Health Insurance 101: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The jargon, the endless options, and the potential financial implications can be overwhelming. However, understanding the basics is crucial for protecting your financial well-being and ensuring access to quality healthcare. This comprehensive guide will break down the essentials of health insurance, empowering you to make informed decisions about your coverage.

What is Health Insurance?

Health insurance is a contract between you (the policyholder) and an insurance company (the insurer). In exchange for regular payments called premiums, the insurer agrees to cover a portion or all of your healthcare costs. These costs can include doctor visits, hospital stays, surgeries, prescription drugs, and more. Without health insurance, you would be responsible for paying these expenses out-of-pocket, which can quickly lead to significant debt.

Types of Health Insurance Plans:

Several types of health insurance plans exist, each with its own structure and cost-sharing mechanisms. Understanding these differences is key to choosing the right plan for your individual needs and budget.

Health Maintenance Organizations (HMOs): HMOs typically require you to choose a primary care physician (PCP) within their network. Your PCP acts as a gatekeeper, referring you to specialists within the network if needed. HMOs generally offer lower premiums but may have stricter rules about seeing out-of-network providers. If you see an out-of-network provider without a referral, you’ll likely pay the full cost.

Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. You can generally see any doctor or specialist, in-network or out-of-network, without a referral. However, seeing out-of-network providers will usually result in higher out-of-pocket costs. PPOs typically have higher premiums than HMOs but offer greater choice.

Point of Service (POS) Plans: POS plans combine elements of both HMOs and PPOs. They often require a PCP and may offer lower costs for in-network care, but they also allow you to see out-of-network providers, although at a higher cost.

Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs in that they require you to choose a PCP and generally only cover care from in-network providers. However, unlike HMOs, EPOs typically don’t require a referral to see a specialist within the network.

High Deductible Health Plans (HDHPs): HDHPs have lower premiums than other plans but come with a high deductible, meaning you pay a significant amount out-of-pocket before your insurance coverage kicks in. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money to pay for medical expenses. Learn more about HSA options by visiting our website. www.waukeshahealthinsurance.com

Key Terms to Understand:

Premium: The monthly payment you make to maintain your health insurance coverage.

Deductible: The amount you must pay out-of-pocket for covered healthcare services before your insurance begins to pay.

Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket for covered healthcare services in a plan year. Once you reach this limit, your insurance company will cover 100% of your eligible expenses.

Network: The group of doctors, hospitals, and other healthcare providers that your insurance plan contracts with to provide services at a negotiated rate.

Pre-existing Condition: A health condition you had before your health insurance coverage started. The Affordable Care Act (ACA) prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions.

Choosing the Right Plan:

Selecting the right health insurance plan depends on several factors, including:

Your budget: Consider your monthly premium payments and your ability to meet your deductible and other out-of-pocket costs.

Your health needs: If you have pre-existing conditions or anticipate needing significant healthcare services, you may need a plan with lower out-of-pocket costs.

Your preferred doctors and hospitals: Check whether your preferred providers are in the plan’s network.

Your lifestyle: If you travel frequently, you may want a plan that offers broader coverage.

The Affordable Care Act (ACA):

The ACA, also known as Obamacare, significantly impacted the health insurance landscape. It expanded access to health insurance by prohibiting insurers from denying coverage based on pre-existing conditions and establishing health insurance marketplaces where individuals and families can compare and purchase plans. For more information on ACA compliance and your options, contact us today. www.waukeshahealthinsurance.com

Open Enrollment:

Open enrollment is the period during which you can enroll in or change your health insurance plan. The open enrollment period varies depending on your state and the type of coverage you’re seeking. Missing the open enrollment period can result in penalties or a delay in coverage.

Understanding Your Explanation of Benefits (EOB):

Your EOB is a statement from your insurance company that explains how your healthcare claims were processed. It details the services you received, the charges, the amounts your insurance paid, and your responsibility. Carefully reviewing your EOBs can help you identify any errors or discrepancies.

Finding Affordable Health Insurance:

Finding affordable health insurance can be challenging, but several resources can help:

Health insurance marketplaces: These online marketplaces allow you to compare plans and enroll in coverage.

Your employer: Many employers offer health insurance as a benefit to their employees.

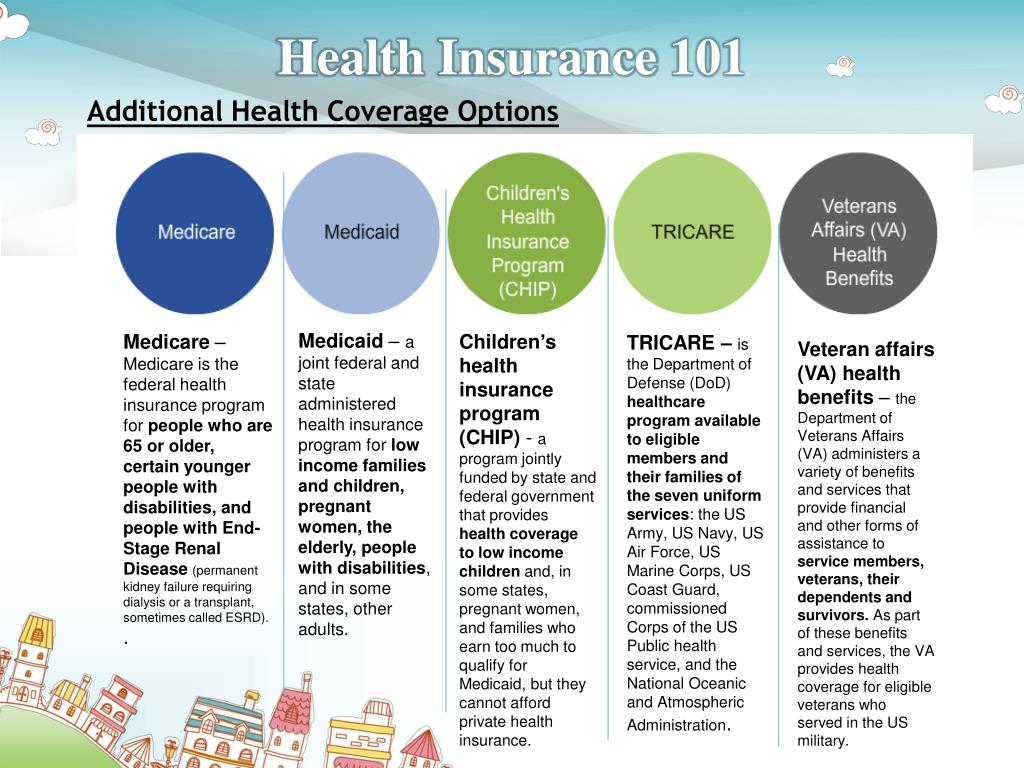

Government programs: Programs like Medicaid and Medicare provide subsidized or free health insurance to eligible individuals. We can help you navigate these programs and find the best fit for your needs. www.waukeshahealthinsurance.com

Maintaining Your Health Insurance:

Once you have health insurance, it’s important to maintain your coverage by paying your premiums on time and keeping your contact information updated with your insurance company. Regularly review your plan details to ensure it still meets your needs.

The Importance of Health Insurance:

Health insurance is a vital component of financial security. Unexpected illnesses or injuries can lead to substantial medical bills, and without insurance, these costs can quickly overwhelm your finances. Having health insurance provides peace of mind, knowing that you have access to quality healthcare without the fear of crippling debt. Don’t wait until you need it; secure your health insurance today. www.waukeshahealthinsurance.com

Conclusion:

Understanding health insurance is a crucial step towards protecting your financial well-being and accessing quality healthcare. By familiarizing yourself with the different types of plans, key terms, and available resources, you can make informed decisions that best suit your individual needs and budget. Remember to utilize the resources available to you, including online marketplaces, your employer, and government programs, to find the most affordable and comprehensive coverage. Contact us at Waukesha Health Insurance for personalized guidance and support. www.waukeshahealthinsurance.com We are dedicated to helping you navigate the complexities of health insurance and find the perfect plan for you.