Health Insurance for Children with Special Needs-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Each offers unique benefits and eligibility requirements.

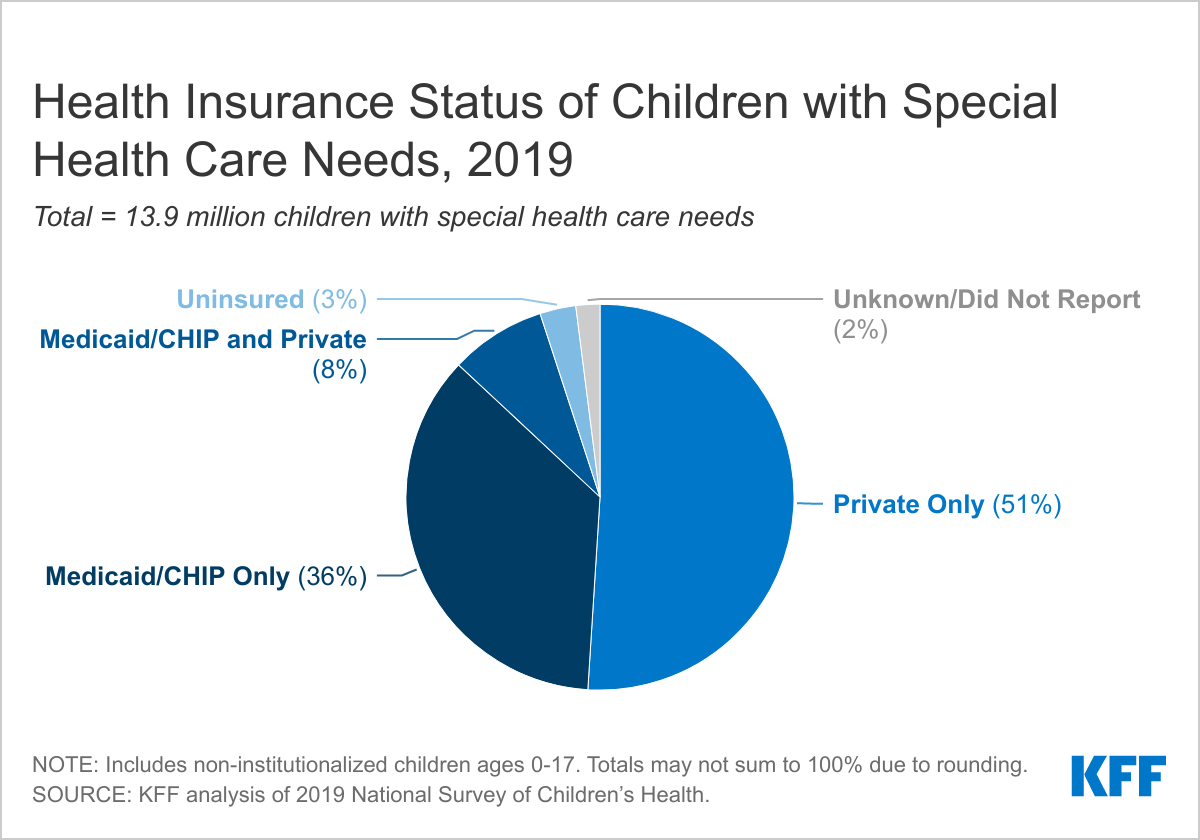

Medicaid: Medicaid is a joint federal and state program that provides healthcare coverage to low-income individuals and families. Eligibility criteria vary by state, but generally include income and asset limits. Medicaid often covers a wide range of services, including therapies, medications, and medical equipment, making it a crucial option for many families with children with special needs. However, navigating the application process and understanding the specific benefits offered in your state can be challenging. Consult our resources to learn more about Medicaid eligibility and benefits in your area.

CHIP: The Children’s Health Insurance Program (CHIP) is designed to provide coverage for children in families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP offers comprehensive coverage similar to Medicaid, including many services vital for children with special needs. Check your state’s CHIP eligibility requirements to see if your family qualifies.

Private Insurance: Private health insurance plans, often offered through employers or purchased individually, can provide comprehensive coverage for children with special needs. However, these plans can be expensive, and the level of coverage for specific services may vary greatly depending on the plan. It’s crucial to carefully review the policy details, paying close attention to coverage for therapies, medications, and durable medical equipment (DME). Understanding your private insurance policy is key to ensuring your child receives the care they need.

Key Considerations When Choosing a Plan

Selecting the right health insurance plan for a child with special needs requires careful consideration of several factors:

Coverage for Specific Services: Different plans offer varying levels of coverage for specific services your child may require. This includes therapies (physical, occupational, speech), medical equipment (wheelchairs, feeding tubes), medications, and specialized medical care. Carefully review the plan’s benefit summaries and ensure it adequately covers your child’s needs. Use our comparison tools to help you analyze different plans side-by-side.

Network Providers: Many plans have networks of preferred providers. Choosing a plan with providers who are familiar with your child’s specific needs and condition is crucial for ensuring quality care and efficient access to services. Find in-network providers in your area to streamline your child’s healthcare access.

Out-of-Pocket Costs: Even with insurance, out-of-pocket costs can be significant. Consider factors like deductibles, co-pays, and coinsurance. A plan with a lower deductible and co-pays can significantly reduce your financial burden.

Appeals Process: Understand the plan’s appeals process in case a claim is denied. Having a clear understanding of this process can be invaluable if you need to advocate for your child’s care.

Pre-authorization Requirements: Some services, especially those considered specialized or expensive, may require pre-authorization from the insurance company. Knowing the pre-authorization process and requirements can help avoid delays in care.

Advocating for Your Child’s Healthcare Needs

Being an effective advocate for your child’s healthcare is crucial. This involves:

Keeping Detailed Records: Maintain meticulous records of your child’s medical history, treatments, and expenses. This information is invaluable when filing claims and appealing denials.

Understanding Your Rights: Familiarize yourself with your rights under the Affordable Care Act (ACA) and other relevant laws. This knowledge empowers you to effectively advocate for your child’s access to care.

Communicating Effectively: Maintain open communication with your child’s doctors, therapists, and insurance company representatives. Clearly articulate your child’s needs and any concerns you may have.

Seeking Support: Don’t hesitate to seek support from patient advocacy groups and other organizations that specialize in assisting families with children with special needs. These organizations can provide valuable resources and guidance.

Resources and Further Assistance

Navigating the complexities of health insurance for children with special needs can be daunting, but you’re not alone. Several resources are available to help you:

Your State’s Insurance Department: Your state’s insurance department can provide information about available plans, eligibility requirements, and assistance programs.

Patient Advocacy Groups: Numerous organizations advocate for the rights and needs of individuals with special needs and their families. These groups can provide valuable support, resources, and guidance.

Healthcare Providers: Your child’s healthcare providers can offer guidance on choosing the right insurance plan and navigating the healthcare system.

Our Website: We offer comprehensive resources, tools, and information to help you find the best health insurance for your child with special needs. Explore our resources to learn more.

Conclusion

Securing adequate health insurance for a child with special needs is a critical step in ensuring they receive the necessary care and support to thrive. By understanding the available options, carefully considering your child’s specific needs, and actively advocating for their healthcare, you can navigate this complex landscape and provide your child with the best possible future. Remember to utilize the available resources and don’t hesitate to seek assistance when needed. Your dedication and proactive approach will make a significant difference in your child’s life. Contact us today for personalized assistance.