The Role of Health Insurance in Preventative Healthcare-www.waukeshahealthinsurance.com

Table of Content

The Role of Health Insurance in Preventative Healthcare

Preventative healthcare, the proactive approach to maintaining health and well-being, is no longer a luxury but a necessity in today’s world. While the benefits are undeniable – reduced healthcare costs, improved quality of life, and increased longevity – access to these crucial services often hinges on the availability and comprehensiveness of health insurance. This article delves into the pivotal role health insurance plays in facilitating preventative healthcare, exploring its impact on individual well-being and the broader healthcare system.

Understanding Preventative Healthcare:

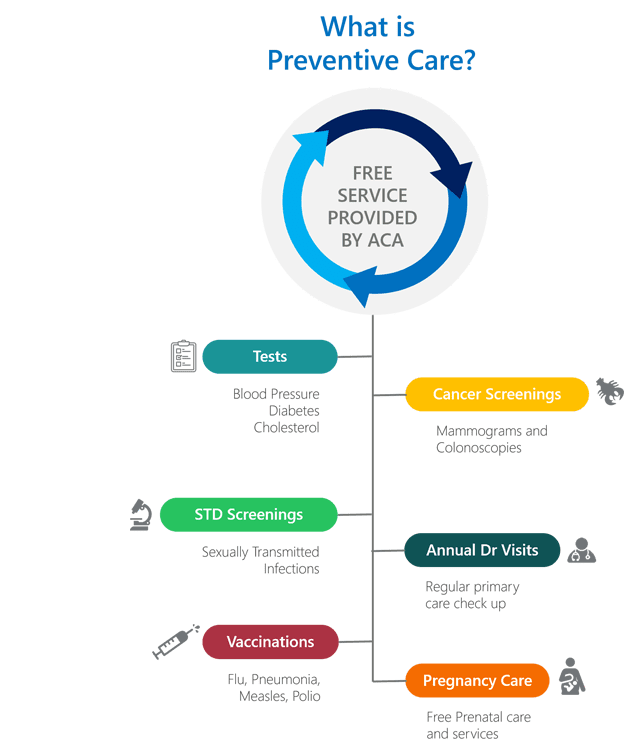

Preventative healthcare encompasses a wide range of services aimed at preventing diseases before they occur or detecting them at an early, more treatable stage. This includes routine check-ups, vaccinations, screenings for various cancers and chronic diseases, and lifestyle counseling. The core principle is to intervene proactively, minimizing the risk of developing serious health problems and reducing the need for costly and often invasive treatments later on.

The Financial Barrier to Preventative Care:

Without adequate health insurance, the cost of preventative healthcare can be a significant barrier for many individuals and families. The expenses associated with routine check-ups, screenings, and vaccinations can quickly add up, making them inaccessible to those with limited financial resources. This financial constraint often leads to delayed or forgone preventative care, resulting in more serious health issues down the line that require more extensive and expensive treatment.

Health Insurance as an Enabler:

Health insurance acts as a crucial financial safety net, making preventative healthcare more affordable and accessible. Most comprehensive health insurance plans cover a significant portion, if not all, of the costs associated with routine preventative services. This coverage includes:

Annual physical examinations: These comprehensive check-ups allow healthcare providers to assess overall health, identify potential risks, and provide personalized recommendations for maintaining well-being. Many plans cover these visits with minimal or no out-of-pocket costs.

Vaccinations: Vaccines are a cornerstone of preventative healthcare, protecting against a range of infectious diseases. Health insurance typically covers the cost of recommended vaccines for adults and children, ensuring widespread access to this crucial protection.

Cancer screenings: Early detection is key to successful cancer treatment. Health insurance plans often cover essential cancer screenings, such as mammograms, Pap smears, colonoscopies, and prostate exams, at regular intervals based on age and risk factors.

Chronic disease screenings: Many chronic diseases, such as diabetes, hypertension, and high cholesterol, can be managed effectively with early detection and intervention. Health insurance plans frequently cover screenings for these conditions, enabling early diagnosis and treatment.

Preventive counseling: Lifestyle choices significantly impact health outcomes. Health insurance plans often cover counseling services focused on weight management, smoking cessation, and stress reduction, empowering individuals to make healthier choices.

The Broader Impact of Insured Preventative Care:

The impact of health insurance coverage for preventative care extends beyond the individual level. By making these services accessible, health insurance contributes to:

Improved public health: Increased uptake of preventative services leads to a healthier population overall, reducing the burden of chronic diseases and improving overall quality of life.

Reduced healthcare costs: Early detection and prevention of diseases can significantly reduce the need for expensive treatments and hospitalizations later on, leading to cost savings for both individuals and the healthcare system.

Increased productivity: A healthier workforce is a more productive workforce. By promoting preventative healthcare, health insurance contributes to a more productive and engaged workforce.

Reduced healthcare disparities: Health insurance plays a vital role in reducing healthcare disparities by ensuring that preventative services are accessible to all, regardless of socioeconomic status.

Choosing the Right Health Insurance Plan:

Selecting a health insurance plan that adequately covers preventative healthcare is crucial. It’s essential to carefully review the plan’s benefits and coverage details to ensure it aligns with individual needs and health goals. Factors to consider include:

Network of providers: Choosing a plan with a wide network of in-network providers ensures access to a broader range of healthcare professionals and facilities.

Copays and deductibles: Understanding the copays and deductibles associated with preventative services is crucial to avoid unexpected costs.

Coverage for specific screenings: Review the plan’s coverage for specific screenings relevant to individual risk factors and age.

Preventive care benefits: Look for plans that explicitly emphasize coverage for a comprehensive range of preventative services. For assistance in finding the right plan for your needs, you can consult with a qualified insurance broker or utilize online resources like our website at www.waukeshahealthinsurance.com.

The Future of Preventative Healthcare and Insurance:

The future of preventative healthcare is closely tied to the evolution of health insurance. As the focus shifts towards proactive health management, we can expect to see continued improvements in insurance coverage for preventative services. This includes greater emphasis on personalized preventative care based on individual risk factors, increased integration of technology to facilitate remote monitoring and early detection, and expanded coverage for wellness programs and lifestyle interventions.

Conclusion:

Health insurance plays a vital role in enabling access to preventative healthcare. By removing the financial barrier to essential services, it empowers individuals to take control of their health and well-being, leading to improved individual outcomes and a healthier society. Choosing a comprehensive health insurance plan that prioritizes preventative care is a crucial investment in long-term health and financial security. For assistance in navigating the complexities of health insurance and finding a plan that meets your specific needs, explore the resources available at www.waukeshahealthinsurance.com. Understanding your options and making informed decisions about your health insurance is the first step towards a healthier and more secure future. Don’t hesitate to contact us at www.waukeshahealthinsurance.com for personalized guidance. We are dedicated to helping you find the best health insurance plan to support your preventative healthcare journey. Remember, proactive health management is an investment in your well-being, and with the right health insurance, that investment becomes significantly more accessible.