Health Insurance for Families with Special Medical Needs-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The financial burden, particularly concerning healthcare costs, can be overwhelming. Finding the right health insurance plan that adequately covers the unique and often extensive medical requirements of a child with special needs is paramount. This article aims to guide families through the complexities of securing comprehensive health insurance, highlighting crucial considerations and resources available.

Understanding the Unique Needs of Children with Special Medical Needs:

Children with special medical needs encompass a broad spectrum, including those with chronic illnesses like cystic fibrosis, diabetes, autism spectrum disorder, cerebral palsy, Down syndrome, and many others. Their healthcare needs often extend beyond routine checkups, encompassing specialized therapies, medications, medical equipment, and frequent hospitalizations. These expenses can quickly escalate, placing a significant strain on family finances.

The Importance of Comprehensive Health Insurance:

Comprehensive health insurance is not just a financial safety net; it’s a lifeline for families with special needs children. Without adequate coverage, families face the daunting prospect of crippling medical debt, potentially jeopardizing their financial stability and their child’s access to essential care. A robust plan should cover:

- Doctor visits and specialist consultations: Regular checkups with primary care physicians and specialists are crucial for monitoring health and managing conditions.

- Hospitalizations and emergency care: Unexpected illnesses and emergencies can require costly hospital stays and intensive care.

- Prescription medications: Many children with special needs require ongoing medication, which can be incredibly expensive without insurance coverage.

- Therapy services: Physical, occupational, speech, and behavioral therapies are often essential components of care for children with special needs.

- Durable medical equipment (DME): This includes items like wheelchairs, oxygen tanks, feeding tubes, and other equipment necessary for daily living.

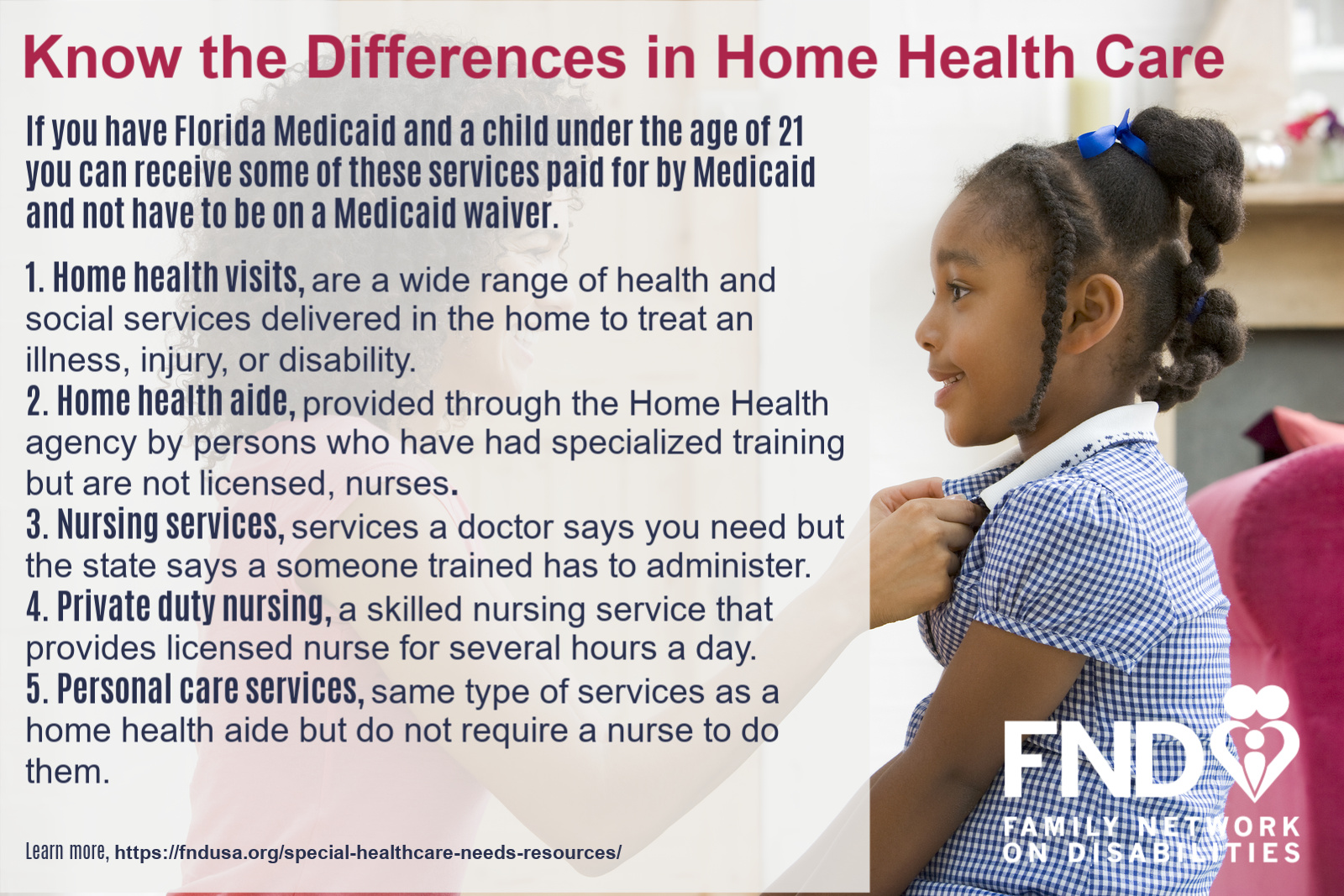

- Home healthcare: Some children require ongoing home healthcare services, such as nursing care or skilled medical assistance.

Navigating the Health Insurance Marketplace:

Choosing the right health insurance plan can feel overwhelming. The Affordable Care Act (ACA) marketplaces offer a range of plans, but understanding the nuances of coverage and cost-sharing is crucial. Key factors to consider include:

- Premium costs: The monthly payment for your insurance plan.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copay: The fixed amount you pay for each doctor visit or service.

- Coinsurance: Your share of the costs after you’ve met your deductible.

- Out-of-pocket maximum: The most you’ll pay out-of-pocket in a year.

- Network of providers: Ensure the plan includes your child’s specialists and preferred healthcare facilities.

Finding the Right Plan for Your Family’s Needs:

Finding the optimal health insurance plan requires careful research and consideration of your family’s unique circumstances. It’s advisable to:

- Assess your child’s specific medical needs: Create a detailed list of all medical services, medications, and equipment your child requires.

- Compare plans carefully: Use online comparison tools and consult with insurance brokers to compare different plans and their coverage options. Consider exploring plans offered through www.waukeshahealthinsurance.com to see if they meet your family’s needs.

- Understand the terms and conditions: Carefully review the plan’s policy documents to fully understand the coverage details and limitations.

- Seek professional advice: Consulting with a healthcare navigator or insurance broker can provide valuable guidance and support throughout the process.

Additional Resources and Support:

Navigating the healthcare system for children with special needs can be complex. Several resources can provide valuable support and assistance:

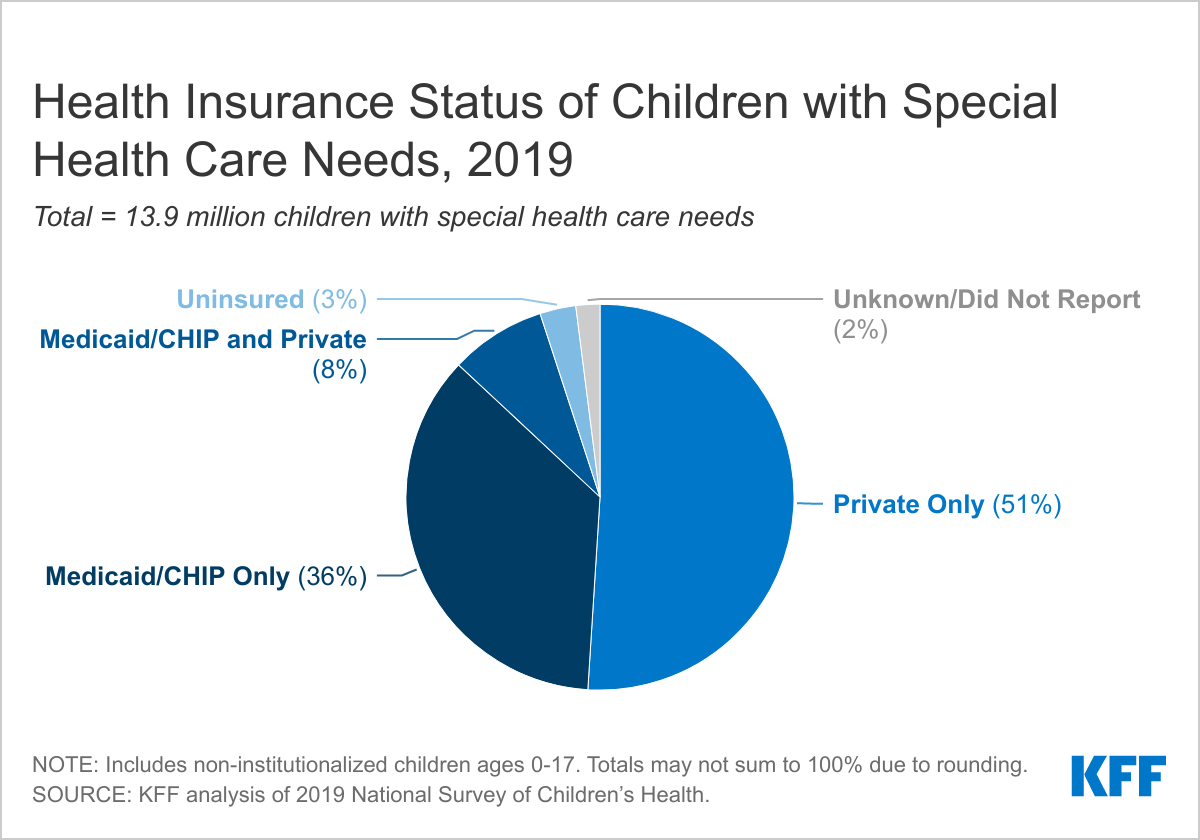

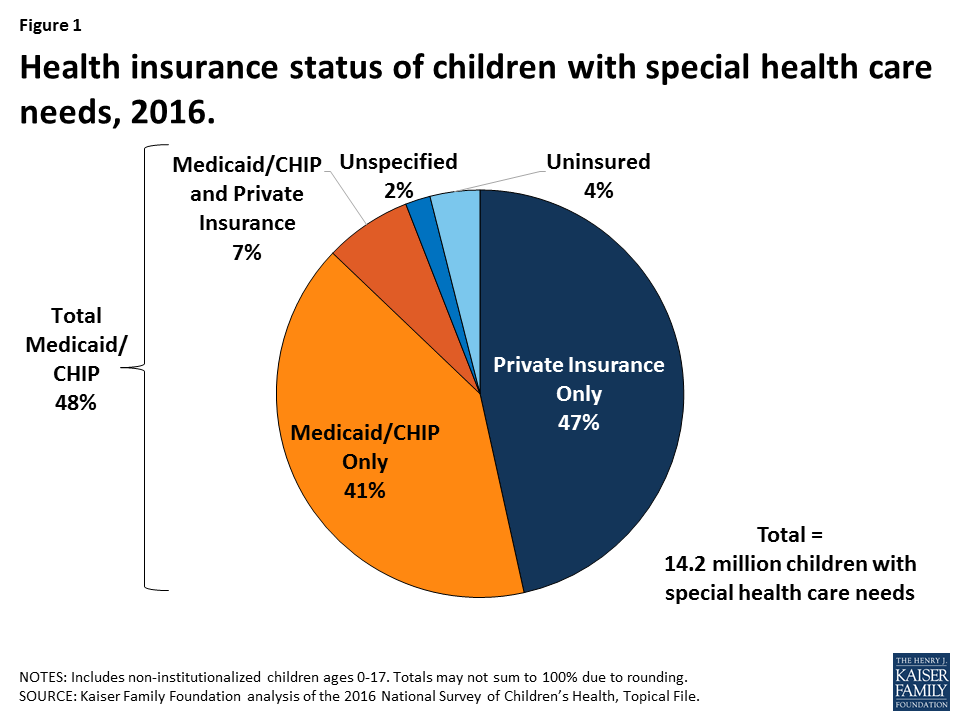

- State Medicaid and CHIP programs: These government-funded programs provide healthcare coverage for low-income families and children.

- Patient advocacy groups: Organizations dedicated to specific conditions often offer valuable resources, support, and advocacy services.

- Healthcare navigators: These professionals can help families understand their insurance options and navigate the healthcare system.

The Role of Advocacy:

Advocating for your child’s healthcare needs is crucial. This includes:

- Understanding your rights: Familiarize yourself with your rights under the ACA and other relevant laws.

- Communicating effectively with healthcare providers: Maintain open communication with your child’s doctors and other healthcare professionals.

- Appealing denials: If your insurance company denies coverage for a necessary service, understand the appeals process and advocate for your child’s needs.

Financial Planning and Assistance:

Managing the financial burden of healthcare costs for children with special needs requires careful planning and consideration of various resources:

- Flexible spending accounts (FSAs) and health savings accounts (HSAs): These accounts can help you save money for healthcare expenses on a pre-tax basis.

- Charitable organizations: Many charitable organizations provide financial assistance to families facing high medical costs.

- Crowdfunding: Online platforms allow families to raise funds to cover medical expenses.

Looking Ahead:

Securing appropriate health insurance for a child with special medical needs is a crucial step in ensuring their well-being and your family’s financial stability. By carefully researching your options, understanding your rights, and advocating for your child’s needs, you can navigate the complexities of the healthcare system and provide your child with the best possible care. Remember to utilize available resources and don’t hesitate to seek professional guidance. For comprehensive health insurance options in Waukesha, Wisconsin, visit www.waukeshahealthinsurance.com. They can help you find a plan that fits your family’s unique needs and budget. Remember, securing the right health insurance is an investment in your child’s future and your family’s peace of mind. By being proactive and informed, you can navigate this journey with greater confidence and ensure your child receives the care they deserve. Don’t delay – start your search for the right health insurance plan today by visiting www.waukeshahealthinsurance.com. Your family’s well-being depends on it. The process may seem daunting, but with careful planning and the right resources, you can find a solution that provides both financial security and the best possible healthcare for your child. Remember to explore the options available at www.waukeshahealthinsurance.com to find the perfect fit for your family.