

Seeking Professional Guidance:

Given the complexities of health insurance, seeking professional guidance can be incredibly beneficial. An independent insurance broker can help you navigate the options, compare plans, and understand the nuances of your coverage. They can provide personalized recommendations based on your health needs and financial situation. Consider contacting a local broker like those at www.waukeshahealthinsurance.com for personalized assistance.

Specific Considerations for Pre-existing Conditions:

Individuals with pre-existing conditions should pay close attention to the following aspects of their health insurance plan:

- Prescription drug coverage: Ensure your plan covers the medications you need for your pre-existing condition. Check the formulary (list of covered medications) and understand any cost-sharing requirements.

- Specialist coverage: If your pre-existing condition requires specialized care, confirm that your plan covers visits to specialists within its network.

- Mental health coverage: Many pre-existing conditions have a significant mental health component. Ensure your plan offers adequate mental health coverage, including therapy and medication.

- Preventative care: Preventative care is crucial for managing pre-existing conditions. Choose a plan that covers preventative services, such as annual checkups and screenings.

The Importance of Continuous Coverage:

Maintaining continuous health insurance coverage is vital, especially for individuals with pre-existing conditions. Gaps in coverage can lead to challenges in accessing care and potentially higher premiums in the future. Understanding your options for maintaining continuous coverage is crucial, and resources like www.waukeshahealthinsurance.com can provide valuable insights.

Beyond the ACA:

While the ACA provides significant protections, it’s important to be aware of potential limitations. Understanding your state’s specific regulations and the details of your chosen plan is crucial. Some plans may have higher deductibles or co-pays than others, even if they offer the same level of coverage. Always carefully review the plan details before enrolling. Consulting with professionals at www.waukeshahealthinsurance.com can help clarify any uncertainties.

Looking Ahead:

The healthcare landscape is constantly evolving. Staying informed about changes to the ACA and other healthcare legislation is essential for individuals with pre-existing conditions. Regularly review your health insurance plan to ensure it continues to meet your needs. Don’t hesitate to seek professional advice to ensure you have the best possible coverage. Resources such as www.waukeshahealthinsurance.com can provide ongoing support and guidance.

This article provides a comprehensive overview of health insurance for individuals with pre-existing conditions. Remember, accessing affordable and comprehensive healthcare is a right, not a privilege. By understanding your options and seeking professional guidance, you can navigate the complexities of health insurance and secure the coverage you need to live a healthy and fulfilling life. Don’t hesitate to reach out to experts at www.waukeshahealthinsurance.com for personalized assistance.