How to Navigate the Health Insurance Marketplace-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

However, navigating this system can be daunting. This comprehensive guide will walk you through the process, providing tips and resources to help you find the best plan for your needs. Remember, the specifics can vary by state, so always check your state’s marketplace for the most up-to-date information. For those in the Waukesha, Wisconsin area, consider exploring resources like www.waukeshahealthinsurance.com for local expertise.

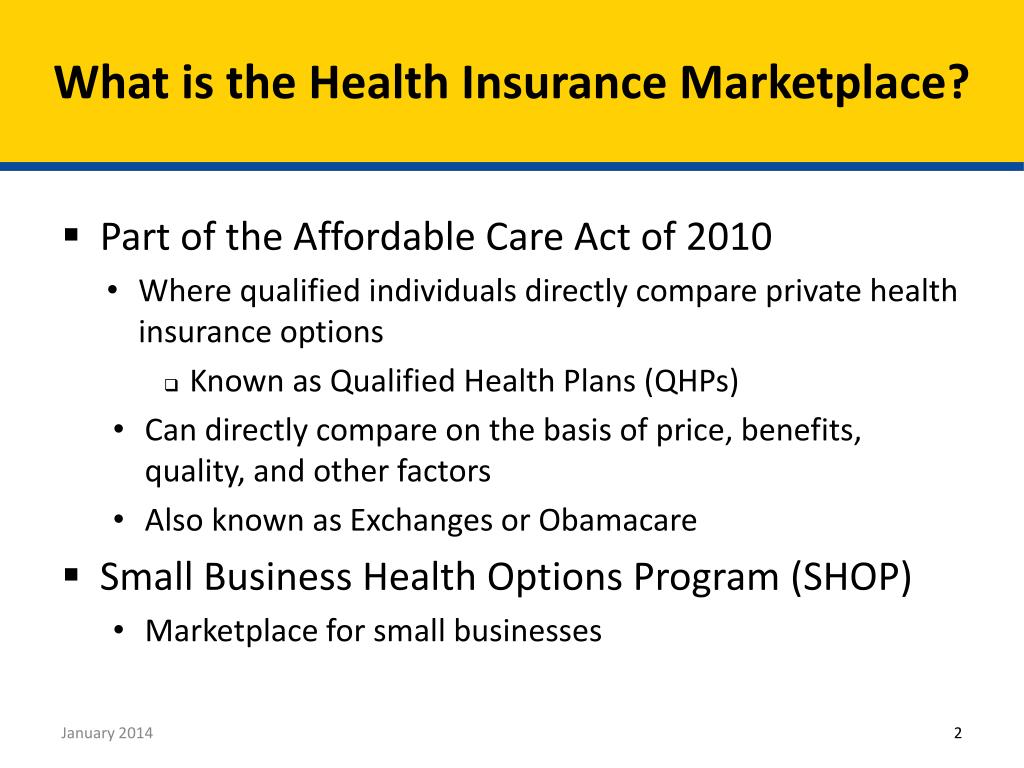

Understanding the Marketplace:

The health insurance marketplace is a platform where you can compare plans from different insurance companies. These plans are categorized into different metal tiers based on their level of cost-sharing:

- Bronze: The lowest monthly premium, but you pay a higher percentage of your medical costs.

- Silver: A balance between premium cost and cost-sharing.

- Gold: Higher monthly premium, but lower out-of-pocket costs.

- Platinum: Highest monthly premium, but the lowest out-of-pocket costs.

- Catastrophic: Only available to those under 30 or those with a hardship exemption. High deductible, low premium.

Choosing the right metal tier depends on your individual financial situation and health needs. If you anticipate needing frequent medical care, a Gold or Platinum plan might be more beneficial despite the higher premium. If you are generally healthy and want to minimize monthly expenses, a Bronze or Silver plan might be a better fit.

Steps to Navigating the Marketplace:

Determine Your Eligibility: Before you begin, determine if you’re eligible for marketplace coverage. Eligibility is based on factors like your income, citizenship status, and residency. The marketplace will guide you through this process.

Create an Account: Once you’ve determined your eligibility, you’ll need to create an account on the HealthCare.gov website (or your state’s marketplace website). You’ll need to provide personal information, including your income, household size, and Social Security number.

Provide Necessary Information: Be prepared to provide accurate and complete information. Inaccurate information can lead to delays or denial of coverage.

Compare Plans: This is the most crucial step. Use the marketplace’s comparison tool to evaluate different plans based on factors like:

- Monthly premium: The amount you pay each month for coverage.

- Deductible: The amount you pay out-of-pocket before your insurance begins to cover costs.

- Copay: The fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: The percentage of costs you pay after meeting your deductible.

- Out-of-pocket maximum: The maximum amount you’ll pay out-of-pocket in a year.

- Network of doctors and hospitals: Ensure your preferred doctors and hospitals are in the plan’s network.

Consider Your Health Needs: Think about your current health status and anticipated healthcare needs for the year. If you have pre-existing conditions, make sure the plan covers them.

Review the Plan Details: Carefully review the plan’s Summary of Benefits and Coverage (SBC) to understand what is and isn’t covered. Pay close attention to the details of your prescription drug coverage, mental health services, and other essential benefits.

Enroll in a Plan: Once you’ve chosen a plan, enroll through the marketplace. You’ll have a specific enrollment period, so be sure to meet the deadline.

Understand Your Responsibilities: After enrolling, understand your responsibilities as a policyholder. This includes paying your premiums on time and keeping your contact information updated.

Tips for Successful Navigation:

- Start early: Don’t wait until the last minute to enroll. Allow ample time to compare plans and make an informed decision.

- Use the marketplace’s tools: Take advantage of the marketplace’s comparison tools and resources.

- Seek professional help: If you’re overwhelmed, consider seeking help from a licensed insurance agent or navigator. Local resources, such as those potentially found through www.waukeshahealthinsurance.com, can be invaluable.

- Understand your financial assistance options: The marketplace offers subsidies to help make coverage more affordable. Determine if you qualify for a premium tax credit or cost-sharing reduction.

- Review your plan annually: Your needs may change over time, so review your plan annually during the open enrollment period to ensure it still meets your needs.

Special Considerations:

- Pre-existing conditions: The ACA prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions.

- Essential health benefits: All marketplace plans must cover essential health benefits, including hospitalization, maternity care, and mental health services.

- Appeals process: If you’re denied coverage or have a dispute with your insurer, understand the appeals process.

Finding Local Help:

Navigating the health insurance marketplace can be complex. Don’t hesitate to seek assistance from qualified professionals. For residents of Waukesha, Wisconsin, researching local insurance agencies and brokers, perhaps starting with a search like "health insurance Waukesha WI," or checking resources like www.waukeshahealthinsurance.com (if applicable and relevant), can provide personalized guidance and support. These local experts can help you understand your options and choose the plan that best fits your needs and budget. Remember, choosing the right health insurance is a crucial decision, and seeking help ensures you make the best choice for your health and financial well-being. Don’t be afraid to ask questions and seek clarification until you feel confident in your understanding of your coverage. Your health is your most valuable asset, and protecting it through informed decision-making is paramount.