By paying regular premiums, you gain access to a range of benefits that protect you from the overwhelming costs of healthcare:-www.waukeshahealthinsurance.com

By paying regular premiums, you gain access to a range of benefits that protect you from the overwhelming costs of healthcare:

- Coverage for Hospital Stays: Hospitalization can be incredibly expensive, involving surgery, medication, nursing care, and other services. Health insurance significantly reduces the out-of-pocket costs associated with hospital stays, ensuring you can receive the necessary care without facing financial ruin.

- Doctor Visits and Preventative Care: Regular check-ups and preventative screenings are crucial for maintaining good health. Health insurance often covers these visits, making it easier to detect and address potential health problems early on, preventing more serious and costly issues down the line. Learn more about the preventative care options covered by various plans at www.waukeshahealthinsurance.com.

- Prescription Drug Coverage: Prescription medications can be incredibly expensive, particularly for chronic conditions. Health insurance helps to manage these costs, providing coverage for a range of prescription drugs, making them more affordable and accessible.

- Mental Health Services: Mental health is just as important as physical health. Many health insurance plans now offer comprehensive coverage for mental health services, including therapy, counseling, and medication, making these essential services more accessible.

- Emergency Care: Accidents and emergencies can happen unexpectedly. Health insurance provides coverage for emergency room visits and treatment, ensuring you receive immediate care without worrying about the immediate financial implications.

Choosing the Right Health Insurance Plan:

Navigating the world of health insurance can be challenging. Different plans offer varying levels of coverage and benefits, so it’s crucial to carefully consider your individual needs and budget when choosing a plan. Factors to consider include:

- Premium Costs: This is the monthly payment you make for your insurance coverage.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Copay: A fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: The percentage of costs you share with your insurance company after your deductible is met.

- Network of Providers: The doctors, hospitals, and other healthcare providers covered by your insurance plan.

Finding the right plan for your specific needs can be simplified by using our online resources at www.waukeshahealthinsurance.com. We offer a variety of plans to suit different budgets and healthcare requirements.

Beyond the Financial Benefits:

The benefits of health insurance extend far beyond the financial. Having health insurance promotes better health outcomes by:

- Encouraging Preventative Care: Knowing you have coverage makes it more likely that you’ll schedule regular check-ups and screenings, leading to early detection and treatment of potential health problems.

- Improving Access to Care: Health insurance provides access to a wider range of healthcare providers and services, ensuring you can receive the specialized care you need.

- Reducing Stress and Anxiety: Knowing you’re protected from the financial burden of unexpected medical expenses reduces stress and anxiety, leading to better overall well-being.

The Importance of Health Insurance for Specific Populations:

Certain populations benefit particularly from having health insurance:

- Families with Children: Children are prone to accidents and illnesses, making health insurance crucial for managing unexpected medical expenses.

- Seniors: As we age, the risk of health problems increases, making comprehensive health insurance essential for managing the costs of healthcare in later life.

- Individuals with Pre-existing Conditions: Health insurance protects individuals with pre-existing conditions from being denied coverage or facing exorbitant premiums. Our website, www.waukeshahealthinsurance.com, provides detailed information on plans that cover pre-existing conditions.

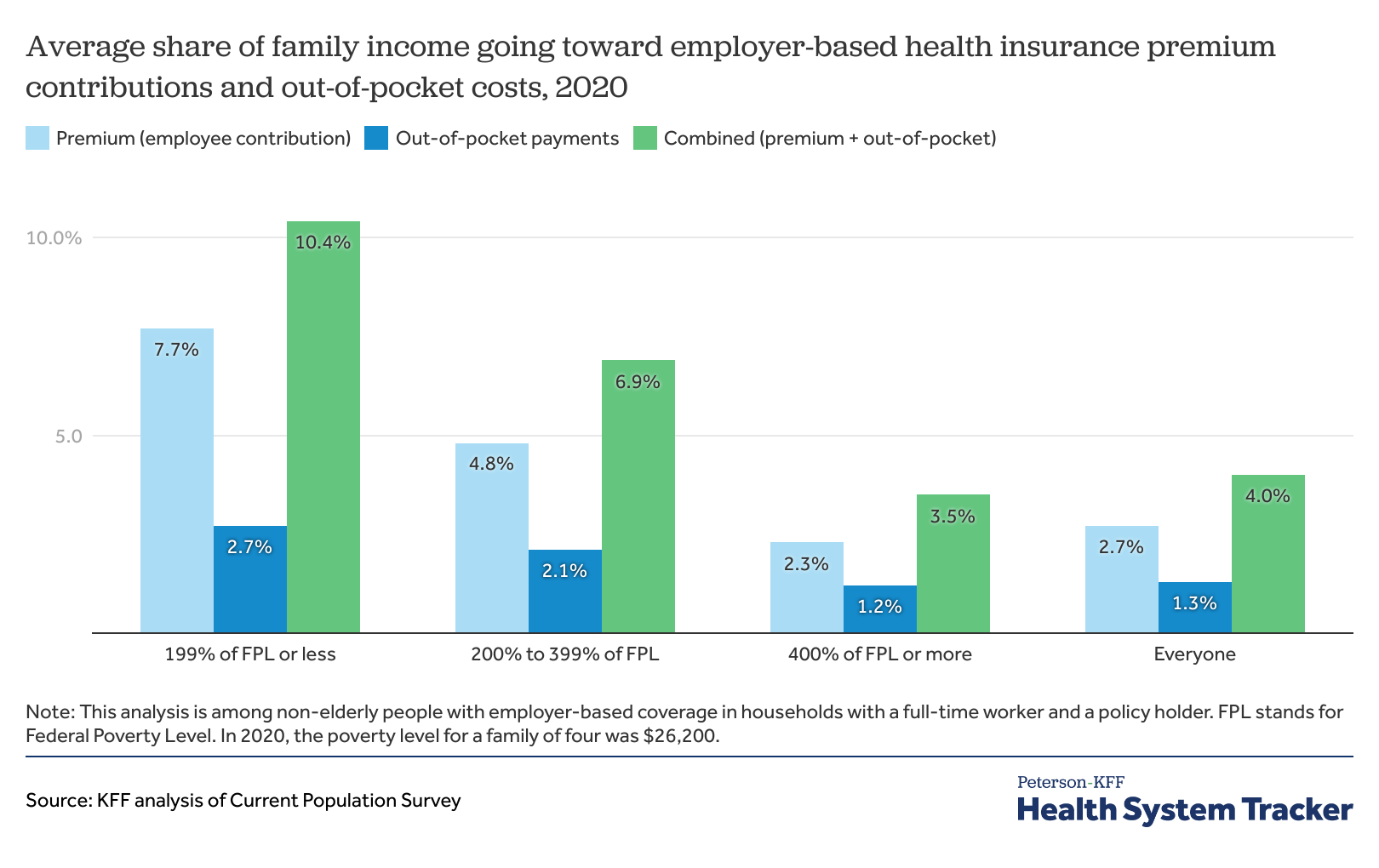

- Low-Income Individuals: Government-sponsored programs like Medicaid and CHIP provide affordable healthcare coverage for low-income individuals and families.

Conclusion:

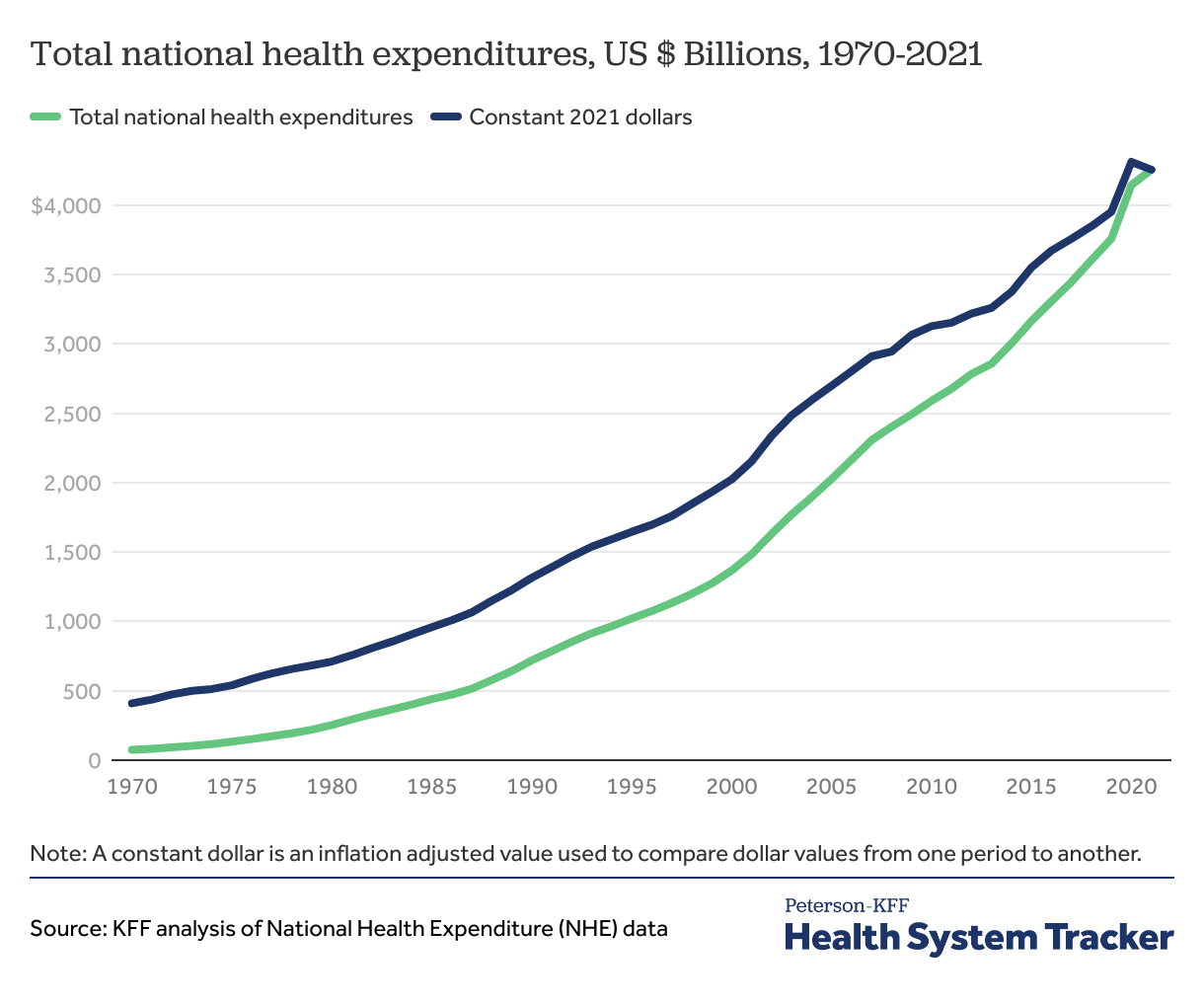

Health insurance is not just a financial product; it’s an investment in your health and well-being. It provides a crucial safety net against the potentially devastating financial impact of illness or injury, allowing you to focus on your recovery rather than worrying about crippling medical bills. While the cost of premiums might seem significant, the peace of mind and access to quality healthcare it provides far outweigh the expense. Don’t gamble with your health and financial security; invest in health insurance today. Contact us at www.waukeshahealthinsurance.com to learn more about our plans and find the perfect coverage for your needs. Your health is your most valuable asset – protect it.