Waukeshahealthinsurance.com-

Waukeshahealthinsurance.com-

This story was originally published by Propublica. Published together with Capitol stage.

ProPublica is a nonprofit news organization that investigates abuses of power. Sign up to receive His big stories As soon as they are published.

Every day, patients across America crack open envelopes with bad news. Another health insurer decided not to pay for the treatment their doctor prescribed. Sometimes it's not for an MRI for a high school wrestler. Sometimes it helps in the process of cancer. A heart scan for a truck driver who sometimes feels short of breath.

But insurance companies don't always make these decisions. Instead, they often give medical reviews to an underground industry that makes money by denying payment requests from doctors who prioritize them. Call the denials for the dollar trade.

The biggest player is Avicor, a company called Evernorth, which is employed by major US insurance companies and provides coverage to 100 million consumers – about 1 in 3 insureds. It is owned by insurance giant Cigna.

Investigations by ProPublica and the Capitol Forum found that EviCore uses an artificial intelligence-powered algorithm, some insiders call “the dial,” that can lead to high-profile betrayals. Some contracts guarantee that the company will make more money by reducing healthcare costs. And doctors issue medical guidelines that delay and deny care to patients.

EviCore and companies like it approve prior authorizations “based on the decision that is more profitable for them,” said Barbara McEnany, a former president of the American Medical Association and a practicing oncologist. “They like to deny things.”

EviCore says it investigates claims to make sure doctor-recommended procedures are safe, necessary and cost-effective. “We're improving the quality of health care, the safety of health care, and most excitingly, we're also reducing a significant amount of unnecessary costs,” said Avicor's medical officer. By A A video was made by the company.

But EviCore's cost reduction is far from accidental, according to the investigation.

EviCore markets itself to insurance companies by promising a 3-to-1 return on investment — meaning that for every $1 spent on EviCore, the insurer pays less than $3 in medical and other costs. According to the investigation, EviCore vendors increased the failure rate by 15%, based on internal documents, corporate data and interviews with dozens of former employees, doctors, industry experts, health care regulators and insurance executives. Almost all of those interviewed spoke on condition of anonymity because they continue to work in the industry.

of The company's own data It shows that since 2021, EviCore has denied prior authorization requests in part or in full 20% of the time in Arkansas, which requires publishing denial rates. In contrast, the Equivalent image For federal Medicare Advantage plans, it was about 7% in 2022.

EviCore has several ways to reduce costs for insurers. Chief among them is the dialer, a proprietary algorithm that is the first stop for evaluating prior authorization. A doctor's office can automatically approve a request based on the information entered.

But the algorithm cannot say no. If it encounters problems, a team of in-house nurses and doctors who consult the company's medical guidelines will send the request for review. Only doctors can reject the last one.

This is where adjusting the dial comes in. EviCore may adjust its algorithm to increase the number of requests sent for review, according to five former employees. The more reviews, the higher the chance of rejection.

Here's how it works, according to former employees: An algorithm evaluates a question and gives it a score. For example, one question may be judged to have a 75% probability of approval, and another to have a 95% probability. If EviCore needs more rejections, anything below 95% can be sent for review. If he wants less, he can set the evaluation threshold at scores below 75 percent.

“We can handle this,” said a former Avicor executive involved in technology affairs. It's a game we play.

Over the years, medical groups have repeatedly complained that EviCore's guidelines were outdated and rigid, leading to inappropriate denials or delays in care. Frustration with the rules has led some doctors to call the company EvilCore. There is even. A parody account By X.

The directive is also used as a tool to reduce costs, the investigation found. “Watch the evaluation guidelines for a company closely because we don't show savings,” says a former EVOCOR employee involved in the radiation oncology program.

EviCore says its guidelines are based on input from peer-reviewed medical studies and professional societies, and are updated regularly to keep up with the latest evidence-based practices. He said the decision was based solely on the guidelines and was not interpreted differently for different customers.

EviCore is not alone in being involved in the dollar denial business. He is the second largest player. Carelon Medical Benefits AdministrationA subsidiary of Elevance Health, formerly known as Anthem Health Insurance. He was sued for wrongfully denying legitimate coverage claims. The company has denied all allegations. Many small companies do the same thing.

There is no doubt that prior authorizations play an important role in modern medicine. They serve to prevent doctors from prescribing unnecessary and even potentially harmful treatments. They also protect insurers from fraudulent doctors who overcharge for services.

In response to questions, a Cigna spokesperson issued a statement on behalf of EviCore. “Simply put, EviCore uses the latest evidence-based medicine to ensure patients get the care they need and avoid services they don't,” he said.

The statement said EviCore used algorithms for some clinical programs, but “Only To expedite the approval of appropriate care and reduce the administrative burden on providers.

The statement said doctors have the ability to appeal earlier approval denials, and the company regularly monitors the results “as part of continuous quality improvement to ensure accurate and timely medical necessity decisions.”

Prior authorization reviews provided by EviCore will save money for the entire health insurance system, the statement said. “A natural byproduct of improved quality of care and reduced waste is savings for our customers, lower out-of-pocket costs for patients and lower health care premiums for Americans.”

In the year In the fall of 2021, as the air grew crisper and the leaves turned red in central Ohio, little John Capp began to feel short of breath. He sighed as he pushed a shopping cart. His feet and ankles were swollen. He can only sleep while sitting.

An echocardiogram revealed that his heart was having trouble pumping blood. Kup's doctor recommended further testing, including inserting a catheter to check for blocked arteries.

A few days after the doctor made the request, the cup was accepted A letter from the insurance companyUnitedHealthcare. The procedure is “not medically necessary,” he said.

One sentence in 8-point type indicates that the insurer has delegated the decision to EVOCOR.

Kupp's doctor put him on medication to reduce inflammation and blood pressure and tried to get permission for a second left heart catheterization. EviCore again rejected it. In Cup's medical records, he summed up his grief: “At best he needs LHC (he was denied twice by insurance).”

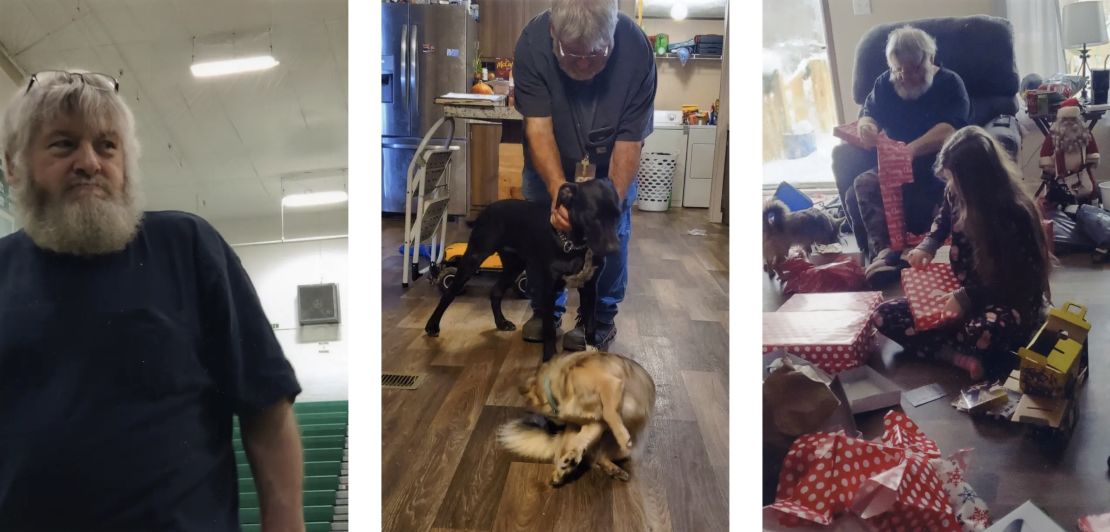

Cupp was 5-foot-7 and 282 pounds, with a wedding ring the size of a quarter. He had a white beard, his face was wide and warm. He is wearing blue jeans overalls and leather work boots. He spent most of his life as a welder, working in metal fabrication shops in his hometown of Circleville, Ohio, population 14,063. He was 61, almost the same age as his father when he died of a massive heart attack. Coop was stoic, his daughter Chris said, but the betrayal worried him.

After rejecting the second one, he said, “Well, I'll have to call the doctor and see what we can do.”

The doctor decided to give permission for the catheter examination. In challenging EviCore, he was fighting not just one company, but an industry.

EviCore is the result of a decades-long push by insurance companies to control health care costs. They suggest Studies show that 20% to the 45% Some treatments are wasteful or ineffective. To reduce such costs, insurers began requiring doctors to request authorization for medical services before agreeing to pay for them—a process known as “utilization review.” As treatments became more complex, evaluations became expensive in themselves.

In the year Created from the 2014 merger of two small companies, EviCore offers a solution: It allows insurers to make prior authorization decisions for highly specialized and expensive procedures. EviCore today offers recommendations for imaging, oncology, cardiology, gastroenterology, sleep disorders and many other fields.

It works with more than 100 insurers across the country, including industry titans like UnitedHealthcare, Aetna and Blue Cross Blue Shield, and some Medicare and Medicaid contractors. Cigna took over the company in 2018, but EviCore has maintained its independence by barring insurers from entering each other's proprietary information.

In response to questions, major insurance companies said they hired EviCore to ensure their customers receive safe and essential medical services while saving on unnecessary care costs.

EviCore has built its business by relying on different types of contracts. In one, a health insurance company pays Evocor a reasonable fee to review coverage claims.

Another type is more profitable, giving EviCore an incentive to cut costs, former employees said. Known as an accident contract, EviCore takes responsibility for paying claims. As an example, an insurer spends $10 million a year on MRIs. If EviCore keeps costs below that figure, it pockets the difference. In some cases, he splits the savings with the insurance company.

“It was a risky model where you really put your money in,” said one former Evocor executive. “Their margins…