How to Find Health Insurance That Pays for Your Prescription Medications-www.waukeshahealthinsurance.com

How to Find Health Insurance That Pays for Your Prescription Medications

The cost of prescription medications can be staggering, often placing a significant financial burden on individuals and families. Finding health insurance that adequately covers your prescription needs is crucial for managing both your health and your finances. Navigating the complexities of health insurance plans and formularies can feel overwhelming, but understanding the key factors involved can empower you to make informed decisions. This comprehensive guide will walk you through the process of finding health insurance that effectively pays for your prescription medications.

Understanding Your Needs:

Before you begin your search, it’s essential to understand your specific needs and circumstances. Consider the following:

- Your Medications: Make a list of all the prescription medications you currently take, including their generic and brand names. Note the dosage and frequency of each medication. This information will be vital when comparing insurance plans.

- Your Health Status: Your overall health status will influence the type of plan you need. If you have pre-existing conditions or anticipate needing extensive medical care, a more comprehensive plan may be necessary.

- Your Budget: Health insurance premiums, deductibles, co-pays, and co-insurance all contribute to the overall cost. Determine how much you can comfortably afford to spend on health insurance each month.

- Your Location: The availability of insurance plans and their coverage varies by location. Knowing your location will help you narrow down your options. For instance, if you reside in Waukesha, Wisconsin, you might want to explore options offered by local providers like those listed on www.waukeshahealthinsurance.com.

Types of Health Insurance Plans:

Several types of health insurance plans are available, each with its own coverage structure and cost implications:

- HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within the network. Referrals are usually needed to see specialists. HMO plans generally have lower premiums but may have stricter limitations on out-of-network care.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see specialists without a referral and often have the option to see out-of-network providers, although at a higher cost. PPO plans usually have higher premiums than HMO plans.

- EPO (Exclusive Provider Organization): EPO plans are similar to HMOs in that they require you to choose a PCP within the network. However, unlike HMOs, EPOs typically do not allow out-of-network care, except in emergencies.

- POS (Point of Service): POS plans combine elements of HMOs and PPOs. They usually require a PCP, but offer some flexibility for seeing out-of-network providers at a higher cost.

- Medicare: If you are 65 or older or have a qualifying disability, Medicare is a federally funded health insurance program. Medicare Part D covers prescription drugs, but it has its own complexities and costs.

- Medicaid: Medicaid is a state and federally funded program that provides health coverage to low-income individuals and families. Medicaid coverage for prescription drugs varies by state.

Understanding Formularies:

A formulary is a list of prescription drugs covered by a health insurance plan. Each plan has its own formulary, and the drugs included, as well as their cost-sharing levels (tiered system), can vary significantly. Understanding your plan’s formulary is crucial for determining whether your medications are covered and at what cost. Many plans use a tiered system, categorizing drugs into different tiers based on cost and therapeutic value. Generic drugs are usually in the lowest tier, while brand-name drugs may be in higher tiers, resulting in higher out-of-pocket costs.

Finding the Right Plan:

Once you’ve assessed your needs and understood the different plan types, you can begin your search for the right health insurance plan. Several resources are available to help you:

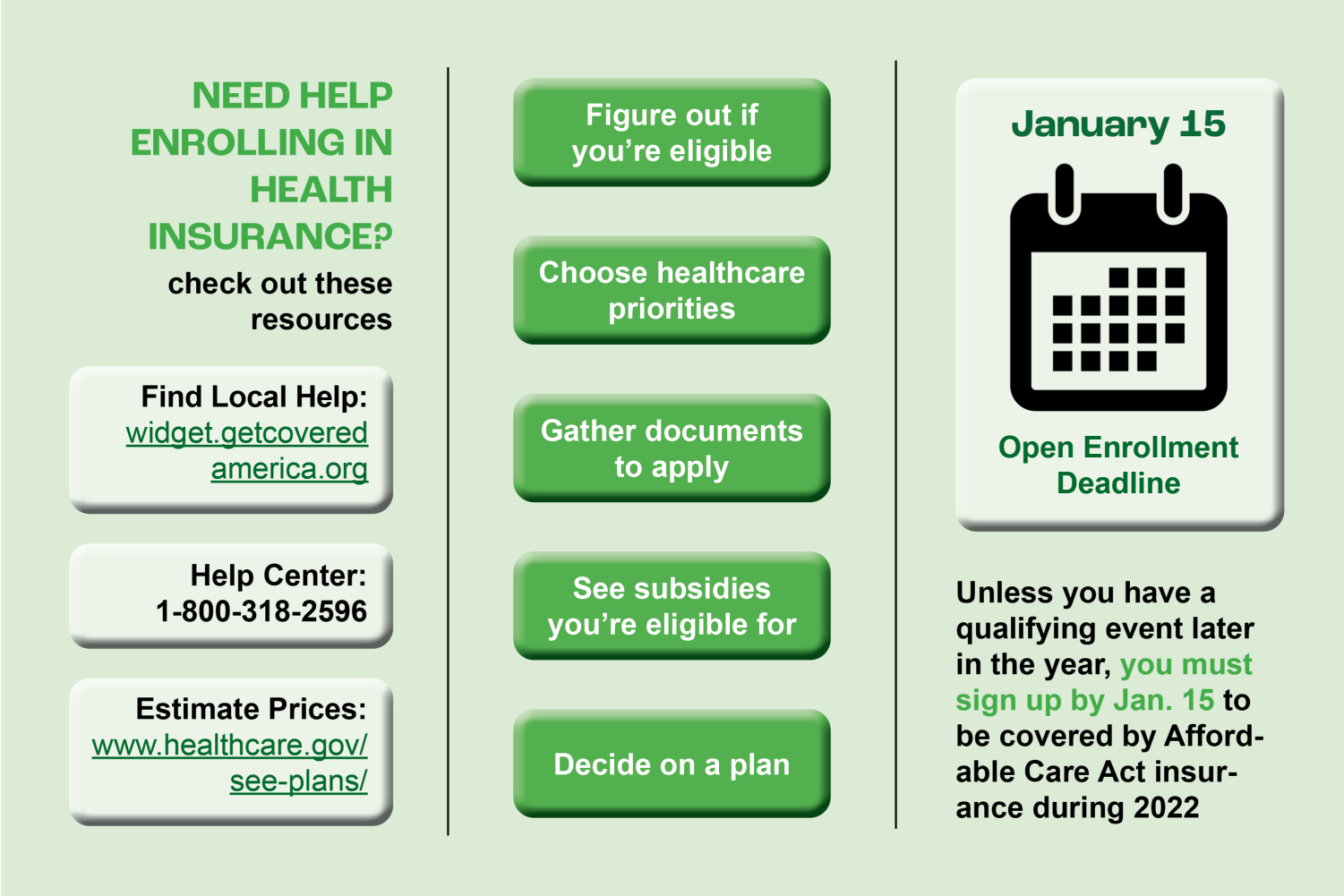

- Healthcare.gov: If you are purchasing insurance through the Affordable Care Act (ACA) marketplaces, Healthcare.gov is the primary website for finding plans in your area. You can use the website’s search tools to filter plans based on your needs and budget.

- Your Employer: If you are employed, your employer may offer health insurance as a benefit. Review the plans offered by your employer carefully to determine which one best suits your needs and prescription medication requirements.

- State Insurance Marketplaces: Many states have their own insurance marketplaces, offering additional options for purchasing health insurance.

- Insurance Brokers: Independent insurance brokers can help you navigate the complexities of health insurance and find a plan that meets your needs. They can compare plans from multiple insurers and provide personalized recommendations. For those in the Waukesha area, consulting with local brokers can be beneficial, potentially leading you to resources like www.waukeshahealthinsurance.com.

Tips for Lowering Prescription Drug Costs:

Even with health insurance, prescription drug costs can be substantial. Here are some tips to help lower your costs:

- Use Generic Medications: Generic drugs are typically much cheaper than brand-name drugs and often just as effective. Talk to your doctor about switching to a generic alternative if one is available.

- Negotiate Prices: Pharmacies may be willing to negotiate prices, especially if you are paying cash. Ask if they offer any discounts or programs.

- Use Prescription Discount Cards: Several companies offer prescription discount cards that can help lower the cost of your medications. These cards are not insurance, but they can provide significant savings.

- Check for Manufacturer Coupons: Some pharmaceutical companies offer coupons or rebates that can reduce the cost of their medications.

- Explore Patient Assistance Programs: Many pharmaceutical companies offer patient assistance programs (PAPs) to help individuals afford their medications. These programs typically provide free or discounted medications to eligible patients.

- Consider Mail-Order Pharmacies: Mail-order pharmacies often offer lower prices on prescription medications, especially for those taking multiple medications regularly.

Conclusion:

Finding health insurance that covers your prescription medications requires careful planning and research. By understanding your needs, comparing different plan types, and utilizing the available resources, you can make an informed decision that protects your health and your finances. Remember to thoroughly review formularies, consider cost-saving strategies, and don’t hesitate to seek assistance from insurance brokers or other professionals if needed. For those in the Waukesha, Wisconsin area, remember to check out the resources available at www.waukeshahealthinsurance.com to find local expertise and options. Taking proactive steps to manage your prescription drug costs is crucial for maintaining your overall well-being.