Health Insurance Benefits You Didn’t Know About-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

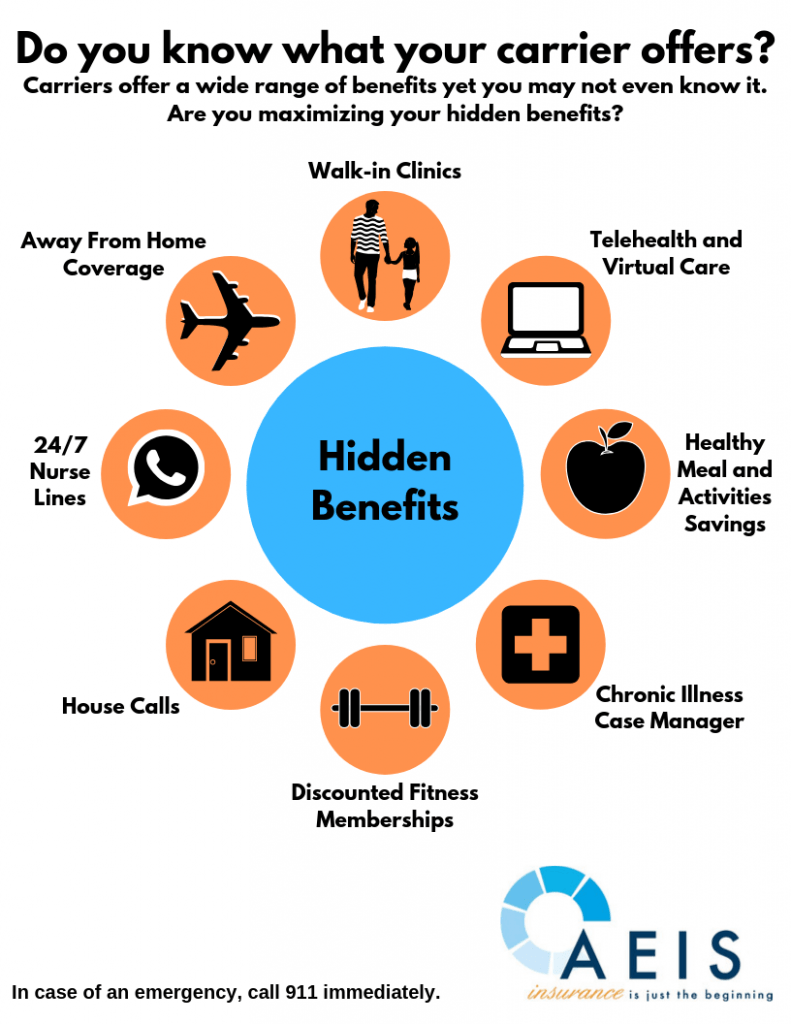

However, many plans offer a surprising array of additional benefits that extend far beyond these core services. These can include preventive care, wellness programs, mental health services, and even financial assistance programs. Understanding these benefits is crucial to making informed decisions about your health and financial future.

1. Preventive Care: Investing in Your Well-being

Preventive care is often touted as a cornerstone of good health, and many health insurance plans cover a wide range of these services at little to no cost. This includes annual physical exams, vaccinations, screenings for diseases like cancer and diabetes, and even routine dental and vision care, depending on your plan. These preventive measures can detect potential health issues early on, leading to earlier intervention and better outcomes. Regular checkups can save you money in the long run by preventing more costly treatments down the line. For a comprehensive list of preventive services covered under your plan, check with your insurance provider or consult your plan documents. Finding the right plan with robust preventive care coverage is crucial. Learn more about finding the perfect plan for your needs at www.waukeshahealthinsurance.com.

2. Wellness Programs: Empowering Healthy Habits

Many insurance companies are actively promoting wellness through various programs designed to encourage healthy lifestyles. These programs can include gym memberships, discounts on fitness trackers, health coaching, and even rewards for achieving health goals like weight loss or quitting smoking. Participating in these programs not only improves your physical and mental health but can also lead to lower premiums or even cash rewards. These incentives are designed to encourage proactive health management and ultimately reduce healthcare costs in the long run. Explore the wellness programs offered by different insurers at www.waukeshahealthinsurance.com.

3. Mental Health Services: Addressing a Critical Need

Mental health is an integral part of overall well-being, and thankfully, the stigma surrounding mental health services is gradually diminishing. Most comprehensive health insurance plans now provide coverage for mental health services, including therapy, counseling, and medication management. Access to these services is crucial for addressing a wide range of mental health conditions, from anxiety and depression to more complex disorders. Don’t hesitate to utilize these benefits if you or a loved one needs support. Find out more about mental health coverage options at www.waukeshahealthinsurance.com.

4. Prescription Drug Coverage: Managing Medications Effectively

Prescription drug costs can be substantial, but health insurance plays a critical role in mitigating these expenses. Understanding your prescription drug formulary – the list of covered medications – is essential. Generic medications are usually cheaper than brand-name drugs and often just as effective. Your insurance plan may also offer mail-order pharmacy services, which can save you money on multiple prescriptions. Always check with your pharmacist to see if there are more cost-effective options available. Learn how to navigate your prescription drug coverage at www.waukeshahealthinsurance.com.

5. Telemedicine: Convenient and Accessible Care

Telemedicine has revolutionized healthcare access, providing convenient and affordable alternatives to traditional in-person visits. Many health insurance plans now cover telemedicine services, allowing you to consult with doctors remotely via video calls or phone consultations. This is particularly beneficial for individuals in rural areas with limited access to healthcare providers or those with mobility issues. Telemedicine can be used for routine checkups, managing chronic conditions, and even receiving mental health services. Discover the benefits of telemedicine and its coverage under your plan at www.waukeshahealthinsurance.com.

6. Rehabilitation Services: Recovery and Restoration

Following an injury or illness, rehabilitation services are crucial for recovery and regaining independence. Health insurance often covers a wide range of rehabilitation services, including physical therapy, occupational therapy, and speech therapy. These services can help individuals regain lost function, improve mobility, and enhance their overall quality of life. Don’t hesitate to utilize these benefits to aid in your recovery process. Find out more about rehabilitation coverage at www.waukeshahealthinsurance.com.

7. Maternity Care: Supporting Mothers and Newborns

Maternity care is a significant expense, and health insurance plays a vital role in making it more affordable. Comprehensive plans typically cover prenatal care, labor and delivery, and postnatal care for both mother and baby. Understanding your coverage for maternity care is crucial for planning and budgeting during pregnancy. Explore maternity coverage options at www.waukeshahealthinsurance.com.

8. Emergency Services: Protection in Times of Need

Emergency services are a cornerstone of health insurance coverage. In case of an unexpected illness or injury, your insurance will cover the costs of emergency room visits, hospitalization, and necessary treatments. This protection provides peace of mind knowing you’re covered during critical situations. Understand your emergency services coverage at www.waukeshahealthinsurance.com.

9. Out-of-Network Coverage: Understanding Your Options

While in-network providers offer the most cost-effective care, understanding your out-of-network coverage is also important. Many plans offer some level of coverage for out-of-network services, though it may be at a higher cost-sharing level. Knowing your options is crucial for making informed decisions about your healthcare. Learn about your out-of-network benefits at www.waukeshahealthinsurance.com.

10. Financial Assistance Programs: Navigating Healthcare Costs

Healthcare costs can be overwhelming, but many insurance companies offer financial assistance programs to help individuals manage these expenses. These programs may include payment plans, discounts, or assistance with applying for government programs like Medicaid or CHIP. Don’t hesitate to explore these options if you’re struggling to afford your healthcare costs. Find out about available financial assistance programs at www.waukeshahealthinsurance.com.

Maximizing Your Health Insurance Benefits

To fully leverage the benefits of your health insurance, take proactive steps to understand your plan’s details. Review your policy documents carefully, familiarize yourself with your provider network, and don’t hesitate to contact your insurance company or your doctor’s office with any questions. Regularly scheduled checkups and proactive health management can significantly contribute to your overall well-being and reduce healthcare costs in the long run. Remember, your health insurance is an investment in your future. By understanding and utilizing all its benefits, you can protect your health and your financial security. Start exploring your options and find the best health insurance plan for you today at www.waukeshahealthinsurance.com.