Health Insurance for People with Migraines and Headaches-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The financial burden associated with managing these conditions, including doctor visits, medications, and potentially even alternative therapies, can be substantial. This is where understanding your health insurance coverage becomes crucial. Finding the right plan can mean the difference between effectively managing your migraines and headaches and struggling to afford the necessary care.

This article will explore the complexities of health insurance coverage for migraines and headaches, offering insights into what to look for in a plan, common coverage pitfalls, and strategies for maximizing your benefits. We’ll also touch upon the specific needs of individuals with chronic migraine and the importance of proactive healthcare management.

Understanding Your Health Insurance Plan:

The first step in navigating the healthcare system with migraines or headaches is understanding your current health insurance plan. This involves carefully reviewing your policy documents, paying close attention to the following key areas:

Network Providers: Ensure your chosen neurologist or primary care physician is within your plan’s network. Out-of-network care typically results in significantly higher out-of-pocket costs. Using the provider search tool on your insurance company’s website is a great way to verify in-network status. Many insurance providers offer online tools to find doctors in your area. For those in the Waukesha area, exploring options through www.waukeshahealthinsurance.com can be a valuable starting point.

Deductible, Copay, and Coinsurance: These are fundamental components of most health insurance plans. Your deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Your copay is a fixed fee you pay at the time of service, while coinsurance is the percentage of the bill you are responsible for after meeting your deductible. Higher deductibles often mean lower monthly premiums, but higher out-of-pocket expenses when you need care. Understanding these figures is crucial for budgeting healthcare costs.

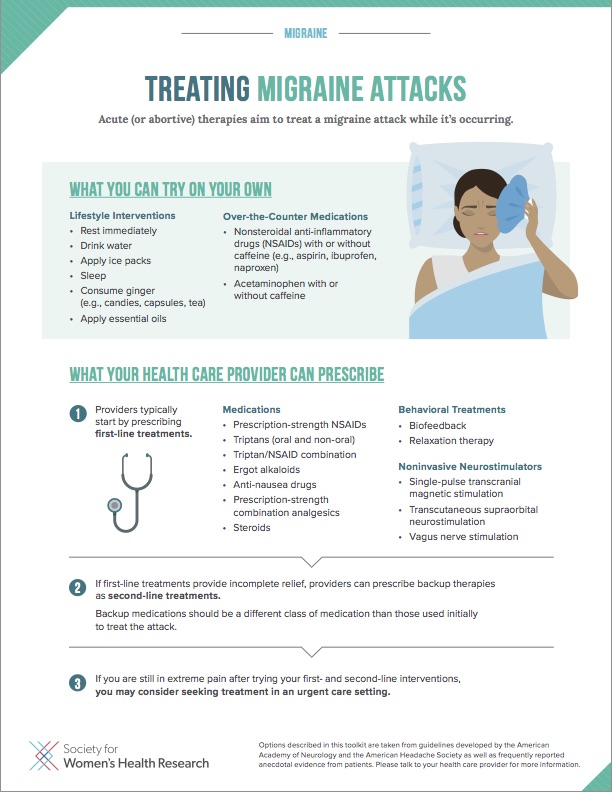

Prescription Drug Coverage (Formulary): Many migraine treatments involve prescription medications, from over-the-counter pain relievers to specialized CGRP inhibitors. Your plan’s formulary lists the medications it covers and their associated cost-sharing. Some plans may require prior authorization for certain medications, adding another layer of complexity. It’s vital to check if your preferred medications are covered and at what tier (tiered formularies categorize drugs based on cost and place them in different tiers with varying co-pays).

Diagnostic Testing Coverage: Diagnosing migraines can involve various tests, including MRIs, CT scans, and blood work. Confirm that your plan covers these diagnostic procedures, as the costs can be substantial.

Specialized Treatment Coverage: Depending on the severity and type of migraine, you may require specialized treatments like Botox injections, nerve blocks, or even surgery. Check your policy for coverage of these procedures, as they often require pre-authorization and may have specific limitations.

Finding the Right Health Insurance Plan:

Choosing the right health insurance plan is a crucial step in managing migraines and headaches effectively. Several factors need consideration:

Premium vs. Out-of-Pocket Costs: Balance the monthly premium cost against potential out-of-pocket expenses. A lower premium might seem attractive, but a high deductible could leave you with substantial bills if you experience frequent migraines.

Network Adequacy: Ensure a sufficient number of qualified neurologists and headache specialists are within your plan’s network.

Prescription Drug Coverage: Prioritize plans with comprehensive coverage for your specific medications, including those for preventative treatment and acute migraine relief.

Mental Health Coverage: Migraines are often associated with mental health conditions like anxiety and depression. Ensure your plan offers adequate mental health coverage, including therapy and medication.

For residents of Waukesha, Wisconsin, exploring options through www.waukeshahealthinsurance.com provides access to a range of plans and allows for personalized comparisons based on individual needs and budgets. Using online comparison tools can significantly simplify the process of finding the best fit.

Advocating for Yourself:

Managing migraines and headaches effectively requires proactive engagement with your healthcare providers and insurance company. Here are some crucial steps:

Maintain Detailed Records: Keep a detailed migraine diary, documenting the frequency, severity, triggers, and treatments used. This information is invaluable for your doctor and can help support claims for necessary treatments.

Communicate Clearly with Your Doctor: Openly discuss your symptoms, treatment goals, and any concerns about insurance coverage with your physician. They can help navigate the complexities of the healthcare system and advocate on your behalf.

Understand Your Explanation of Benefits (EOB): Carefully review your EOBs to ensure your claims are processed correctly and that you are not being overcharged. Don’t hesitate to contact your insurance company if you have any questions or discrepancies.

Appeal Denied Claims: If your insurance company denies a claim, understand your rights to appeal the decision. Often, providing additional medical documentation can strengthen your appeal.

Chronic Migraine and Specialized Care:

Individuals with chronic migraine (15 or more headache days per month) often require more intensive management strategies. This might include preventative medications, specialized injections, or even referral to a headache specialist or neurologist with expertise in migraine treatment. Ensuring your health insurance plan adequately covers these specialized services is paramount. Many plans offer coverage for these specialized services, but pre-authorization may be required.

The Importance of Preventative Care:

While acute treatment addresses migraine attacks, preventative care aims to reduce the frequency and severity of headaches. This may involve lifestyle changes, medication, or other therapies. Understanding your insurance coverage for preventative care is essential for long-term management.

Conclusion:

Navigating the world of health insurance with migraines and headaches can be challenging, but with careful planning and proactive engagement, you can secure the coverage you need to manage your condition effectively. Understanding your policy, advocating for yourself, and utilizing available resources, such as online comparison tools and the expertise of your healthcare providers, are crucial steps in this process. For those in the Waukesha area, remember to explore the resources available at www.waukeshahealthinsurance.com to find a plan that best suits your individual needs and budget. Remember, effective migraine management is a journey, and having the right insurance coverage is a significant step towards improving your quality of life. Don’t hesitate to seek professional guidance to ensure you are making informed decisions about your healthcare and insurance coverage.