Choosing Between PPO vs. HMO Health Insurance Plans-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Tentu, berikut adalah artikel tentang memilih antara rencana asuransi kesehatan PPO vs. HMO dengan lebih dari 1500 kata:

Choosing Between PPO vs. HMO Health Insurance Plans

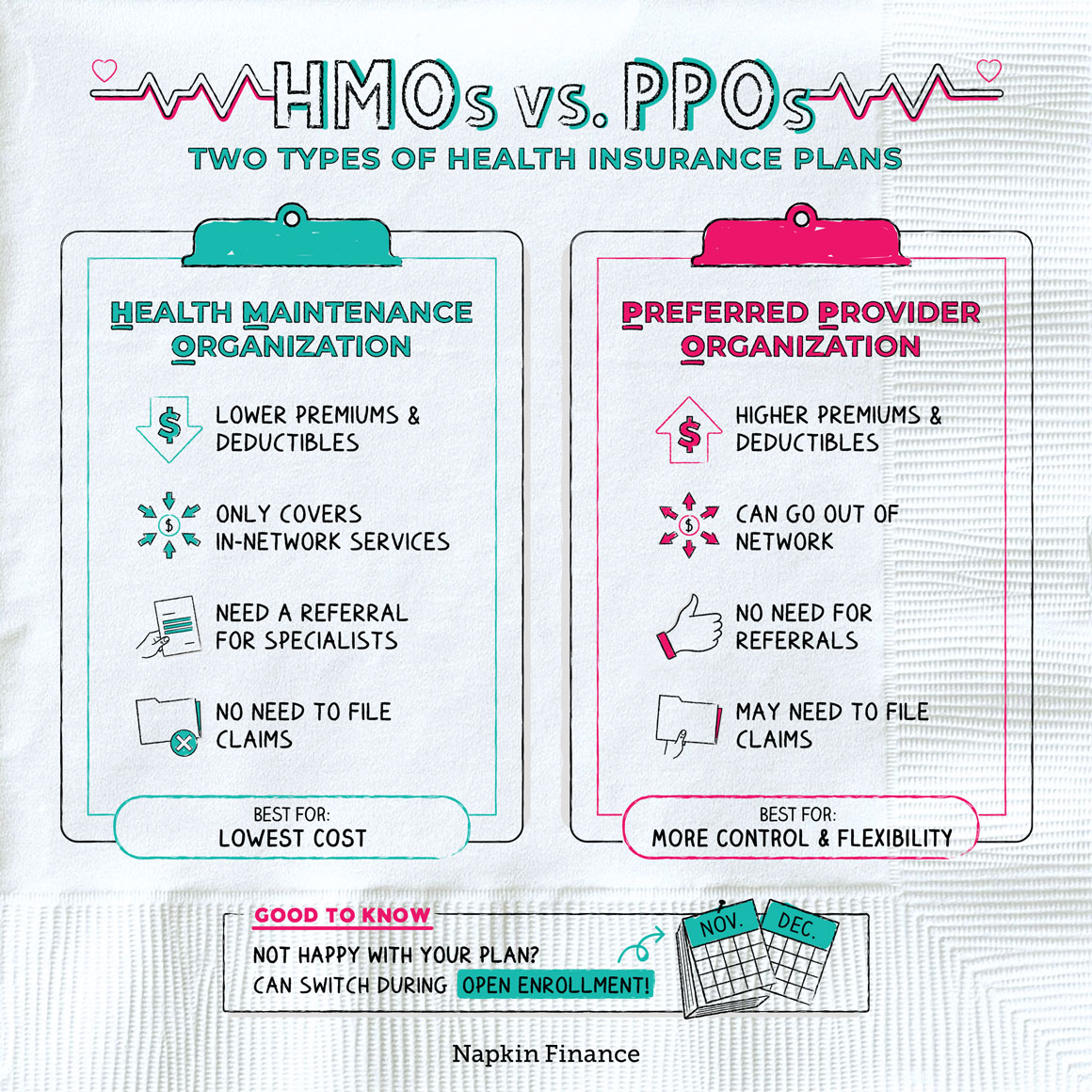

Choosing a health insurance plan can be a daunting task. With so many options available, it’s easy to feel overwhelmed. Two of the most common types of plans are Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs). Understanding the key differences between PPOs and HMOs is crucial to selecting the plan that best fits your individual needs and budget. This comprehensive guide will delve into the intricacies of each plan, highlighting their advantages and disadvantages to help you make an informed decision. For personalized assistance in navigating the complexities of health insurance in Waukesha County, Wisconsin, consider consulting with a local expert at www.waukeshahealthinsurance.com.

Understanding PPOs (Preferred Provider Organizations)

PPO plans offer greater flexibility and choice compared to HMOs. With a PPO, you can see any doctor or specialist you choose, whether or not they are in the plan’s network. However, you’ll typically pay less if you stay within the network. This is because in-network providers have negotiated discounted rates with the insurance company. Seeing out-of-network providers will result in higher out-of-pocket costs, including higher deductibles, co-pays, and coinsurance.

Key Features of PPO Plans:

- Flexibility: See any doctor or specialist, in-network or out-of-network.

- Higher Premiums: Generally, PPO plans have higher monthly premiums than HMOs.

- Higher Out-of-Pocket Costs (for out-of-network care): While in-network care is often covered at a lower cost, out-of-network care can be significantly more expensive.

- No Primary Care Physician (PCP) Required: You don’t need a referral to see specialists.

- Greater Choice: More freedom to choose your healthcare providers.

Advantages of PPO Plans:

- Flexibility and Convenience: The ability to see any doctor, regardless of network status, offers significant convenience, especially in emergencies or when seeking specialized care.

- Broader Network: PPO networks tend to be larger than HMO networks, providing access to a wider range of healthcare providers.

- No Referrals Needed: You can see specialists without needing a referral from your PCP, streamlining the process of accessing specialized care.

Disadvantages of PPO Plans:

- Higher Premiums: The increased flexibility comes at a cost, with PPO plans generally having higher monthly premiums than HMOs.

- Higher Out-of-Pocket Costs (Out-of-Network): Utilizing out-of-network providers can lead to substantially higher expenses, potentially impacting your budget significantly.

- Less Predictable Costs: The lack of a referral requirement and the option to see out-of-network providers can make it more challenging to predict your healthcare expenses.

Understanding HMOs (Health Maintenance Organizations)

HMO plans offer a more structured approach to healthcare. With an HMO, you’ll typically need to choose a primary care physician (PCP) within the network. Your PCP acts as your gatekeeper, referring you to specialists as needed. Seeing out-of-network providers is generally not covered, except in emergencies.

Key Features of HMO Plans:

- Lower Premiums: HMO plans usually have lower monthly premiums than PPO plans.

- Lower Out-of-Pocket Costs (In-Network): In-network care is typically less expensive with an HMO.

- PCP Required: You need a referral from your PCP to see specialists.

- Smaller Network: HMO networks are generally smaller than PPO networks.

- Predictable Costs: Staying within the network makes it easier to predict your healthcare expenses.

Advantages of HMO Plans:

- Lower Premiums: The more restrictive nature of HMO plans often translates to lower monthly premiums, making them a more budget-friendly option.

- Lower Out-of-Pocket Costs (In-Network): Staying within the network ensures lower costs for routine care and specialist visits.

- Preventive Care Focus: HMOs often emphasize preventive care, encouraging regular checkups and screenings to maintain good health.

Disadvantages of HMO Plans:

- Limited Choice: You are limited to seeing doctors within the network, which may restrict your choices.

- Referral Requirements: Needing a referral from your PCP to see specialists can add extra steps and potentially delay access to specialized care.

- Out-of-Network Limitations: Out-of-network care is generally not covered, except in emergencies, leaving you with significant out-of-pocket expenses if you need to see a provider outside the network.

Choosing the Right Plan for You

The best plan for you depends on your individual circumstances, including your health needs, budget, and preferences. Consider the following factors:

- Your Health Status: If you have pre-existing conditions or anticipate needing frequent specialist visits, a PPO might offer more flexibility. If you are generally healthy and prefer lower premiums, an HMO might be a better fit.

- Your Budget: HMO plans generally have lower premiums, but PPOs might offer better value if you anticipate needing significant out-of-network care.

- Your Preferences: Do you prioritize flexibility and choice, or do you prefer a more structured and potentially less expensive plan?

- Your Location: Consider the size and location of the network. Ensure that the plan’s network includes providers in your area and those you would want to see.

Additional Considerations:

- Prescription Drug Coverage: Compare the formularies (lists of covered medications) of different plans to ensure your medications are covered.

- Mental Health Coverage: Check the plan’s coverage for mental health services, including therapy and medication.

- Dental and Vision Coverage: Some plans offer integrated dental and vision coverage, while others require separate policies.

Seeking Professional Guidance

Navigating the complexities of health insurance can be challenging. For personalized advice and assistance in choosing the right plan for your needs in Waukesha County, Wisconsin, consider contacting a local health insurance expert at www.waukeshahealthinsurance.com. They can help you compare plans, understand your options, and make an informed decision. Remember, choosing the right health insurance plan is a crucial step in protecting your health and financial well-being. Don’t hesitate to seek professional help to ensure you make the best choice for you and your family. They can also help you understand the nuances of the Affordable Care Act (ACA) and how it impacts your choices. Understanding your options and making an informed decision is key to securing the best possible healthcare coverage. The team at www.waukeshahealthinsurance.com is dedicated to providing comprehensive support and guidance throughout the process. Contact them today to begin your journey towards securing the right health insurance plan. Remember, your health is your wealth, and choosing the right insurance plan is an investment in your future well-being. Don’t delay; contact www.waukeshahealthinsurance.com for expert advice and support.